How to Surrender PAN Card Online: Step-by-Step Guide

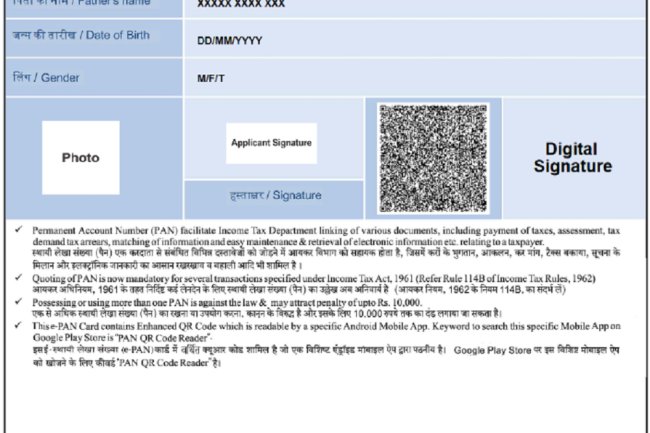

Introduction : The Permanent Account Number (PAN) is a crucial document for tax-related transactions in India. However, there might be instances when you need to surrender your PAN card. This typically happens if you have multiple PAN cards, which is illegal under Indian law, or in case of the death of a PAN holder. Fortunately, the Income Tax Department allows you to surrender a PAN card online easily. In this article, we will guide you through the process of surrendering your PAN card online, ensuring you follow the legal process and avoid any penalties.

Reasons to Surrender a PAN Card

-

Duplicate or Multiple PAN Cards

Owning more than one PAN card is illegal in India. If you’ve mistakenly obtained multiple PAN cards, it’s important to surrender the extra ones immediately. -

PAN Card Holder is Deceased

After the death of a PAN cardholder, it is necessary to surrender their PAN card to avoid misuse or unauthorized use of their identity. -

Non-Resident Individuals or Companies

Foreigners or NRIs (Non-Resident Indians) who have been assigned a PAN card but no longer require it may also surrender their PAN to the Indian tax authorities.

Steps to Surrender PAN Card Online

The process of surrendering your PAN card online is simple and can be done through the NSDL or Income Tax e-Filing portals. Follow these steps:

-

Surrender PAN via Income Tax e-Filing Portal

- Visit the Income Tax e-Filing portal.

- Log in using your PAN card credentials (User ID is your PAN number).

- Navigate to the "Profile Settings" section.

- Under "PAN/Aadhaar Linking," you’ll find an option to "Surrender PAN."

- Fill out the form, mentioning the reason for surrender, and submit it.

-

Surrender PAN via NSDL Portal

- Visit the NSDL website.

- Navigate to the “PAN Card Services” section and select “Surrender PAN.”

- You will need to fill out Form 49A for individuals or Form 49AA for entities like companies or firms.

- Enter the details of the PAN card(s) you wish to surrender, including your duplicate or extra PAN numbers.

- Submit the form and track the application status using the acknowledgment number provided.

-

For Deceased Individuals

If the PAN cardholder is deceased, their legal heir can apply for PAN card surrender by submitting the death certificate along with Form 49A or 49AA. This can be done either online via the NSDL portal or by physically visiting an Income Tax Office.

Consequences of Not Surrendering Duplicate PAN

Having more than one PAN card is a violation under Section 139A of the Income Tax Act, 1961. If caught holding multiple PANs, individuals can face a penalty of up to ₹10,000. Therefore, it is essential to surrender any duplicate or additional PAN cards immediately.

Important Points to Remember

- Ensure you surrender any additional or unused PAN cards to avoid legal penalties.

- Keep a copy of the acknowledgment receipt after successfully submitting the surrender request.

- In case of PAN surrender for deceased individuals, a legal heir should submit the necessary documents.

Conclusion

Surrendering a PAN card online is a straightforward process. Whether you have multiple PAN cards or need to surrender the PAN of a deceased relative, following the correct procedure ensures compliance with Indian tax laws. Always use official government portals like the Income Tax e-filing website or NSDL for safe and secure submission of your PAN surrender request.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?