How to Search PAN Details by PAN Number: A Complete Guide

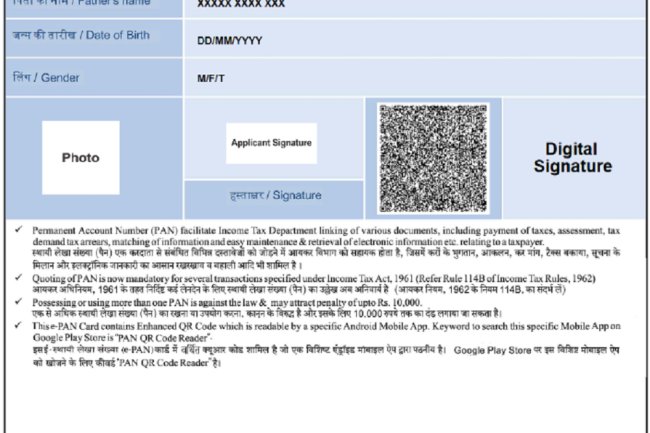

Introduction : A PAN (Permanent Account Number) is a unique, ten-digit alphanumeric identifier issued by the Income Tax Department of India to individuals and entities for tax purposes. The PAN is vital for conducting financial transactions, filing income tax returns, and serving as an identity proof. If you have a PAN number and need to find specific details associated with it, you can easily do so online. This article provides a step-by-step guide on how to search for PAN details using a PAN number.

Why You Might Need to Search PAN Details by PAN Number

There are several reasons why you might want to search for PAN details using a PAN number:

- Verification Purposes: To verify the authenticity of a PAN for financial transactions, job applications, or regulatory compliance.

- Prevent Fraud: To check if a PAN is valid and belongs to a genuine entity or individual, preventing identity theft and financial fraud.

- Update Personal Information: To confirm the details linked with a PAN before initiating updates or corrections.

What Information Can You Retrieve Using a PAN Number?

By searching for PAN details using a PAN number, you can obtain the following information:

- PAN Card Holder’s Name: The full name of the individual or entity as registered with the Income Tax Department.

- PAN Status: Whether the PAN is active, inactive, or under any form of scrutiny.

- Jurisdiction Details: The jurisdiction under which the PAN holder falls, based on their address and other factors.

- PAN Card Type: Whether the PAN is for an individual, company, partnership, trust, or other entity.

Step-by-Step Guide to Search PAN Details by PAN Number

Here is a detailed guide to help you search for PAN details using a PAN number:

-

Visit the Official Income Tax e-Filing Website:

- Open your web browser and navigate to the Income Tax e-Filing website.

-

Go to the 'Verify Your PAN Details' Section:

- On the homepage, look for the option labeled "Verify Your PAN Details" or something similar. This section is designed specifically for users to verify and check the details associated with a PAN number.

-

Enter the PAN Number:

- In the designated field, enter the PAN number you wish to verify. Ensure that the number is entered correctly to avoid errors.

-

Enter Additional Required Information:

- You may be prompted to enter additional information such as the full name of the PAN holder, date of birth or date of incorporation, and the registered mobile number for authentication purposes.

-

Complete the CAPTCHA:

- Fill in the CAPTCHA code displayed on the screen to verify that you are not a robot. This step is essential for security reasons.

-

Submit the Details:

- Click on the “Submit” button to proceed. The website will then process the information and display the PAN details on the screen.

-

View PAN Details:

- After submission, you will be able to view the details associated with the entered PAN number. These details typically include the PAN holder’s name, PAN status, jurisdiction, and other relevant information.

Alternative Methods to Search PAN Details by PAN Number

If you prefer an alternative method or the official website is temporarily unavailable, here are other ways to search for PAN details by PAN number:

-

Third-Party PAN Verification Services:

- There are several third-party websites that offer PAN verification services. While these can be convenient, it is important to ensure that the website is reputable to protect your data privacy and security.

-

Contact the Income Tax Department:

- You can also directly contact the Income Tax Department’s helpline to verify PAN details. They can guide you through the process and provide the necessary information.

-

Use the NSDL or UTIITSL Portal:

- The National Securities Depository Limited (NSDL) and UTI Infrastructure Technology and Services Limited (UTIITSL) websites also offer PAN verification services. You can use these platforms to search PAN details using a PAN number.

Important Considerations

While searching for PAN details using a PAN number, keep the following considerations in mind:

- Data Privacy: Be cautious about sharing PAN details and personal information. Always use official or trusted platforms to avoid data breaches and fraud.

- Ensure Correct Information: Double-check the PAN number and other details before submission to avoid errors in retrieving the information.

- Legal Compliance: Use the PAN verification service responsibly and in compliance with legal requirements. Misuse of PAN details for fraudulent activities can result in legal action.

Conclusion

Searching for PAN details by PAN number is a straightforward process that can be done online via the official Income Tax Department website or other trusted platforms. Whether for verification, preventing fraud, or updating records, knowing how to retrieve PAN details quickly and accurately is essential for both individuals and businesses. Always use secure and authorized channels to protect your personal information and ensure a safe experience.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455).

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?