Know Your PAN Card Number: A Comprehensive Guide

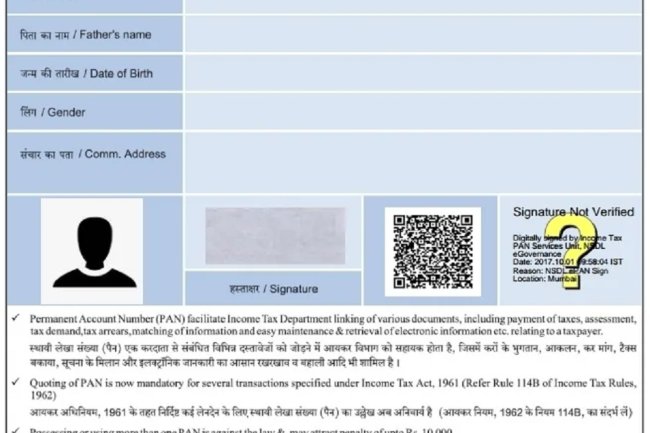

Introduction : A PAN (Permanent Account Number) card is a crucial document issued by the Income Tax Department of India to track financial transactions and prevent tax evasion. It is a unique ten-character alphanumeric identifier issued to all taxpayers in India. If you have misplaced your PAN card or simply can't remember your PAN number, there are several ways to retrieve it. This guide will walk you through various methods to know your PAN card number.

Why is the PAN Card Important?

Before diving into the methods to find your PAN card number, it’s essential to understand why it is important:

- Tax Filings: PAN is mandatory for filing income tax returns.

- Financial Transactions: It is required for various financial transactions, such as opening a bank account, applying for a credit or debit card, purchasing high-value assets, and more.

- Identification: PAN serves as a unique identity proof for individuals and entities.

Methods to Know Your PAN Card Number

1. Using the Income Tax Department's E-filing Portal

The Income Tax Department provides a simple way to retrieve your PAN card number online. Follow these steps:

- Visit the Income Tax e-filing website.

- Navigate to the ‘Know Your PAN’ section.

- Enter your details, such as name, date of birth, and mobile number.

- Enter the Captcha code for verification.

- Click on ‘Submit’.

- You will receive an OTP (One Time Password) on your registered mobile number. Enter the OTP and click ‘Validate’.

- Upon successful validation, your PAN number will be displayed on the screen.

2. Using Your Aadhaar Number

If your PAN is linked to your Aadhaar number, you can retrieve it by following these steps:

- Visit the Income Tax e-filing website.

- Go to the ‘Instant PAN through Aadhaar’ section.

- Enter your Aadhaar number and Captcha code.

- An OTP will be sent to your registered mobile number. Enter the OTP and click ‘Submit’.

- Your PAN details will be displayed on the screen if the Aadhaar number is already linked to a PAN.

3. Through Your Bank or Financial Institution

Many banks and financial institutions provide the facility to know your PAN number if you have linked your PAN with your bank account. Here’s how you can retrieve your PAN through your bank:

- Log in to your net banking account.

- Look for the ‘PAN details’ section under profile settings or personal information.

- Your PAN number will be displayed on the screen.

4. Via Call to the Income Tax Helpline

You can also call the Income Tax Department's helpline to know your PAN number:

- Call the Income Tax helpline at 1800-180-1961 or 1961.

- Provide your personal details like name, date of birth, and address as registered with the Income Tax Department.

- The customer service representative will help you retrieve your PAN number after verifying your identity.

5. Physical Visit to the Nearest Income Tax Office

If online methods do not work for you, you can always visit your nearest Income Tax office. Ensure you carry a valid ID proof and any documents related to your PAN application. The officials will guide you on how to retrieve your PAN card number.

Tips for Keeping Your PAN Number Secure

- Store It Digitally: Save your PAN card number on your phone or email for easy access.

- Avoid Sharing Publicly: Do not share your PAN number on social media or with unknown entities.

- Regularly Check Your PAN: Keep a check on your financial transactions linked with your PAN.

Conclusion

Losing or forgetting your PAN card number can be inconvenient, but with the methods listed above, you can easily retrieve it. Always ensure your PAN is safe and securely stored to avoid any future inconvenience. Remember, your PAN card is more than just a document; it's a key to many financial activities and transactions in India.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?