How to Check Your PAN Number Online: A Step-by-Step Guide

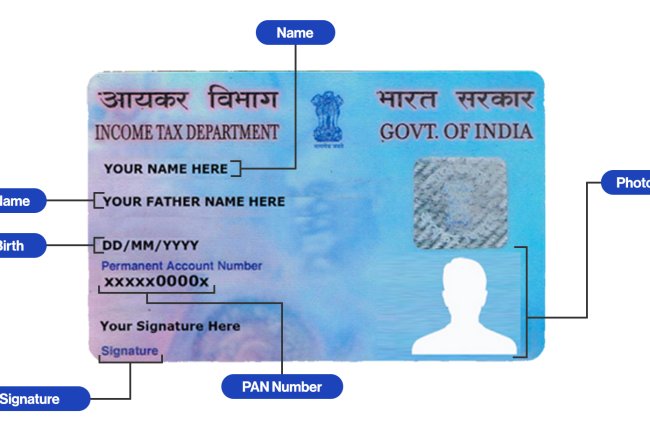

Introduction : The Permanent Account Number (PAN) is a unique identification number issued by the Income Tax Department of India. PAN is crucial for financial transactions, tax filing, and KYC (Know Your Customer) verifications. If you have misplaced or forgotten your PAN number, you can easily retrieve it online. This article will walk you through the various methods available to check your PAN number online.

Why You Need to Know Your PAN Number

Your PAN number is essential for:

- Income Tax Filing: PAN is required to file income tax returns.

- Financial Transactions: Many high-value transactions in banks, stock exchanges, or property purchases require PAN.

- Opening Bank Accounts: Most banks in India require PAN for account opening.

- Loan Applications: PAN is mandatory when applying for loans or credit cards.

- KYC Verification: Financial institutions and telecom services require PAN for KYC compliance.

If you’ve forgotten or misplaced your PAN number, it’s important to retrieve it to avoid issues with these processes.

Steps to Check PAN Number Online

You can easily check your PAN number online through the Income Tax Department’s official website or other government-authorized portals.

Method 1: Using the Income Tax e-Filing Website

The Income Tax Department of India offers an easy way to retrieve your PAN number online. Follow these steps:

-

Visit the Income Tax e-Filing Portal

Go to the official Income Tax e-Filing website. -

Click on ‘Know Your PAN’

Scroll down the homepage and click on the “Know Your PAN” option under the ‘Quick Links’ section. -

Enter Your Personal Details

You’ll be prompted to fill in details such as your full name, date of birth, and mobile number. Ensure the details match those used in your PAN application. -

Submit Captcha Code

After entering your details, complete the CAPTCHA verification and click submit. -

Receive OTP Verification

An OTP (One-Time Password) will be sent to your registered mobile number. Enter the OTP to proceed. -

View Your PAN Number

After OTP verification, your PAN number will be displayed on the screen.

Method 2: Using the NSDL or UTIITSL Portals

Another way to check your PAN number online is through the NSDL or UTIITSL websites. These portals are authorized by the government for PAN services, including retrieving PAN details.

-

Go to the NSDL Website

Visit the official NSDL PAN Services page. -

Select ‘Know Your PAN’

Find the relevant option to retrieve your PAN number. -

Enter Required Information

You will be required to provide your personal details, including your full name, date of birth, and registered mobile number. -

Receive OTP and Verify

An OTP will be sent to your registered mobile number for verification. -

View Your PAN Number

Once verified, your PAN number will be displayed on the screen.

Method 3: Using the Aadhaar Number to Check PAN

If your PAN is linked with Aadhaar, you can also retrieve your PAN number by using your Aadhaar details.

-

Visit the Income Tax e-Filing Portal

Go to the Income Tax e-Filing website. -

Select ‘Link Aadhaar with PAN’

Choose the “Link Aadhaar” option under the ‘Quick Links’ section. -

Enter Aadhaar Number

Input your Aadhaar number and other relevant details. -

Verify with OTP

An OTP will be sent to your Aadhaar-registered mobile number. Enter the OTP to proceed. -

Retrieve PAN

After verification, you will be able to view your PAN number linked with your Aadhaar card.

What to Do If You Don’t Have a Registered Mobile Number?

If you don’t have access to the mobile number linked with your PAN or Aadhaar, you can visit a nearby PAN service center to update your details. Once your mobile number is updated, you can proceed with the online steps mentioned above to check your PAN number.

Common Issues When Checking PAN Number Online

- Mismatched Details: Ensure that the details you enter (name, date of birth) match exactly with your PAN records.

- Inactive PAN: If your PAN number has been deactivated, you will need to contact the Income Tax Department to resolve the issue.

- Forgot Registered Mobile Number: If you no longer have access to the registered mobile number, you must update your number via Aadhaar or at a PAN service center.

Importance of Keeping Your PAN Updated

- Prevents Misuse: Keeping your PAN details updated helps prevent identity theft or misuse of your PAN.

- Seamless Financial Transactions: Accurate PAN details ensure smooth financial and legal transactions.

- Compliance with Laws: PAN is linked with various financial processes like TDS, tax returns, and large financial transactions.

FAQs

1. Can I check my PAN number online for free?

Yes, checking your PAN number online via the Income Tax e-filing portal is free.

2. What if my PAN number is incorrect?

If your PAN number is incorrect or not found, you can correct it by submitting a PAN correction request through the NSDL or UTIITSL portals.

3. How long does it take to retrieve my PAN number?

You can retrieve your PAN number instantly after completing the OTP verification process.

4. Can I retrieve PAN details using my Aadhaar number?

Yes, if your PAN is linked to your Aadhaar, you can use your Aadhaar number to retrieve your PAN details.

5. What happens if I have multiple PAN cards?

It is illegal to hold multiple PAN cards. If you have more than one PAN card, you should surrender the additional card(s) immediately.

Conclusion

Retrieving your PAN number online is a simple and convenient process that only takes a few minutes. By using the Income Tax e-filing portal or government-authorized services like NSDL and UTIITSL, you can easily check your PAN details. Make sure to keep your PAN information up-to-date to ensure smooth financial transactions and compliance with tax laws.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?