How to Check Your PAN Card Number Online: A Comprehensive Guide

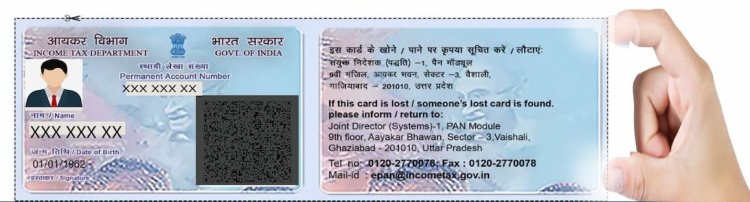

Introduction : The Permanent Account Number (PAN) is a vital identification tool issued by the Income Tax Department of India, used for various financial and tax-related transactions. Whether you've misplaced your PAN card or simply need to verify your PAN number, you can easily check it online. This guide will walk you through the steps to check your PAN card number online using various official resources.

Why You Might Need to Check Your PAN Card Number

There are several reasons why you might need to verify or retrieve your PAN card number:

- Lost or Misplaced PAN Card: If you’ve lost your PAN card, knowing your PAN number is essential for tax filing and financial transactions.

- Forgotten PAN Number: If you can't recall your PAN number and need it for official purposes.

- Tax Filing: Ensuring your PAN number is accurate before filing your income tax returns.

- Verification: Financial institutions, employers, or government agencies may require PAN verification for processing various applications.

Methods to Check Your PAN Card Number Online

There are several ways to check your PAN card number online. Below are the most commonly used methods:

1. Using the Income Tax E-filing Portal

The official Income Tax e-filing portal allows you to retrieve your PAN number using your personal details.

- Step 1: Visit the Income Tax e-filing website: www.incometaxindiaefiling.gov.in.

- Step 2: Under the ‘Quick Links’ section, click on ‘Know Your PAN’.

- Step 3: You will be required to enter your full name, date of birth, and registered mobile number.

- Step 4: Complete the captcha verification and click ‘Submit’.

- Step 5: You will receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to verify your identity.

- Step 6: After verification, your PAN number will be displayed on the screen along with other relevant details.

2. Using the NSDL PAN Verification Service

The National Securities Depository Limited (NSDL) provides a PAN verification service that allows you to check your PAN number online.

- Step 1: Visit the NSDL PAN verification page: www.tin-nsdl.com.

- Step 2: Select ‘PAN Verification’ from the options available.

- Step 3: Enter your personal details such as name, date of birth, and mobile number.

- Step 4: Complete the captcha and submit the form.

- Step 5: Your PAN number will be displayed after successful verification.

3. Using Aadhaar to Retrieve PAN Number

If your PAN is linked to your Aadhaar number, you can use your Aadhaar details to retrieve your PAN number.

- Step 1: Visit the Income Tax e-filing portal and select the ‘Link Aadhaar’ option.

- Step 2: Enter your Aadhaar number, name, and mobile number.

- Step 3: After verifying with OTP, your linked PAN number will be displayed.

What Information Do You Need to Check Your PAN Number?

To check your PAN number online, you will need the following details:

- Full Name: As registered with the Income Tax Department.

- Date of Birth: As mentioned on your PAN card.

- Registered Mobile Number: This is necessary for OTP verification.

- Aadhaar Number (optional): If you are using Aadhaar to retrieve your PAN number.

Important Points to Remember

- Accurate Information: Ensure that the information you provide matches exactly with the details registered with the Income Tax Department.

- Secure Portals: Always use official government websites such as the Income Tax e-filing portal or NSDL for PAN verification to ensure data security.

- OTP Verification: Keep your registered mobile number handy for OTP verification.

Conclusion

Checking your PAN card number online is a quick and straightforward process that can be done through official portals. Whether you’ve lost your PAN card or need to verify your PAN number, following the steps outlined in this guide will help you retrieve your PAN number securely and efficiently. Make sure to keep your PAN details safe and accessible for future financial and tax-related activities.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?