Everything You Need to Know About e-PAN Card: A Complete Guide

Introduction : The e-PAN card is a digitally signed PAN card issued by the Income Tax Department of India. It serves the same purpose as the physical PAN card but comes in an electronic format. With the rise of digital transactions and the government's push for a paperless economy, the e-PAN card has become an essential tool for individuals and businesses alike. In this article, we will explore what an e-PAN card is, how to apply for one, and why it is beneficial.

What is an e-PAN Card?

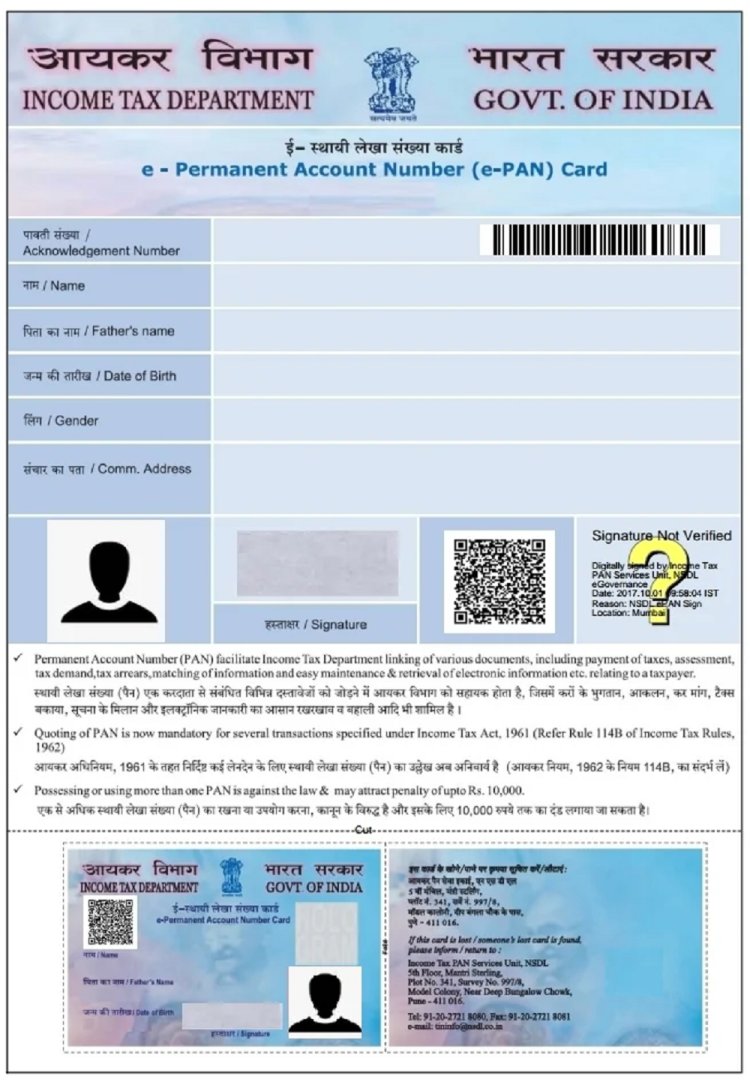

An e-PAN card is an electronic version of the traditional PAN card. It contains the same details as the physical card, including:

- Your PAN number (a unique 10-digit alphanumeric code)

- Your name

- Date of birth

- Photograph

- Digital signature

The e-PAN is a secure, digitally signed PDF document issued by the Income Tax Department and is legally equivalent to the physical PAN card.

Benefits of an e-PAN Card

The e-PAN card offers several advantages over the traditional physical card:

- Instant Issuance: e-PAN can be issued within minutes, making it ideal for urgent financial transactions.

- Convenience: The e-PAN is delivered directly to your email, so you don't have to worry about losing a physical card.

- Accessibility: You can easily store the e-PAN on your smartphone or computer and access it whenever needed.

- Paperless: The e-PAN aligns with the government's vision of a paperless economy and reduces the need for physical documentation.

Who Can Apply for an e-PAN Card?

Anyone who needs a PAN card can apply for an e-PAN. This includes:

- Individuals who have never had a PAN card before.

- Individuals who have lost or misplaced their physical PAN card and need a duplicate.

- Individuals who prefer a digital version of their existing PAN card for ease of access.

How to Apply for an e-PAN Card

Step 1: Visit the Official Portal

To apply for an e-PAN card, start by visiting the official e-filing portal of the Income Tax Department: https://www.incometaxindiaefiling.gov.in. Alternatively, you can also apply through the NSDL or UTIITSL websites.

Step 2: Choose the e-PAN Application Option

On the portal, look for the option to apply for an e-PAN card. This will usually be found under the "Quick Links" or "Services" section.

Step 3: Provide Your Details

You'll need to fill out a form with the following details:

- Aadhaar Number: The e-PAN application is linked to your Aadhaar, so you must have an Aadhaar number to apply.

- Name and Date of Birth: These should match the details on your Aadhaar card.

- Mobile Number and Email ID: Ensure that these are linked with your Aadhaar to receive OTPs for verification.

Step 4: Upload Your Signature and Photo (if required)

In most cases, your photograph and signature are automatically fetched from your Aadhaar data. However, if prompted, you may need to upload them.

Step 5: Verification and Submission

After filling in your details, you'll receive an OTP on your registered mobile number. Enter this OTP to verify your identity and submit your application.

Step 6: Receive Your e-PAN

Once your application is successfully submitted and verified, you will receive your e-PAN card in your email within a few minutes. The e-PAN will be in PDF format, digitally signed by the Income Tax Department, and ready for use.

How to Download Your e-PAN Card

If you've already applied for an e-PAN and need to download it again, you can do so by visiting the official portal, providing your PAN or Aadhaar number, and following the verification process. The e-PAN will be sent to your registered email ID.

Why Should You Opt for an e-PAN Card?

Opting for an e-PAN card is a smart choice in today’s digital age. It’s not just about convenience; the e-PAN also ensures that you have your PAN details readily available in a secure format. Moreover, it reduces the risk of losing or damaging your PAN card and makes it easier to share your PAN details digitally when required.

Conclusion

The e-PAN card is a modern solution for a traditional requirement, offering a fast, convenient, and secure way to access your PAN information. Whether you're applying for a new PAN or replacing a lost one, the e-PAN card provides an efficient and eco-friendly alternative to the physical card. With the entire process available online, obtaining your e-PAN has never been easier.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?