How to Check Your PAN Number: A Step-by-Step Guide

Introduction : Your Permanent Account Number (PAN) is a vital identification document for all taxpayers in India. Whether you’re filing your income tax return, opening a bank account, or conducting financial transactions, your PAN number is essential. But what happens if you misplace your PAN card or forget the number? Fortunately, there are multiple ways to check your PAN number online and offline. In this article, we’ll walk you through the various methods for checking your PAN number with ease.

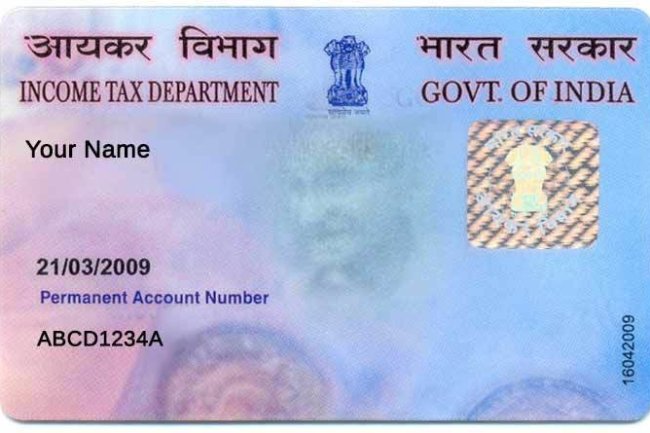

What is a PAN Number?

A PAN (Permanent Account Number) is a 10-digit alphanumeric identifier issued by the Income Tax Department of India. It links all your financial transactions, helping the government track tax payments and reduce tax evasion. PAN is required for financial dealings like filing income tax returns, applying for loans, and making high-value investments.

Why You May Need to Check Your PAN Number

There are several situations where you might need to check your PAN number:

- Lost or misplaced PAN card: You may have lost your PAN card and need to retrieve your number.

- Forgot PAN number: You might have forgotten your PAN number but need it urgently for official work or tax filing.

- Verification purposes: If you need to verify the correctness of your PAN details.

- Filing income tax returns: You may need your PAN number while filing income tax returns.

How to Check PAN Number Online

Here are the different ways you can check your PAN number online:

1. Via the Income Tax E-filing Website

- Step 1: Visit the official Income Tax E-filing website.

- Step 2: Under the 'Quick Links' section, click on the 'Know Your PAN' option.

- Step 3: Fill in your personal details like full name, date of birth, and mobile number.

- Step 4: An OTP (One-Time Password) will be sent to your registered mobile number. Enter the OTP to verify.

- Step 5: Your PAN details, including your PAN number, will be displayed on the screen.

2. Via the NSDL Website

- Step 1: Go to the official NSDL website and navigate to the PAN section.

- Step 2: Enter your Aadhaar number (if your PAN is linked to your Aadhaar) or provide other necessary details like your name and date of birth.

- Step 3: After verification, your PAN number will be shown on the screen.

3. Via Aadhaar Number

If your PAN is linked to your Aadhaar, you can use your Aadhaar number to retrieve your PAN information. Simply visit the Income Tax Department website and follow the instructions.

How to Check PAN Number Offline

If you prefer an offline method, you can check your PAN number through the following methods:

1. Call the Income Tax Helpline

- You can contact the Income Tax Department helpline at 1800 180 1961.

- Provide the necessary details like your name, date of birth, and registered mobile number, and they will help you retrieve your PAN number.

2. Check Your Previous Documents

If you’ve filed income tax returns in the past or have applied for loans, your PAN number will be present on these documents. Simply refer to your tax acknowledgment slip or bank statements to find your PAN number.

Important Points to Remember

- Ensure that your mobile number is updated: The OTP will only be sent to the mobile number registered with your PAN.

- Keep your PAN number safe: It’s a sensitive piece of information and should be kept secure to avoid identity theft or fraud.

- Use only official websites: When checking your PAN number online, always use the official Income Tax Department or NSDL websites to ensure security.

Conclusion

Checking your PAN number is a simple process, whether online or offline. By following the steps outlined in this guide, you can easily retrieve your PAN number whenever needed. Make sure to use the official websites and secure your PAN information to avoid misuse.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?