How to Get Your PAN Number by Name

Introduction : Your Permanent Account Number (PAN) is a critical identification tool for tax-related and financial activities in India. If you’ve misplaced your PAN card or forgotten your PAN number, you can easily retrieve it online using just your name and a few other personal details. In this article, we will guide you through the steps to find your PAN number by name using official online portals.

Why is Your PAN Number Important?

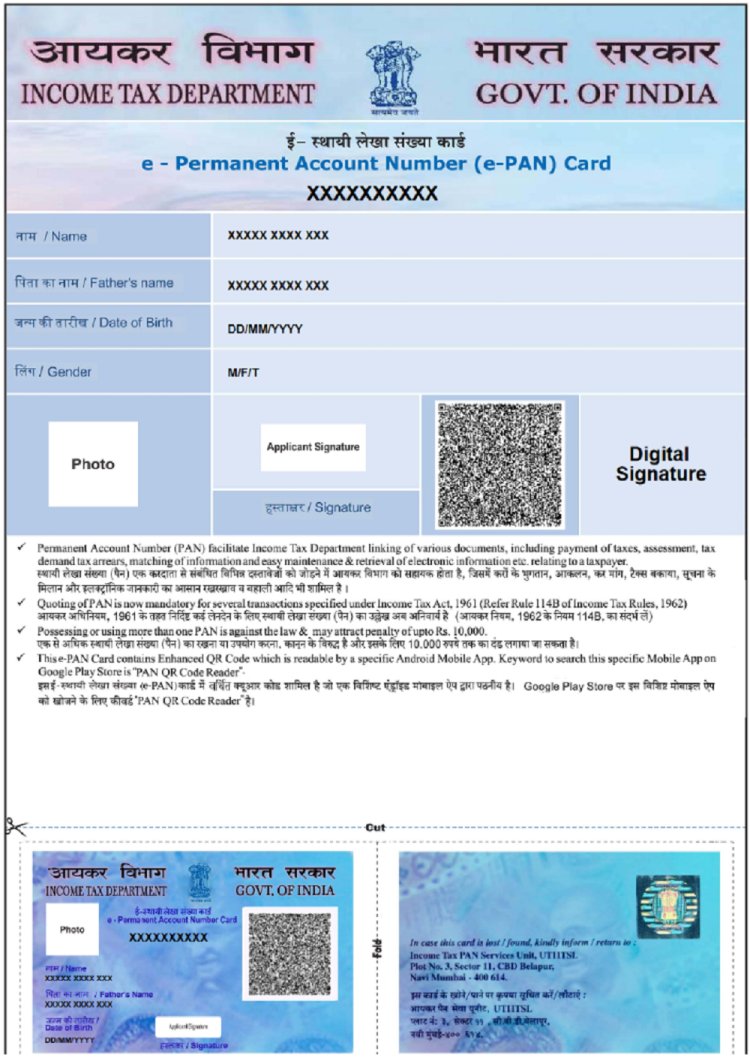

A PAN (Permanent Account Number) is a unique 10-digit alphanumeric code issued by the Income Tax Department of India. It is required for a wide range of financial transactions, including:

- Filing income tax returns

- Making high-value financial transactions (such as buying property)

- Opening a bank account

- Applying for loans or credit cards

- Investing in mutual funds or stocks

Given its importance, losing or forgetting your PAN number can cause delays or issues in completing financial transactions. Fortunately, retrieving your PAN number is a straightforward process.

How to Get Your PAN Number by Name

If you’ve forgotten your PAN number and don’t have access to your PAN card, you can retrieve it online by following these simple steps:

Method 1: Retrieve PAN Number via the Income Tax e-Filing Portal

The easiest way to find your PAN number is through the official Income Tax e-Filing portal. Here’s how:

Step 1: Visit the Income Tax e-Filing Portal

Go to the official Income Tax Department e-Filing website. This is the government-authorized portal where you can retrieve your PAN details securely.

Step 2: Select the “Know Your PAN” Option

Once on the portal, look for the “Know Your PAN” service. This tool allows you to retrieve your PAN number by entering your personal information.

Step 3: Provide Personal Details

You will be asked to provide the following details:

- Full Name (as registered with your PAN)

- Date of Birth (DOB)

- Mobile number (registered with your PAN)

In some cases, the portal may ask for your father’s name to ensure proper identification.

Step 4: Verify Through OTP

After entering your personal details, you’ll receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to verify your identity.

Step 5: View Your PAN Number

Once your identity is verified, your PAN number will be displayed on the screen. Make sure to note it down or save it for future reference.

Method 2: Retrieve PAN Number via NSDL Portal

You can also retrieve your PAN number using the NSDL (National Securities Depository Limited) portal.

Step 1: Visit the NSDL Website

Go to the official NSDL website and click on the option to “Know Your PAN.”

Step 2: Enter Required Information

Provide your full name, date of birth, and the mobile number linked to your PAN.

Step 3: Verify OTP

An OTP will be sent to your mobile number for verification. Once you enter the OTP, you’ll be able to view your PAN number.

Method 3: Retrieve PAN Number via UTIITSL Portal

The UTIITSL (UTI Infrastructure Technology and Services Limited) portal also offers the service to retrieve PAN details by name.

Step 1: Visit UTIITSL Portal

Go to the UTIITSL website and click on the "Know Your PAN" option.

Step 2: Enter Your Details

Provide your full name, date of birth, and other necessary information. An OTP will be sent to your registered mobile number for verification.

Step 3: Retrieve PAN Number

Once the OTP is verified, your PAN number will be displayed on the screen.

Method 4: Retrieve PAN Number Through Aadhaar Link

If your PAN card is linked to your Aadhaar number, you can retrieve your PAN number via the Aadhaar website.

Step 1: Visit the Aadhaar Website

Go to the UIDAI Aadhaar website and use the Aadhaar services to link your PAN or retrieve it if linked previously.

Step 2: Provide Necessary Information

Enter your Aadhaar number, name, and registered mobile number.

Step 3: Verify OTP and Retrieve PAN

After OTP verification, if your PAN is linked to your Aadhaar, your PAN number will be displayed.

Is It Safe to Retrieve PAN Number Online?

Yes, retrieving your PAN number online is safe if done through official government websites like the Income Tax e-Filing portal, NSDL, or UTIITSL. These websites use OTP verification and encryption to protect your data. However, avoid sharing your personal details with unauthorized or third-party websites.

Important Security Tips

- Always use official portals like the Income Tax Department, NSDL, or UTIITSL to check your PAN number.

- Ensure that the website URL starts with "https://" to confirm a secure connection.

- Never share your OTP or PAN number with unauthorized parties.

Conclusion

Retrieving your PAN number by name is a simple and secure process, thanks to the various online tools provided by the Income Tax Department, NSDL, and UTIITSL. Whether you’ve lost your PAN card or simply forgotten the number, you can easily find it using the steps outlined above. Make sure to store your PAN number safely for future use to avoid any inconvenience.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?