How to Get a PAN Card Number - A Complete Guide

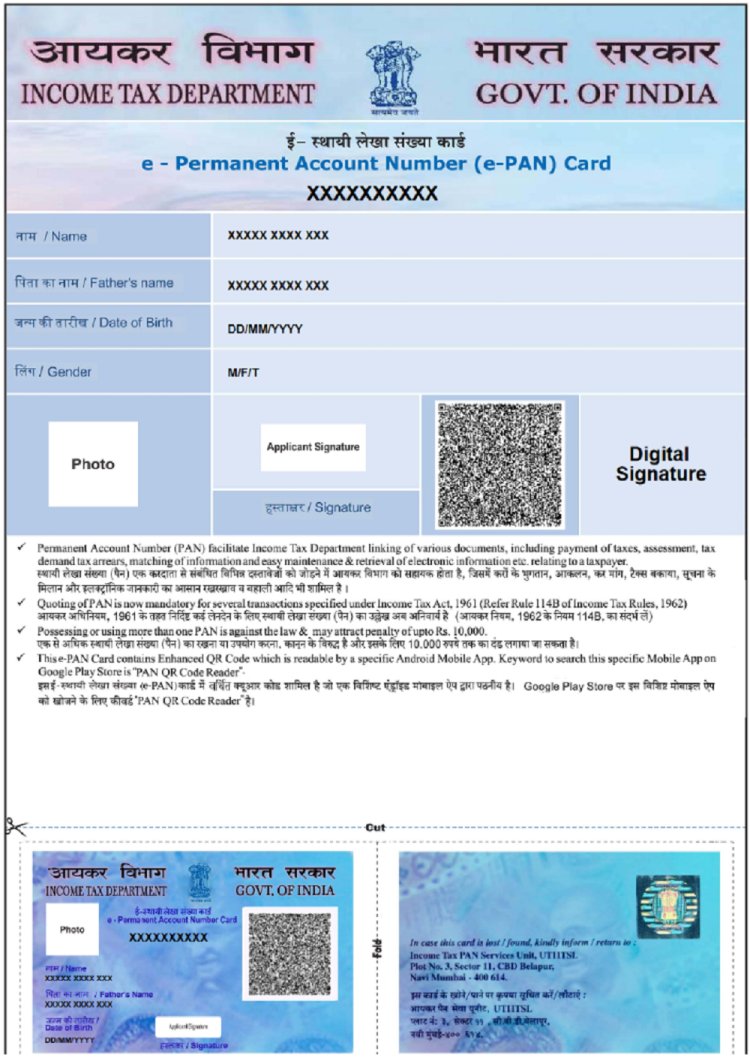

Introduction : A PAN (Permanent Account Number) is essential for anyone who earns or conducts financial transactions in India. Issued by the Income Tax Department, it serves as a unique identifier for taxpayers. Whether you're applying for a new PAN card or retrieving your PAN number, this guide will walk you through the steps to get your PAN card number quickly and efficiently.

Why You Need a PAN Card

A PAN card is mandatory for filing income tax returns, opening a bank account, buying or selling property, investing in the stock market, and conducting other major financial transactions. Without a PAN card, you may face limitations on financial activities and higher taxes on income.

How to Get a New PAN Card Number

-

Apply Online via NSDL or UTIITSL Portals

- Visit the official NSDL e-Gov PAN portal or UTIITSL PAN portal.

- Choose the appropriate form (Form 49A for Indian citizens, Form 49AA for foreign citizens).

- Fill in your personal details, including name, date of birth, and address.

- Upload the required documents, such as proof of identity, address, and date of birth.

- Pay the application fee online (approximately INR 107 for Indian communication address).

- Submit the form and note down the acknowledgment number for tracking purposes.

- After successful verification, your PAN card will be dispatched to your address, and you can use the acknowledgment number to check your PAN status.

-

Apply Offline

- Obtain the PAN application form (Form 49A) from any PAN service center or download it from the official NSDL/UTIITSL websites.

- Fill in the form manually with your details and attach copies of required documents (proof of identity, address, and date of birth).

- Submit the form at the nearest PAN service center along with the application fee.

- After verification, your PAN card will be sent to your registered address.

How to Retrieve Your PAN Card Number

-

Using the Income Tax e-Filing Portal

- Visit the official Income Tax e-Filing portal.

- Click on 'Verify Your PAN'.

- Enter your personal details, such as name, date of birth, and mobile number.

- Click 'Submit' to retrieve your PAN card number.

-

Using the NSDL Portal

- Go to the NSDL PAN portal.

- Select 'Know Your PAN'.

- Provide your name, date of birth, and mobile number.

- A One-Time Password (OTP) will be sent to your registered mobile number. Enter the OTP, and your PAN number will be displayed.

-

Through SMS

- Send an SMS in the format 'NSDLPAN' followed by your 15-digit acknowledgment number to 57575.

- You'll receive an SMS with your PAN details, including your PAN card number.

Important Tips

- Ensure the accuracy of the information you provide during the application process to avoid delays.

- Always keep a digital copy of your PAN card to avoid losing the number.

- If you don't receive your PAN card within the expected time frame, use your acknowledgment number to track the status.

Conclusion

Getting a PAN card number is an essential step for managing your finances in India. Whether you're applying for a new PAN card or retrieving an existing PAN number, following the steps outlined above will ensure a smooth and hassle-free process. Make sure to keep your PAN card secure, as it plays a crucial role in your financial and tax-related activities.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?