How to Check PAN Card Number Details Online: A Complete Guide

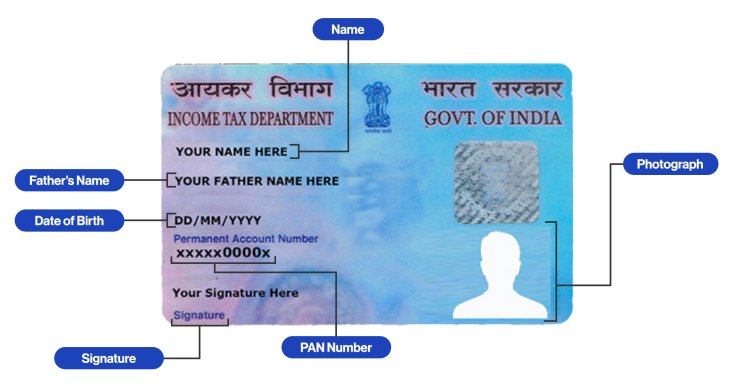

Introduction : The Permanent Account Number (PAN) is a unique 10-digit alphanumeric identifier issued by the Income Tax Department of India. It is essential for various financial and tax-related activities, including filing income tax returns, opening bank accounts, and making large financial transactions. If you need to check your PAN card number details, whether for verification or other purposes, this article will guide you through the process step by step.

Why Check PAN Card Number Details?

There are several reasons why you might need to check the details associated with your PAN card number:

- Verification: To ensure that the details on your PAN card match those registered with the Income Tax Department.

- Filing Taxes: Correct PAN details are required for accurate tax filing and to avoid any discrepancies.

- Financial Transactions: Banks and other financial institutions often require PAN verification for high-value transactions and investments.

- Updating Information: If you need to update your PAN details, it’s important to check the existing information before making changes.

Methods to Check PAN Card Number Details Online

-

Using the Income Tax e-Filing Portal

The official Income Tax e-Filing website provides a straightforward way to check your PAN card details. Here’s how to do it:

Step 1: Visit the Income Tax e-Filing website: https://www.incometax.gov.in/.

Step 2: Log in to your account using your PAN number, password, and date of birth. If you don’t have an account, you can register by providing your PAN and other personal details.

Step 3: Once logged in, navigate to the "Profile Settings" section.

Step 4: Click on "PAN Details." Here, you’ll find all the details associated with your PAN card, including your full name, date of birth, and PAN number.

-

Using the ‘Know Your PAN’ Service

If you don’t have access to your PAN card or need to retrieve your PAN number details, you can use the "Know Your PAN" service provided by the Income Tax Department:

Step 1: Visit the official Income Tax e-Filing website.

Step 2: Under the "Quick Links" section, click on "Know Your PAN."

Step 3: Enter your full name, date of birth, and registered mobile number. Ensure the information matches the records of the Income Tax Department.

Step 4: Complete the captcha verification and click "Submit."

Step 5: You will receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to proceed.

Step 6: After verification, your PAN card number details will be displayed on the screen.

-

Through NSDL and UTIITSL Portals

You can also check your PAN card details through the NSDL (National Securities Depository Limited) and UTIITSL (UTI Infrastructure Technology And Services Limited) websites:

NSDL Portal:

- Visit the NSDL website and select the "PAN Card" section.

- Choose the "PAN Verification" option and enter your PAN number to view the details.

UTIITSL Portal:

- Visit the UTIITSL website and navigate to the "PAN Services" section.

- Use the “PAN Verification” service to check your PAN card details by entering your PAN number.

-

Aadhaar-PAN Linkage for Details

If your PAN is linked to your Aadhaar number, you can check your PAN details through the Aadhaar linkage service on the Income Tax e-Filing portal:

Step 1: Go to the Income Tax e-Filing website.

Step 2: Click on the "Link Aadhaar" option under Quick Links.

Step 3: Enter your Aadhaar number and PAN number.

Step 4: Verify your details. Once verified, your PAN details linked to Aadhaar will be displayed.

-

Contacting the Income Tax Department

If you face issues checking your PAN card details online, you can reach out to the Income Tax Department’s customer care. They can assist you in retrieving your PAN number details by verifying your identity.

Common PAN Card Details You Can Check:

- PAN Number: The unique 10-digit alphanumeric identifier.

- Full Name: As registered with the Income Tax Department.

- Date of Birth: The birth date associated with your PAN card.

- Address: The address linked to your PAN, if available.

- Linked Aadhaar Number: If your PAN is linked to Aadhaar, you can verify the linkage.

Importance of Correct PAN Card Details:

- Accurate Tax Filing: Incorrect PAN details can lead to errors in tax returns and potential penalties.

- Banking and Investments: Many financial institutions require accurate PAN details for processing transactions.

- Preventing Identity Theft: Regularly checking your PAN details helps ensure that your identity is not being misused.

Conclusion:

Checking your PAN card number details online is a simple and efficient process that can be done through various official portals. Whether you need to verify your PAN details for tax purposes, financial transactions, or personal reasons, the methods outlined above will help you access your information quickly and securely. Keeping your PAN details accurate and up to date is essential for smooth financial operations and compliance with tax regulations.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?