Everything You Need to Know About PAN: The Ultimate Guide

Introduction : In today's financial world, having a Permanent Account Number (PAN) is crucial. Whether you're filing taxes, opening a bank account, or conducting high-value transactions, your PAN card acts as an essential identity proof for various purposes. But what exactly is PAN? How do you apply for it? And why is it so important? In this article, we'll dive into everything you need to know about PAN.

What is PAN?

Permanent Account Number (PAN) is a 10-character alphanumeric identifier issued by the Income Tax Department of India. It’s unique to each individual, company, or entity and remains unchanged throughout your lifetime. PAN helps the government track financial transactions and prevent tax evasion.

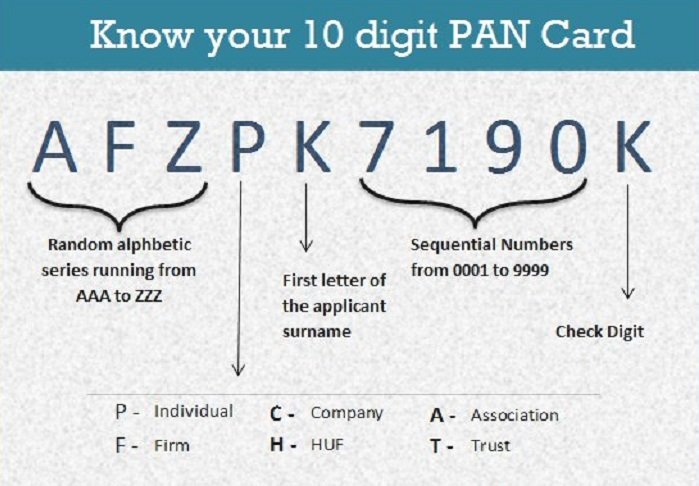

Structure of PAN

Your PAN consists of 10 characters:

- First five characters: Letters that indicate information about the holder

- Next four characters: Numbers representing your personal identity

- Last character: A letter that acts as a check digit

For example, a typical PAN number might look like: ABCDE1234F.

Why is PAN Important?

- Tax Filing: Every individual or entity who is liable to pay taxes must possess a PAN. It's necessary for filing Income Tax Returns (ITR).

- Identity Proof: PAN serves as a valid identity proof for various financial purposes.

- Opening Bank Accounts: You need PAN for opening a bank account or making transactions above ₹50,000.

- Property Purchase: PAN is mandatory when buying or selling property exceeding ₹5 lakh.

- Investment: PAN is needed to invest in mutual funds, stocks, and bonds.

How to Apply for a PAN Card

- Online Application: Visit the NSDL or UTIITSL websites.

- Documents Required: Submit proof of identity, proof of address, and two recent passport-sized photographs.

- Fee: The application fee is usually ₹110 for Indian applicants and ₹1,020 for foreign applicants.

- Delivery: After verification, the PAN card will be delivered to your registered address.

Situations Where PAN is Mandatory

- Filing ITR

- Buying or selling property

- Depositing cash exceeding ₹50,000

- Making investments

- Applying for a credit or debit card

How to Correct PAN Card Details?

If you’ve noticed a discrepancy in your PAN card details, such as name or address, you can request changes online through the NSDL or UTIITSL portal. Submit the required documents for proof and follow the procedure for rectification.

Difference Between PAN and Aadhar

While both PAN and Aadhar serve as identity proof, they serve different purposes. PAN is primarily used for financial transactions, while Aadhar is a universal identity document for availing various government schemes.

Conclusion

Owning a PAN card is not just a legal requirement but also a necessity in today’s financial ecosystem. Whether you’re a salaried individual, a business owner, or an investor, having a PAN helps streamline your financial dealings. Make sure to apply for it, update your details when necessary, and use it responsibly.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?