How to Check PAN Number Online: A Quick Guide

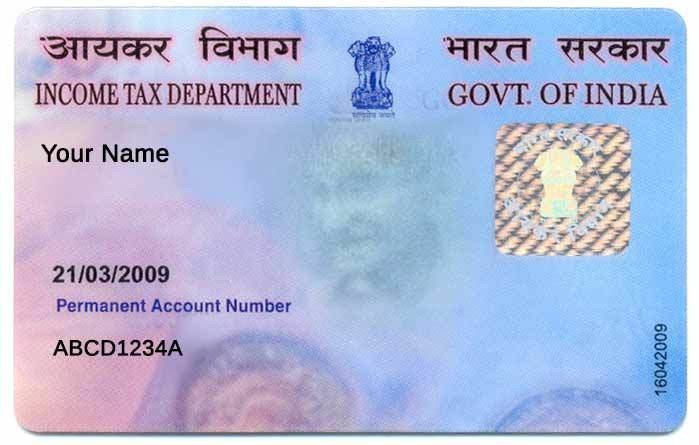

Introduction : The Permanent Account Number (PAN) is a unique identifier issued by the Income Tax Department of India. It is essential for various financial transactions, such as filing income tax returns, opening bank accounts, and making large transactions. If you need to check your PAN number but don’t have your physical PAN card handy, you can easily do so online. This guide will walk you through the steps to check your PAN number online.

Methods to Check Your PAN Number Online

-

Using the Income Tax e-Filing Website

The Income Tax e-Filing website allows you to check your PAN number by using your personal details. Here’s how you can do it:

Step 1: Visit the official Income Tax e-Filing website: https://www.incometax.gov.in/.

Step 2: Look for the "Know Your PAN" option under the Quick Links section on the homepage.

Step 3: Enter the required details, such as your full name, date of birth, and registered mobile number. Ensure that the details match the information registered with the Income Tax Department.

Step 4: Complete the captcha verification to proceed.

Step 5: You will receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to verify your identity.

Step 6: After successful verification, your PAN number will be displayed on the screen.

-

Through NSDL or UTIITSL Websites

The National Securities Depository Limited (NSDL) and UTI Infrastructure Technology And Services Limited (UTIITSL) also provide online PAN services. Here’s how you can use these platforms:

NSDL Portal:

- Visit the NSDL website and select the "PAN Card" section.

- Choose the "Know Your PAN" option and enter your details to retrieve your PAN number.

UTIITSL Portal:

- Visit the UTIITSL website and navigate to the "PAN Services" section.

- Use the “PAN Verification” service to check your PAN number by entering the required details.

-

Using Aadhaar to Check PAN Number

If your PAN is linked to your Aadhaar number, you can use the Aadhaar-based service to check your PAN details online. This service is available on the e-Filing portal:

Step 1: Go to the Income Tax e-Filing website.

Step 2: Select the "Link Aadhaar" option under the Quick Links.

Step 3: Enter your Aadhaar number and other personal details.

Step 4: After verification, your PAN number will be displayed.

-

Check PAN Number via SMS

Some financial institutions and authorized agencies allow you to check your PAN number via SMS. You may need to send an SMS in a specific format to a designated number to receive your PAN details on your mobile phone.

Why Knowing Your PAN Number is Important

- For Filing Income Tax Returns: PAN is mandatory for filing taxes, and knowing your PAN number is essential to avoid any delays or penalties.

- For Financial Transactions: PAN is required for high-value transactions, investments, and banking activities.

- For Identity Verification: PAN is often used as proof of identity for various official purposes.

Troubleshooting and FAQs

-

What if I don’t receive the OTP?

- Ensure that your mobile number is correctly registered with the Income Tax Department. If you still don’t receive the OTP, you may need to contact customer support for assistance.

-

Can I check someone else's PAN number?

- For privacy and security reasons, you cannot retrieve someone else's PAN number unless you have proper authorization.

-

Is there a fee to check my PAN number online?

- The Income Tax Department’s e-Filing website offers this service free of charge. However, some third-party services may charge a nominal fee.

Conclusion:

Checking your PAN number online is a simple and efficient process, thanks to the various digital services offered by the Income Tax Department and authorized agencies. Whether you’ve misplaced your PAN card or simply need to verify your PAN number, the online tools available make it easy to access your information with just a few clicks.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?