How to Search PAN Card by Name: A Quick Guide

Introduction : A Permanent Account Number (PAN) is an essential identification tool for individuals and entities in India, linking all their financial transactions with the Income Tax Department. While the PAN card is a physical document, you may sometimes forget or misplace your PAN number. Fortunately, it is possible to search for your PAN card by name and retrieve your PAN number online. In this article, we will guide you through the steps on how to search for your PAN card by name, as well as the requirements you’ll need to follow for a successful search.

Why You Might Need to Search PAN by Name?

There are several reasons why you might need to search for your PAN card using your name:

- Lost or misplaced PAN card: If you've lost your PAN card and don’t remember the PAN number.

- Forgotten PAN number: You may need to retrieve your PAN number for tax filing, bank account opening, or other financial transactions.

- To resolve multiple PAN issues: In case multiple PANs were mistakenly issued, you might want to retrieve details of all issued PANs to rectify the issue.

Steps to Search PAN Card by Name

Here’s how you can search your PAN card number using your name online:

1. Visit the Income Tax e-Filing Website

Go to the official Income Tax Department's e-filing website. This portal allows users to access various PAN-related services, including retrieving their PAN number.

2. Select ‘Know Your PAN’ Option

On the homepage, find and click the “Know Your PAN” link under the 'Quick Links' section. This feature helps you search for your PAN by name and other details.

3. Enter Your Personal Details

You will be required to provide:

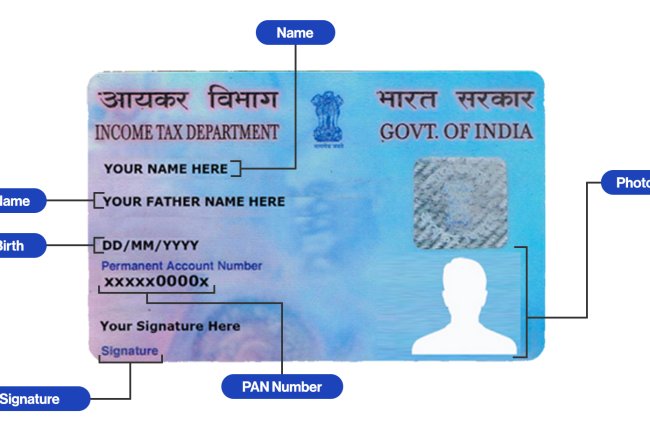

- Full Name: Ensure that you enter your full name exactly as it appears on your PAN card or in the records.

- Father’s Name: The father’s name should match the one registered with your PAN.

- Date of Birth: Enter your date of birth in DD/MM/YYYY format.

4. Complete Captcha Verification

You will be prompted to enter a captcha code. This is done to verify that the request is legitimate and to prevent bots from accessing the information.

5. Receive an OTP on Your Registered Mobile Number

An OTP (One-Time Password) will be sent to your registered mobile number linked to your PAN. Enter the OTP on the website to authenticate your request.

6. Retrieve Your PAN Number

Once your OTP is verified, your PAN number will be displayed on the screen. You can note it down or save it for future reference.

Important Points to Remember

- The name you enter must match exactly with the name registered on your PAN card. Any mismatch can lead to an error.

- You must have access to the mobile number registered with your PAN to receive the OTP.

- If your mobile number is not linked with your PAN, you will need to update it before proceeding.

- Only individuals can retrieve PAN details using this method. Companies or organizations must follow a different process.

What to Do If You Encounter Issues

If you face any problems during the process or if your name doesn't match the records, you can:

- Contact the Income Tax Department helpline for assistance.

- Visit a PAN service center like NSDL or UTIITSL to resolve discrepancies or update incorrect details.

FAQs

1. Can I search for someone else’s PAN number using their name?

No, you cannot search for someone else’s PAN details. The OTP verification step ensures that only the PAN holder has access to their PAN number.

2. What if I don’t have access to my registered mobile number?

You will need to update your mobile number by submitting a request through the NSDL or UTIITSL portal before attempting to retrieve your PAN.

3. Is there any fee for searching PAN by name?

No, the service to retrieve your PAN number through the Income Tax e-filing portal is free.

4. Can I search PAN by name and date of birth?

Yes, you can search for your PAN card using both your full name and date of birth, along with other necessary details like your father's name.

Conclusion

Searching for your PAN card by name is a quick and easy process that can be done entirely online. By following the steps mentioned above, you can retrieve your PAN number and avoid delays in financial or tax-related activities. Always ensure that your PAN details, especially your mobile number, are updated to make this process smooth.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?