How to Search for a Company’s PAN Number: A Complete Guide

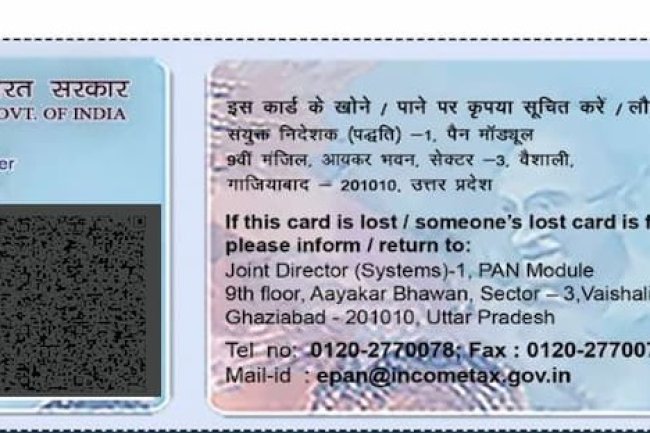

Introduction : A Permanent Account Number (PAN) is a crucial identifier issued by the Income Tax Department of India, not just for individuals but also for companies and other entities. Whether you need to verify a company’s PAN for tax purposes, financial transactions, or official documentation, it is essential to know how to search for a company's PAN number. This article will guide you through the process of finding a company's PAN number using available online resources.

Why You Might Need to Search for a Company’s PAN Number

There are several reasons you may need to search for a company’s PAN number:

- Verification: Ensuring the accuracy of a company’s PAN for tax filings or other legal purposes.

- Financial Transactions: PAN is often required for significant financial transactions, including payments, contracts, or partnerships.

- Tax Compliance: Verifying a company's PAN helps ensure that they are compliant with tax regulations.

- Legal Documentation: PAN may be required for official documents, agreements, or applications involving a company.

Methods to Search for a Company’s PAN Number

While individuals can easily find their PAN numbers using personal details, the process for companies is a bit more specialized. Below are some of the ways to search for a company’s PAN number.

1. Using the Income Tax E-filing Portal

If you have access to the company’s name and other basic details, you can use the official Income Tax e-filing portal to verify the PAN details.

- Step 1: Visit the official Income Tax e-filing website: www.incometaxindiaefiling.gov.in.

- Step 2: Under the Quick Links section, find the ‘Know Your TAN’ option. Though the portal primarily helps with TAN (Tax Deduction and Collection Account Number), company PAN details can sometimes be cross-referenced here if linked.

- Step 3: Enter the required details, such as the company’s name, registered address, or TAN number if available.

- Step 4: Complete the captcha verification and submit the form. The portal will provide you with relevant tax-related details, which may include the PAN number.

2. Using the NSDL Website for PAN Verification

If you need to verify a company’s PAN for official purposes, the National Securities Depository Limited (NSDL) offers a PAN verification service.

- Step 1: Visit the NSDL PAN verification portal: www.tin-nsdl.com.

- Step 2: Select ‘PAN Verification’ from the available options.

- Step 3: You may need to register for this service if you don’t have an existing account. This service is generally used by government entities, financial institutions, and businesses that need to verify PAN details regularly.

- Step 4: Once registered, you can search for the company’s PAN using its name or registration details.

3. Requesting PAN Details from the Company

Sometimes, the easiest way to obtain a company’s PAN number is to request it directly from the company. Businesses are often required to provide their PAN for legal and financial dealings. You can request the PAN number through official correspondence, especially if you are engaged in business with the company.

4. Consulting with a Chartered Accountant or Tax Professional

If you are unable to find a company’s PAN number through online searches, a chartered accountant or tax professional with access to specialized databases may be able to help. These professionals often have access to more detailed financial and tax records and can assist you in locating a company’s PAN number.

Important Points to Remember

- Authorized Use: Ensure that you have a legitimate reason to search for a company’s PAN number, as this information is sensitive and regulated by privacy laws.

- Accurate Information: When searching for a company’s PAN, ensure that the details you provide (such as the company name or registration number) are accurate to avoid errors.

- Secure Access: Always use official and secure portals for searching PAN details to protect the confidentiality of the information.

Conclusion

Searching for a company’s PAN number can be essential for financial, legal, and tax-related activities. By following the methods outlined in this guide, you can access a company’s PAN details efficiently and securely. Whether you use official government portals, request the information directly from the company, or consult with a tax professional, it’s important to ensure that you handle PAN information with care and in accordance with legal requirements.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?