How to Check PAN Details Online: A Comprehensive Guide

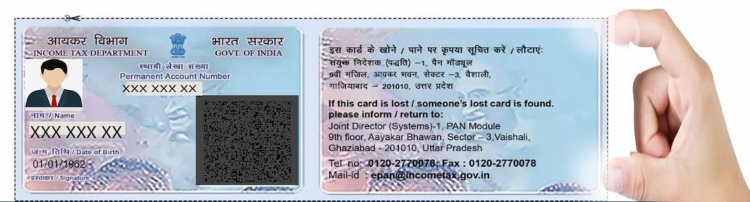

Introduction : The Permanent Account Number (PAN) is a critical identifier for all taxpayers in India, issued by the Income Tax Department. It is essential for various financial transactions, including filing income tax returns, opening bank accounts, and more. Occasionally, you may need to verify or check your PAN details to ensure they are accurate and up to date. This article will guide you through the process of checking your PAN details online.

Why Is It Important to Check Your PAN Details?

Ensuring the accuracy of your PAN details is crucial for several reasons:

- Avoiding Discrepancies: Incorrect PAN details can lead to issues when filing tax returns or completing financial transactions.

- Verification: If you’re linking your PAN with other documents like Aadhaar or a bank account, verifying the details beforehand ensures a smooth process.

- Updating Information: Regularly checking your PAN details helps in identifying any outdated information that may need to be updated.

Steps to Check Your PAN Details Online

The Income Tax Department has made it easy for individuals to check their PAN details online. Below are the steps to do so:

Step 1: Visit the Income Tax e-Filing Portal

Start by visiting the official Income Tax Department's e-Filing portal at www.incometaxindiaefiling.gov.in. This is the primary platform for all PAN-related services.

Step 2: Log In or Register

To access your PAN details, you will need to log in to the portal. If you do not have an account, you can easily register using your PAN number, email ID, and mobile number.

Step 3: Navigate to ‘Profile Settings’

Once logged in, go to the 'Profile Settings' section located on the dashboard. Here, you will find an option to view and update your profile details.

Step 4: View PAN Details

Click on ‘PAN Details’ under Profile Settings. You will be able to see all the details associated with your PAN, including:

- PAN Number: Your unique 10-digit alphanumeric code.

- Name: Your full name as per the PAN records.

- Date of Birth: Your date of birth as registered with the Income Tax Department.

- Father’s Name: The name of your father as per the PAN records.

- Status: Indicates whether your PAN is active.

Step 5: Verify and Update (If Necessary)

Carefully review the displayed details. If everything is accurate, there’s no further action needed. However, if you notice any discrepancies, you may need to update your PAN details. This can be done through the ‘Profile Settings’ or by visiting a PAN service center.

Alternative Methods to Check PAN Details

In addition to the e-Filing portal, you can also check your PAN details through:

- NSDL or UTIITSL Portals: Both NSDL and UTIITSL offer services to check PAN details online. You can visit their websites and use the ‘PAN Verification’ option.

- Mobile Apps: Certain apps authorized by the Income Tax Department allow you to check your PAN details on your smartphone.

Important Tips

- Confidentiality: Always ensure that you are using a secure and official platform to check your PAN details.

- Accurate Information: Double-check the details you enter, especially your PAN number, to avoid any errors.

- Regular Checks: Periodically checking your PAN details can help you stay updated and avoid any issues during tax filing or financial transactions.

Conclusion

Checking your PAN details online is a straightforward process that can be done in just a few minutes. Whether for verification or updating purposes, having accurate PAN details is essential for seamless financial and tax-related activities. By following the steps outlined above, you can ensure that your PAN details are correct and up-to-date, helping you avoid any potential issues in the future.

If you encounter any problems or need assistance, the Income Tax Department offers support through their helpline and PAN service centers.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?