How to Check Your PAN Card Number Online - A Simple Guide

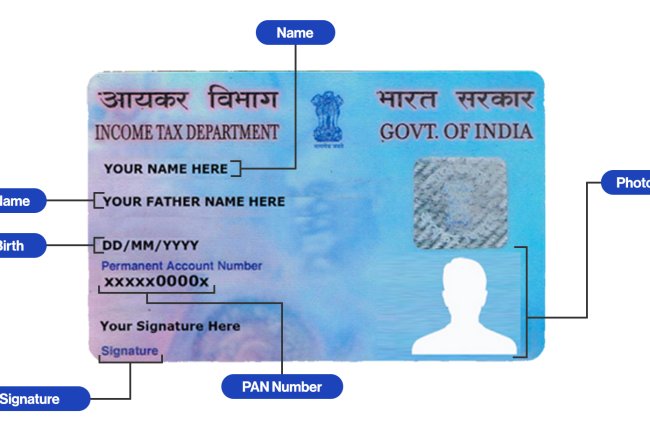

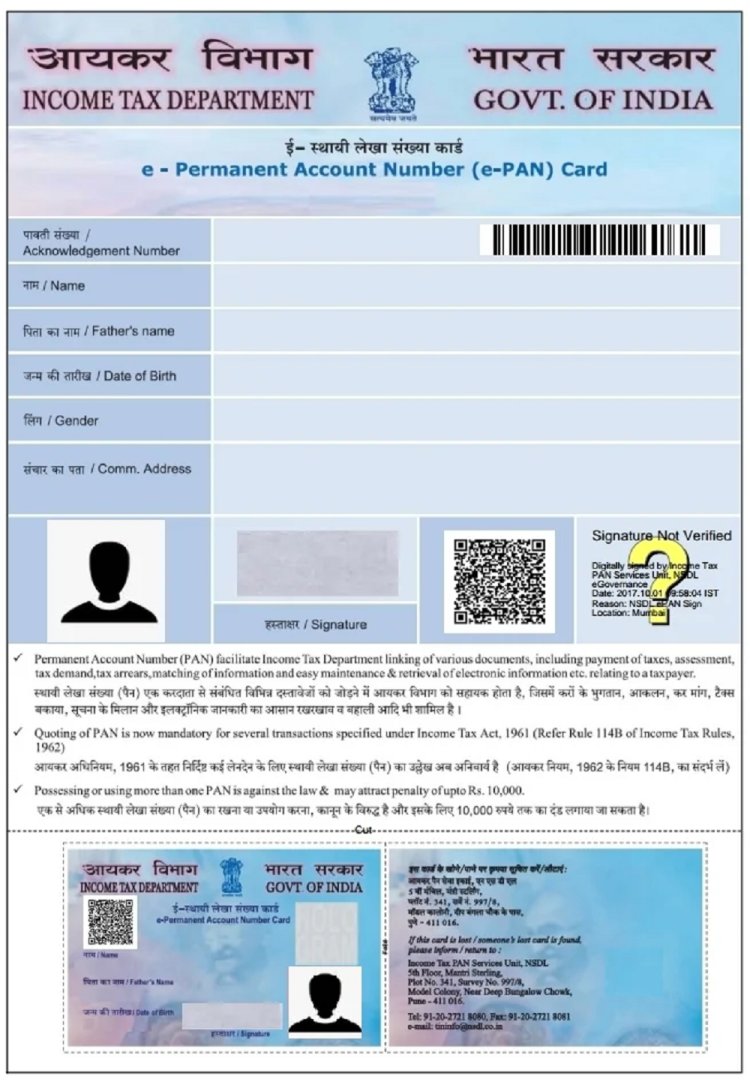

Introduction : PAN (Permanent Account Number) is a crucial identification number for taxpayers in India, issued by the Income Tax Department. Whether you have misplaced your PAN card, forgotten the number, or need to verify it for official purposes, you can easily check your PAN card number online. This guide will walk you through the process of PAN card number enquiry in a few simple steps.

Why is PAN Important?

PAN serves as a unique identifier for individuals and entities, linking all financial transactions, such as tax payments, investments, and more. It’s essential for filing income tax returns, opening a bank account, and making large financial transactions.

Methods to Check Your PAN Card Number Online

-

Using the Income Tax e-Filing Portal

- Visit the official Income Tax e-Filing portal.

- Click on 'Verify Your PAN'.

- Enter your details, including your name, date of birth, and mobile number.

- Click on 'Submit'. Your PAN details will be displayed on the screen.

-

Using the NSDL Portal

- Go to the NSDL PAN portal.

- Select 'Know Your PAN' under the PAN section.

- Enter your details like your name, date of birth, and mobile number.

- A One-Time Password (OTP) will be sent to your registered mobile number.

- Upon entering the OTP, your PAN number will be displayed.

-

Through SMS

- Send an SMS in the format 'NSDLPAN' followed by your 15-digit acknowledgment number to 57575.

- You will receive an SMS with your PAN card details.

Important Tips

- Ensure that the details you provide match the information on your PAN application.

- If you do not receive the details via SMS or online portals, it may indicate a discrepancy in your information or other issues. In such cases, contacting customer support or visiting the nearest PAN service center is advisable.

Conclusion

Checking your PAN card number online is quick, easy, and convenient. Whether you need it for filing taxes, making financial transactions, or simply verifying your details, following the above methods will help you retrieve your PAN card number within minutes.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?