How to Get Details Using Your PAN Number: A Complete Guide

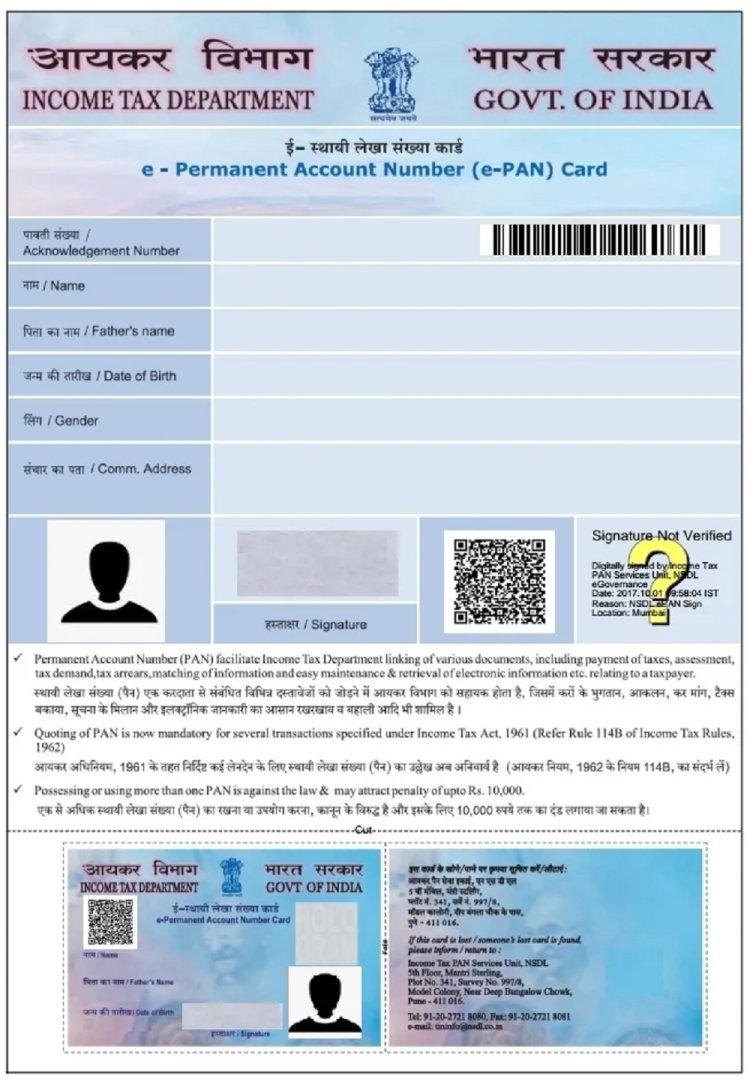

Introduction : The Permanent Account Number (PAN) is an essential document for individuals and businesses in India. Not only does it serve as proof of identity, but it also links all your financial transactions to a unique number. In certain scenarios, you might need to retrieve specific details associated with your PAN number, such as your name, date of birth, or even transaction history. This article provides a comprehensive guide on how to access various details using your PAN number and why it can be important for financial activities.

What Information Can You Get Using Your PAN Number?

Your PAN number can be used to retrieve multiple pieces of information linked to your financial profile. Here are some of the key details you can access using your PAN number:

- Full Name: As registered with the Income Tax Department.

- Date of Birth: For individual PAN holders.

- PAN Status: Whether your PAN card is active or has been canceled.

- Tax Filing Status: Details of your tax return filing and tax dues.

- Financial Transactions: Information on high-value transactions like mutual fund investments, property purchases, etc.

- Linked Aadhaar Number: Check if your PAN is linked to your Aadhaar number for compliance with government norms.

Why You Might Need PAN Number Details

You may need to retrieve information associated with your PAN number in several situations:

- Filing Income Tax Returns (ITR): Ensuring the accuracy of personal details and filing status.

- Verification: For Know Your Customer (KYC) procedures with banks or financial institutions.

- Tracking Transactions: Monitoring high-value financial activities linked to your PAN.

- Checking PAN Status: Ensuring your PAN card is active for tax purposes.

- Aadhaar-PAN Linking: To check whether your PAN is successfully linked to your Aadhaar for government compliance.

How to Get Details Using Your PAN Number: Step-by-Step Guide

Step 1: Visit the Income Tax Department’s Official Website

To retrieve details linked to your PAN number, visit the Income Tax Department’s e-filing portal or NSDL (National Securities Depository Limited) website. These platforms provide easy access to PAN-related services.

Step 2: Choose the Service You Need

Depending on the information you are looking for, select from options such as ‘Know Your PAN’, ‘Check PAN Status’, or ‘Track Financial Transactions’.

Step 3: Enter Your PAN Number

You will be required to enter your 10-digit alphanumeric PAN number. Be sure to enter it correctly to avoid errors in fetching your details.

Step 4: Enter Additional Information

For security reasons, you may be asked to provide further details such as your full name, date of birth, and a registered mobile number.

Step 5: Verify Through OTP

Once your details are entered, an OTP (One-Time Password) will be sent to your registered mobile number for verification. Enter the OTP to proceed.

Step 6: View or Download Your Details

After successfully verifying your identity, you can view your PAN-related information. This includes your name, date of birth, PAN status, tax filing history, and other financial data.

How to Use Your PAN Number for Tracking Transactions

If you want to track high-value financial transactions associated with your PAN number, the Income Tax Department’s e-filing portal provides access to the Form 26AS, which contains details about:

- Tax deducted at source (TDS) on salary, interest, or other payments.

- Advance tax payments made by you.

- Large financial transactions like property deals or stock market investments.

How to Check Form 26AS:

- Log in to the e-filing portal.

- Select ‘View Form 26AS (Tax Credit)’.

- Enter your PAN number and verification details.

- View and download the form for reference.

FAQs About PAN Number Details

Q1: Can I find my PAN details without a registered mobile number?

A1: No, a registered mobile number is required for OTP verification to access PAN details.

Q2: Can I retrieve someone else's details using their PAN number?

A2: No, PAN details are protected, and accessing someone else’s PAN information without authorization is illegal.

Q3: What should I do if my PAN details are incorrect?

A3: If any details associated with your PAN number are incorrect, you can request a correction through the NSDL or UTIITSL websites.

Conclusion

Retrieving details with your PAN number is a simple process that provides access to essential personal and financial information. Whether for tax filing, financial transaction tracking, or PAN status verification, knowing how to use your PAN number for such purposes can save you time and effort. Always ensure that you’re using official portals to safeguard your data.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?