Lost Your PAN Number? Here’s How to Recover It Quickly and Easily

Introduction : Losing your PAN number can be stressful, especially since it is a crucial identification tool for financial transactions and tax-related activities in India. Whether you've misplaced your physical PAN card or simply forgotten the number, don’t worry—there are several ways to recover your lost PAN number quickly and efficiently. In this article, we’ll guide you through the steps to retrieve your lost PAN number both online and offline.

Why Your PAN Number Is Important

Before diving into how to recover your lost PAN number, let’s understand why it’s so vital:

- Tax Filing: PAN is mandatory for filing income tax returns in India.

- Banking Transactions: Banks often require your PAN number for transactions above a certain threshold.

- Financial Investments: If you’re investing in mutual funds, stocks, or other assets, you’ll need your PAN number.

- Identity Verification: PAN serves as proof of identity in various legal and financial contexts.

Given its importance, retrieving your lost PAN number should be a top priority.

How to Recover Your Lost PAN Number: Step-by-Step Guide

1. Using the Income Tax e-Filing Portal:

- Visit the official Income Tax e-Filing website.

- Log in to your account if you’re a registered user. If not, you can easily register using your basic details such as name, date of birth, and contact information.

- Once logged in, go to the ‘Profile Settings’ section and select ‘PAN Details’ from the dropdown menu.

- Your PAN number will be displayed on the screen along with other relevant details.

2. Retrieve PAN via Aadhaar Number:

- If your PAN is linked with your Aadhaar, you can retrieve your PAN number through the Income Tax Department’s Aadhaar-based retrieval service.

- Enter your Aadhaar number and other required details to recover your PAN.

3. Check Previous Financial Documents:

- Your PAN number might be listed on financial documents such as bank statements, mutual fund statements, Form 16 (if you are salaried), or income tax returns. Reviewing these documents could help you retrieve your PAN number.

4. Use the NSDL or UTIITSL Websites:

- Visit the NSDL or UTIITSL websites.

- These portals offer services for PAN retrieval using your name, date of birth, and registered mobile number.

5. Contact Your Bank or Financial Institution:

- If your PAN is linked to your bank account or investment accounts, you can find your PAN number through your net banking portal or by contacting customer service.

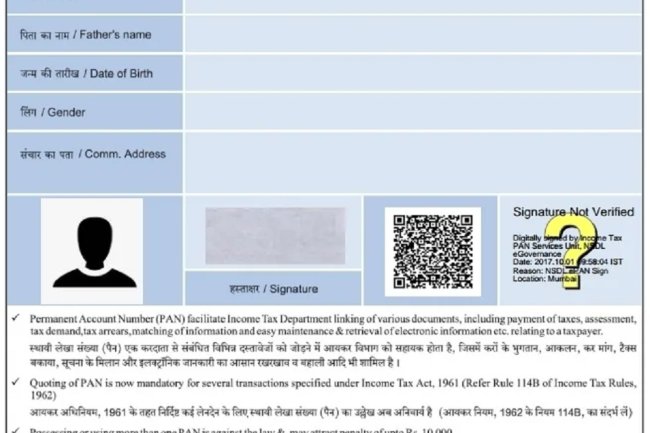

6. Apply for a Reprint of Your PAN Card:

- If you cannot retrieve your PAN number through the above methods, you can apply for a reprint of your PAN card through the NSDL or UTIITSL portals.

- You will need to provide identification details and pay a nominal fee.

What to Do If You Face Issues Recovering Your PAN Number

If you encounter difficulties while trying to recover your PAN number, consider the following steps:

- Double-Check Your Information: Ensure that all the information you provide (such as your name, date of birth, and contact details) matches the details registered with your PAN.

- Update Your Details: If your contact details (e.g., phone number, email address) have changed, you may need to update them before you can retrieve your PAN number.

- Contact Customer Support: If all else fails, you can contact the Income Tax Department’s helpline or the customer support services of NSDL or UTIITSL for assistance.

How to Prevent Future Loss of Your PAN Number

To avoid losing your PAN number again, follow these tips:

- Store Digitally: Save your PAN number in a secure digital format, such as a password-protected document or notes app.

- Record Physically: Write down your PAN number and keep it in a safe place, like a personal diary or secure file.

- Link PAN with Aadhaar: Linking your PAN with Aadhaar can simplify the retrieval process if you lose your PAN number again in the future.

Conclusion

Losing your PAN number can be inconvenient, but with the right steps, you can recover it quickly and easily. Whether you use the Income Tax e-Filing portal, check your financial documents, or contact your bank, there are multiple ways to retrieve your PAN number. By taking proactive steps to store your PAN number securely, you can avoid future complications and stay on top of your financial responsibilities.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?