Why Do You Need a PAN Card?

A PAN card is more than just a tax identification number. It is used for:

- Filing Income Tax returns

- Opening a bank account

- Buying or selling property

- Making investments

- Receiving taxable salary or professional fees

- Applying for loans or credit cards

- Engaging in transactions above a certain financial threshold

In essence, a PAN card is crucial for any financial dealings in India.

Step-by-Step Guide to Applying for a PAN Card Online

There are two authorized portals where you can apply for a PAN card online:

- NSDL (National Securities Depository Limited)

- UTIITSL (UTI Infrastructure Technology And Services Limited)

Option 1: Applying through the NSDL Website

Step 1: Visit the NSDL PAN Application Website.

Step 2: Choose the appropriate form based on your application type:

- Form 49A for Indian citizens

- Form 49AA for foreign nationals

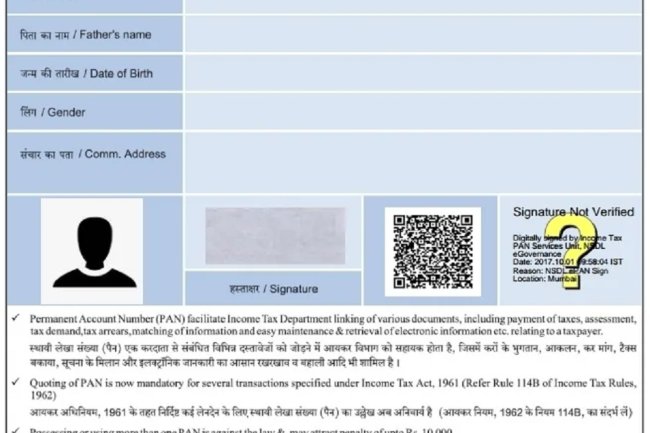

Step 3: Fill in the required personal details, such as:

- Full Name

- Date of Birth

- Email address

- Mobile number

Step 4: Choose your preferred mode of PAN card delivery:

- Physical PAN card by post

- e-PAN (digitally signed PAN card) sent via email

Step 5: Upload supporting documents for proof of identity, address, and date of birth. You can upload scanned copies of documents such as your Aadhaar card, passport, voter ID, or driving license.

Step 6: Pay the processing fee using available online payment methods such as credit/debit card, net banking, or UPI.

Step 7: Once the payment is successful, submit the form and take note of the acknowledgment number. You can use this number to track your PAN card application status.

Step 8: After verification, your PAN card will be dispatched to your registered address, or the e-PAN will be sent to your email.

Option 2: Applying through the UTIITSL Website

Step 1: Visit the UTIITSL PAN Application Website.

Step 2: Select the appropriate form for Indian citizens (Form 49A) or foreign nationals (Form 49AA).

Step 3: Fill in your personal details, including name, date of birth, and contact information.

Step 4: Upload your scanned documents for identity, address, and birth proof. Ensure that the documents are clear and legible.

Step 5: Make the necessary payment using online methods like debit/credit cards, net banking, or UPI.

Step 6: Submit the application and note down your acknowledgment number for tracking purposes.

Step 7: After verification, your PAN card will be sent to your registered address, or you can receive the e-PAN via email.

Documents Required for PAN Card Application

When applying for a PAN card online, you’ll need to submit the following documents:

-

Proof of Identity (any one):

- Aadhaar card

- Passport

- Voter ID

- Driving license

-

Proof of Address (any one):

- Aadhaar card

- Passport

- Utility bill (electricity, water, gas)

- Bank statement

-

Proof of Date of Birth (any one):

- Birth certificate

- Passport

- Matriculation certificate

- Aadhaar card

-

Passport-sized photograph: (for physical PAN card)

Fees for PAN Card Application

- For Indian communication address: ₹110 (including GST)

- For foreign communication address: ₹1,020 (including GST)

Note: Fees may vary slightly depending on the portal and payment method used.

Tracking Your PAN Card Application Status

Once you’ve submitted your application, you can track its status using the acknowledgment number provided. Both the NSDL and UTIITSL websites offer a “Track PAN Status” feature where you can enter your acknowledgment number to see the current status of your application.

Receiving Your PAN Card

After successful verification of your documents and application, your PAN card will be dispatched to your address. If you opted for an e-PAN, it will be emailed to your registered email ID. The entire process usually takes around 15-20 working days.

Conclusion

Applying for a PAN card online is a simple and efficient process that saves you the hassle of visiting government offices. With just a few clicks and some basic documents, you can have your PAN card delivered right to your doorstep or inbox. Whether you’re applying for the first time or need a reissue, the online application process ensures you have your PAN card ready for all your financial and tax-related needs.

Ensure that you double-check your details and documents before submission to avoid delays or rejections.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/