Know the PAN Details – A Comprehensive Guide

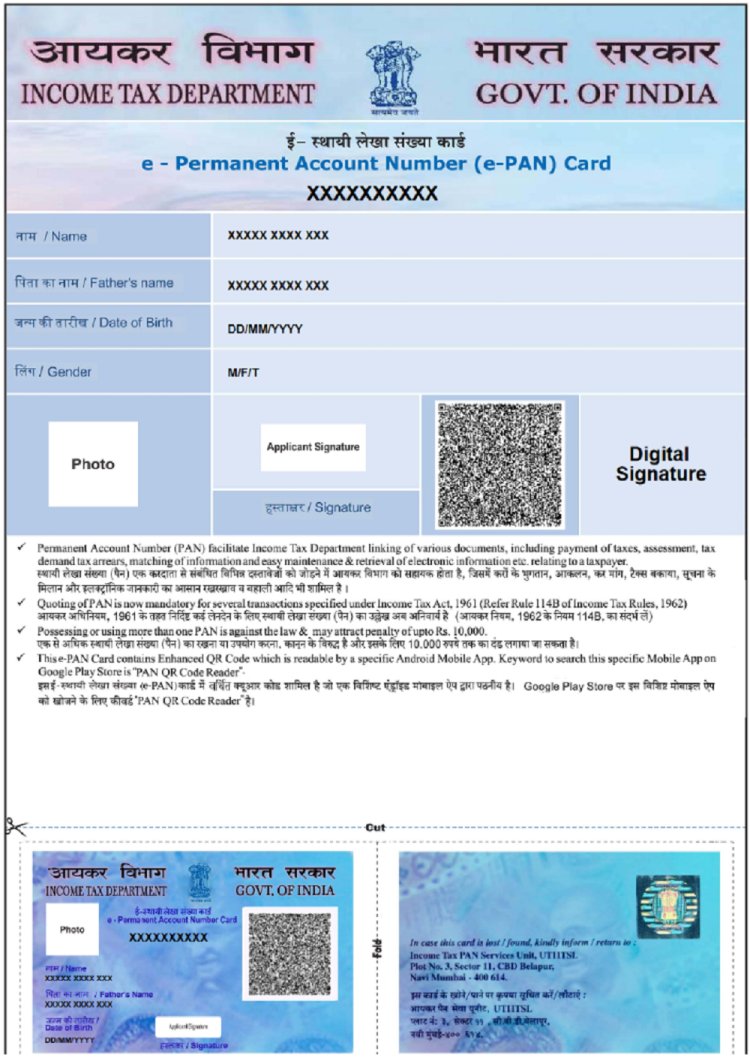

Introduction : Permanent Account Number (PAN) is a crucial document for all financial transactions in India. Issued by the Income Tax Department, PAN helps the government track income tax filings, business transactions, and other financial activities. Whether you're applying for a loan, opening a bank account, or filing taxes, knowing the details of your PAN is essential. Here's everything you need to know about how to check and understand your PAN details.

Why Is PAN Important?

PAN is a 10-character alphanumeric code unique to each individual or entity. It is used for:

- Filing Income Tax Returns – PAN is mandatory to file ITR and track your tax-related details.

- Financial Transactions – It is necessary for high-value transactions like buying property, investing in mutual funds, or taking loans.

- Identity Proof – PAN also serves as a valid identification document.

How to Know Your PAN Details Online

If you have misplaced your PAN or need to verify details, follow these simple steps to retrieve them online:

-

Visit the Income Tax E-filing Website

Go to the Income Tax E-filing Portal. -

Access PAN Services

On the homepage, under the 'Quick Links' section, select 'Know Your PAN.' -

Provide Basic Information

Enter your full name, date of birth, and mobile number as per your PAN card records. -

Verify with OTP

You will receive an OTP on your registered mobile number. Enter the OTP for verification. -

Retrieve Your PAN Details

Once verified, your PAN details, including the PAN number and other registered details, will be displayed.

Common Scenarios When You Need PAN Details

- Lost PAN Card: You can use the steps above to retrieve your PAN number and apply for a duplicate card via UTIITSL or NSDL.

- Mismatched PAN Details: If your name or other details are incorrect, you can submit a correction request online through the UTIITSL or NSDL websites.

- PAN Linking to Aadhaar: Knowing your PAN details is important when linking it to Aadhaar, a process required for filing ITR.

Important Tips to Protect Your PAN

- Never share your PAN unnecessarily.

- Avoid leaving your PAN number in the public domain.

- Ensure PAN is linked to Aadhaar to avoid deactivation.

- Check your PAN status if you're not receiving important financial documents.

Conclusion

Knowing your PAN details is a must for maintaining smooth financial operations in India. Whether it's for tax filing, high-value purchases, or financial records, ensuring that your PAN details are correct and accessible will save you from unnecessary hassles. Always double-check and keep your PAN secure.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?