What is Form 26Q? A Complete Guide

Introduction : Form 26Q is a quarterly statement used for the filing of Tax Deducted at Source (TDS) on payments other than salaries in India. It is a crucial document that businesses and deductors must file with the Income Tax Department. This form helps the government track TDS deductions on payments such as interest, dividends, professional fees, and rent. Filing Form 26Q accurately and on time is essential to comply with TDS rules and avoid penalties. In this article, we’ll take a deep dive into Form 26Q, its purpose, filing process, due dates, and other important aspects.

What is Form 26Q?

Form 26Q is a TDS return statement filed for non-salary payments made by businesses or individuals liable to deduct TDS under the Income Tax Act. It includes details of TDS deducted and deposited on payments such as:

- Interest (other than interest on securities)

- Rent

- Professional and technical fees

- Payments to contractors and sub-contractors

- Commission or brokerage

- Dividend payments

Form 26Q needs to be submitted on a quarterly basis by the deductor (person or entity making the payment) to report the TDS deducted and the payments made to the Income Tax Department. The information filed in Form 26Q is used by the department to ensure that the correct amount of tax has been deducted at source from various transactions and payments.

Purpose of Form 26Q

The primary purpose of Form 26Q is to report TDS on payments other than salaries. This form helps the Income Tax Department monitor TDS compliance by businesses and individuals and ensures that taxes are being deducted and paid on eligible transactions. It also helps in crediting the deducted tax to the PAN of the payees (individuals or entities receiving the payment), which can later be used when they file their income tax returns.

Details Required for Filing Form 26Q

Form 26Q contains the following key information:

- Details of the Deductor: Name, address, and PAN/TAN (Tax Deduction Account Number) of the person or business responsible for deducting TDS.

- Details of the Deductee: Name, PAN, and other identifying details of the person or entity from whom the TDS was deducted.

- Transaction Details: Information about the type of payment made (e.g., interest, rent, professional fees) and the amount of tax deducted at source.

- Challan Details: Details of the TDS payment made to the government, including the Challan Identification Number (CIN), the amount deposited, and the date of deposit.

When Should Form 26Q Be Filed?

Form 26Q must be filed quarterly, with the due dates for each quarter as follows:

- April to June (Q1): Due by 31st July

- July to September (Q2): Due by 31st October

- October to December (Q3): Due by 31st January

- January to March (Q4): Due by 31st May

It is important to file Form 26Q within the stipulated time to avoid penalties and interest on late filings. In case of any errors in the original filing, you can submit a revised Form 26Q to correct the information.

How to File Form 26Q Online

Filing Form 26Q online is a straightforward process, and it can be done through the official TIN-NSDL (Tax Information Network - National Securities Depository Limited) portal. Here's a step-by-step guide to filing Form 26Q online:

Step 1: Registration on the NSDL Website

Before you can file Form 26Q, you need to register on the TIN-NSDL website (https://www.tin-nsdl.com/). You’ll need a valid TAN and other required details for registration.

Step 2: Prepare the Form

Use the NSDL Return Preparation Utility (RPU) or any third-party software approved by the Income Tax Department to prepare Form 26Q. Make sure you have all the necessary details of the deductor, deductees, and challan before preparing the return.

Step 3: Validate the Form

Once you’ve filled in the required details, validate the file using the File Validation Utility (FVU) provided by NSDL. This ensures that the form is error-free and ready for submission.

Step 4: Submit the Form

After validation, upload the file on the TIN-NSDL portal. You’ll receive an acknowledgment number, which can be used to track the status of the filing.

Step 5: Payment of TDS

Ensure that the TDS deducted is deposited with the government before filing Form 26Q. The payment can be made online via the Challan 281 form on the NSDL website.

Consequences of Late Filing or Non-Filing of Form 26Q

Failure to file Form 26Q within the due date can result in penalties and interest under Section 234E and Section 271H of the Income Tax Act. The penalties include:

- Late filing fee: ₹200 per day under Section 234E until the TDS return is filed, subject to the total amount of TDS.

- Penalty for non-filing: A penalty ranging from ₹10,000 to ₹1,00,000 under Section 271H for not filing the return or filing incorrect information.

To avoid these penalties, ensure that Form 26Q is filed correctly and on time.

Key Points to Remember

- Form 26Q is applicable for TDS on payments other than salary, such as interest, rent, professional fees, and commission.

- It must be filed quarterly by businesses and individuals responsible for TDS deductions.

- Filing should be done online through the TIN-NSDL portal.

- Ensure that TDS is deducted and deposited with the government before filing the return.

- Penalties apply for late filing, non-filing, or incorrect filing of Form 26Q.

Conclusion

Form 26Q is an essential part of the TDS filing process for non-salary payments in India. Filing it accurately and on time ensures compliance with tax laws and helps avoid penalties. Businesses and individuals must stay updated on the due dates and filing procedures to ensure smooth processing of TDS returns. With online filing options available, the process has become more streamlined and efficient.

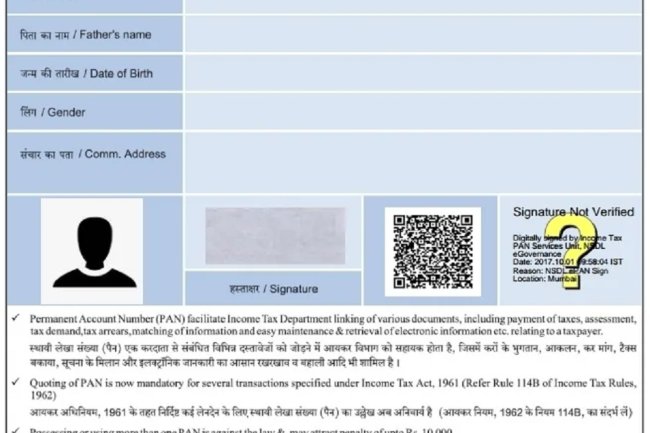

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?