How to Search for PAN Card Details: A Comprehensive Guide

Introduction : The Permanent Account Number (PAN) card is a crucial document for financial and tax-related activities in India. Whether you’ve misplaced your PAN card, forgotten your PAN number, or need to verify PAN details for official purposes, knowing how to search for PAN card details can be extremely useful. This guide will walk you through the process of searching for PAN card details online, why it’s important, and the various methods available.

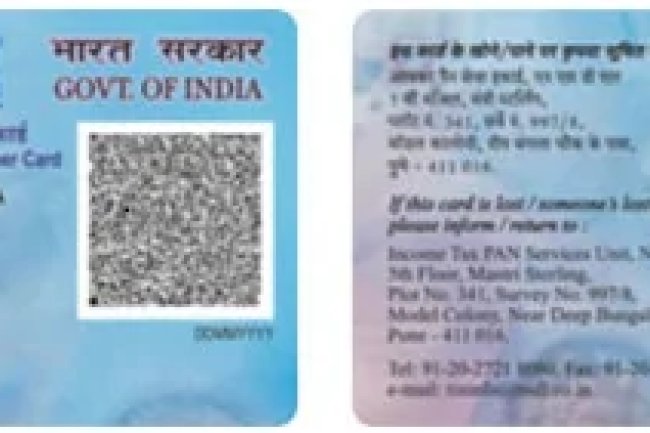

What is a PAN Card?

A PAN card is a 10-digit alphanumeric identification number issued by the Income Tax Department of India. It is used to track financial transactions and ensure that tax-related obligations are met. The PAN card is essential for individuals, businesses, and entities engaging in taxable activities or transactions above a certain threshold.

Why Might You Need to Search for PAN Card Details?

There are several reasons why you might need to search for PAN card details, including:

-

Misplaced PAN Card: If you have lost your PAN card and don’t have the number memorized, you’ll need to retrieve the details to apply for a duplicate card.

-

Verification Purposes: Employers, financial institutions, and other entities may need to verify PAN details to ensure authenticity during KYC (Know Your Customer) processes.

-

Tax Filing: You might need to confirm your PAN number when filing taxes or making large financial transactions.

How to Search for PAN Card Details Online

The Income Tax Department of India provides several ways to search for and verify PAN card details. Below are the most common methods:

1. Using the Income Tax e-Filing Website:

- Step 1: Visit the official Income Tax e-Filing website at https://www.incometax.gov.in.

- Step 2: Navigate to the “Know Your PAN” option under the “Quick Links” section.

- Step 3: Enter your personal details, such as your full name, date of birth, and mobile number.

- Step 4: Complete the CAPTCHA and click “Submit.”

- Step 5: You will receive an OTP on your registered mobile number. Enter the OTP to proceed.

- Step 6: After verification, your PAN details will be displayed on the screen.

2. Using the NSDL PAN Portal:

- Step 1: Go to the NSDL PAN portal at https://www.tin-nsdl.com.

- Step 2: Click on the “PAN Verification” option.

- Step 3: Enter your PAN number or acknowledgment number if you’ve applied for a new PAN.

- Step 4: Provide your personal details and submit the form.

- Step 5: The portal will display the relevant PAN details based on your input.

3. Using the UTIITSL PAN Portal:

- Step 1: Visit the UTIITSL PAN portal at https://www.utiitsl.com.

- Step 2: Select the “PAN Card” option from the menu.

- Step 3: Enter your PAN number or the application coupon number.

- Step 4: Submit your details to view your PAN information.

Important Considerations When Searching for PAN Details

-

Data Privacy: Always use official websites such as the Income Tax e-Filing portal, NSDL, or UTIITSL to search for your PAN details. Avoid third-party websites that might compromise your personal data.

-

Accurate Information: Ensure that the information you enter, such as your name and date of birth, matches the details on your PAN card to avoid errors in retrieving your PAN details.

-

Mobile Number: Your registered mobile number is crucial for receiving OTPs required for verification. Make sure your number is updated with the Income Tax Department.

FAQs

1. Can I search for my PAN card details by name alone?

Yes, you can search for your PAN details using your full name, date of birth, and registered mobile number on the official Income Tax e-Filing website.

2. What should I do if I can't retrieve my PAN details online?

If you are unable to retrieve your PAN details online, you can contact the Income Tax Department’s helpline or visit a PAN facilitation center.

3. Is it legal to search for someone else's PAN details?

No, it is illegal to search for someone else's PAN details without their consent. PAN information is confidential and should only be accessed by authorized individuals.

Conclusion

Searching for PAN card details is a straightforward process that can be done online through official portals. Whether you need to retrieve your own PAN number, verify details for tax purposes, or confirm information for KYC, the methods outlined above provide a secure and reliable way to access the information you need. Always ensure that you use authorized channels to protect your data and privacy.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?