How to Check Your PAN Card Number Online: A Step-by-Step Guide

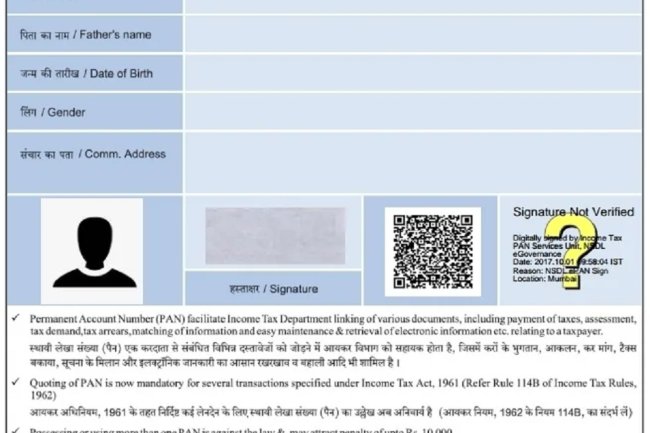

Introduction : Your Permanent Account Number (PAN) is a unique identification code issued by the Income Tax Department of India. It is essential for filing income tax returns, making financial transactions, and verifying identity. If you've misplaced or forgotten your PAN card number, there are simple ways to retrieve it online. In this article, we'll walk you through how to check your PAN card number using your basic details.

Why is PAN Card Number Important?

The PAN card number is vital for a wide range of financial activities, including:

- Filing income tax returns

- Making large financial transactions (such as purchasing property or stocks)

- Opening bank accounts

- Applying for loans and credit cards

- Linking with Aadhaar for identity verification Losing access to your PAN number can cause delays in these activities, so it's essential to retrieve it as soon as possible.

Step-by-Step Guide to Check Your PAN Card Number Online:

1. Visit the Income Tax e-Filing Website

The first step to retrieving your PAN card number is by visiting the official Income Tax Department's e-Filing portal.

2. Go to the 'Know Your PAN' Section

On the homepage, navigate to the 'Quick Links' section and click on 'Know Your PAN.' This option will redirect you to a page where you can check your PAN number by entering a few personal details.

3. Enter Your Details

You will be required to fill in the following information:

- Full name (as per your PAN application)

- Date of birth (DOB)

- Mobile number or email (for OTP verification)

- Father's name (optional but helpful for accurate results)

4. Complete OTP Verification

After entering your details, an OTP (One-Time Password) will be sent to your registered mobile number or email address. Enter the OTP in the verification box and proceed.

5. Get Your PAN Card Number

Once your details are verified, the system will display your PAN card number on the screen. You can note it down or take a screenshot for future reference.

6. Use the PAN Verification Facility (Optional)

If you wish to further verify your PAN number, you can also use the PAN verification service available on the same portal. Simply select the 'Verify PAN' option under 'Quick Links' and enter your PAN card number to cross-check its validity.

Other Ways to Retrieve PAN Card Number:

1. Using the Aadhaar Number

If your PAN is linked to your Aadhaar card, you can retrieve your PAN card number through the Income Tax e-Filing portal by entering your Aadhaar details.

2. Through Your Bank

Many banks also offer the facility to retrieve PAN details, especially if your PAN is linked to your bank account.

3. Check via Income Tax Return (ITR)

If you've filed your Income Tax Return (ITR) online, your PAN number will be available in your ITR form and acknowledgment receipt.

Conclusion:

Forgetting or misplacing your PAN card number can be inconvenient, but with the online tools provided by the Income Tax Department, it's easy to retrieve. The 'Know Your PAN' service is quick, secure, and accessible to anyone with basic details. Always ensure that your PAN is kept safe, as it's essential for multiple financial and legal purposes.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?