How to Get a PAN Card Online: A Complete Guide

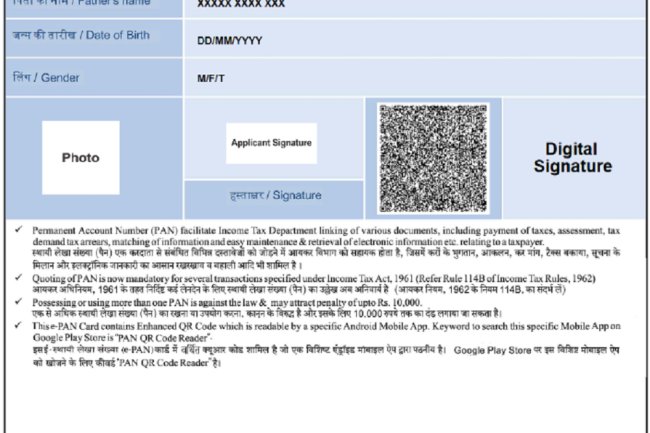

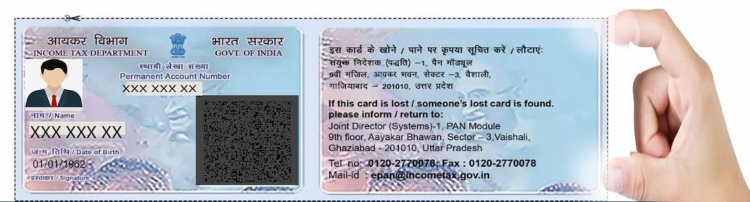

Introduction : A PAN (Permanent Account Number) card is an essential document for all taxpayers in India. It is required for filing income tax returns, opening bank accounts, applying for loans, and engaging in various financial transactions. Thankfully, obtaining a PAN card online is a straightforward process that saves you the hassle of paperwork and long waiting times. In this article, we’ll walk you through the steps to get a PAN card online, including the platforms you can use, the documents required, and other important information.

Why You Need a PAN Card

A PAN card is mandatory for:

- Filing Income Tax Returns: Every taxpayer must have a PAN card to file tax returns.

- Opening a Bank Account: Most banks require a PAN for opening savings and current accounts.

- High-Value Transactions: PAN is required for large transactions like property purchases, investments, and deposits above certain limits.

- Loan Applications: Banks and financial institutions need your PAN for processing loan applications and credit card approvals.

How to Apply for a PAN Card Online

You can apply for a PAN card online through two official government-authorized platforms: NSDL (Protean eGov Technologies Limited) and UTIITSL (UTI Infrastructure Technology and Services Limited). Here’s a step-by-step guide for both:

Applying for PAN via NSDL (Protean eGov Technologies)

-

Visit the Official NSDL Website: Go to the NSDL PAN Application Portal.

-

Select the Application Type: Choose the type of PAN card application (Form 49A for Indian citizens, Form 49AA for foreign citizens).

-

Fill Out the Online Form:

- Enter personal details such as full name, date of birth, mobile number, email, and Aadhaar number.

- Provide information about your income source.

-

Upload Required Documents: Upload scanned copies of your identity proof, address proof, date of birth proof, and passport-size photograph. If you’re applying via Aadhaar e-KYC, your documents may already be linked to Aadhaar.

-

Make Payment: Pay the processing fee through online modes such as credit/debit card, net banking, or UPI.

- For a PAN card delivered within India: ₹93 + taxes.

- For a PAN card delivered outside India: ₹864 + taxes.

-

Submit the Application: After submitting the form and making the payment, you’ll receive an acknowledgment number. Keep this number handy for tracking your PAN card status.

-

Receive Your ePAN or Physical PAN Card: After successful processing, you will receive an ePAN via email. A physical PAN card will be dispatched to your registered address.

Applying for PAN via UTIITSL

-

Visit the UTIITSL PAN Portal: Go to the UTIITSL PAN Card Portal.

-

Select PAN Card Application: Click on “Apply for New PAN Card” and select the appropriate form (Form 49A for Indian citizens, Form 49AA for foreign citizens).

-

Fill Out the Form: Provide your personal details, such as name, date of birth, address, and contact information. If applying via Aadhaar-based e-KYC, your Aadhaar details will be used to fill in much of the form.

-

Upload Documents: Upload scanned copies of your Aadhaar card, passport-size photo, and signature.

-

Pay the Fees: Make the payment online using your preferred method.

- The charges are similar to those on the NSDL website.

-

Submit the Application: After submitting, you’ll receive an acknowledgment number for tracking your application.

-

Receive Your PAN Card: Once processed, you will receive your ePAN in your registered email. The physical card will be delivered to your address.

Documents Required for PAN Card Application

To apply for a PAN card, you need to submit the following documents:

- Proof of Identity (Aadhaar card, voter ID, passport, driving license, etc.)

- Proof of Address (Aadhaar card, utility bill, bank statement, etc.)

- Proof of Date of Birth (Birth certificate, passport, matriculation certificate, etc.)

- Passport-sized Photograph (Recent photo as per specifications)

If you’re using Aadhaar-based e-KYC, only your Aadhaar card details and biometric authentication may be required.

Tracking Your PAN Card Application Status

Once you’ve applied for a PAN card, you can track the status of your application on both the NSDL and UTIITSL websites using your acknowledgment number.

- NSDL Tracking: Visit the NSDL PAN Status Tracking Page and enter your acknowledgment number.

- UTIITSL Tracking: Go to the UTIITSL PAN Status Page and enter your application coupon number to track your PAN card.

Frequently Asked Questions (FAQs)

1. Can I get my PAN card instantly online?

Yes, with the Aadhaar-based e-KYC process, you can get an instant ePAN that is delivered to your email within minutes.

2. Is the ePAN valid like the physical PAN card?

Yes, the ePAN is a digitally signed PAN card and is equally valid for all official purposes.

3. What should I do if there is an error in my PAN card details?

You can apply for corrections in your PAN card through the NSDL or UTIITSL websites.

Conclusion

Applying for a PAN card online is a quick and hassle-free process that ensures you have this essential document in a matter of days. Whether through NSDL or UTIITSL, the entire process can be completed from the comfort of your home, with options for both physical and digital PAN cards.

Make sure to use official portals for applying to safeguard your personal data and ensure a smooth application process.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?