How to Check Your PAN Card Details – A Step-by-Step Guide

Introduction : Your PAN card (Permanent Account Number) is a crucial document for financial and tax-related activities in India. Whether you need to verify your PAN card details for filing taxes, opening a bank account, or conducting high-value transactions, it’s important to know how to access and check your PAN card information. In this guide, we’ll cover the various methods available for checking your PAN card details online.

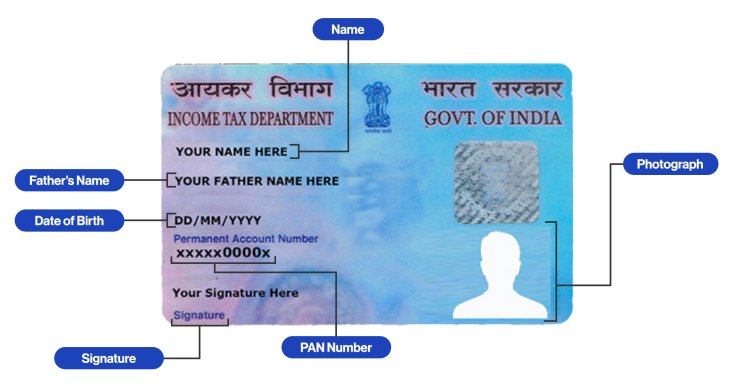

What Are PAN Card Details?

Your PAN card contains the following important information:

- PAN number: A unique 10-character alphanumeric code

- Full name

- Date of birth

- Father’s name

- Photograph

- Signature

This information is crucial for identification in financial transactions and compliance with the Income Tax Department of India.

How to Check Your PAN Card Details Online

1. Using the Income Tax e-Filing Portal

The Income Tax Department’s e-Filing portal is a reliable and easy way to check your PAN card details. Here’s how:

- Step 1: Visit the official e-Filing portal: https://www.incometax.gov.in/iec/foportal

- Step 2: Navigate to the ‘Verify Your PAN Details’ section.

- Step 3: Enter your PAN number, full name, date of birth, and a captcha code for verification.

- Step 4: Click Submit to see your PAN card details.

2. Using the Know Your PAN (KYPAN) Service

The KYPAN service allows you to check PAN details by entering specific personal information. Follow these steps:

- Step 1: Visit the Know Your PAN service section on the e-Filing portal.

- Step 2: Provide your name, date of birth, and mobile number.

- Step 3: After entering the details, an OTP (One-Time Password) will be sent to your registered mobile number.

- Step 4: Enter the OTP and submit the form. You will then be able to view your PAN details on the screen.

3. Using NSDL Portal

The NSDL (National Securities Depository Limited) also provides services to verify your PAN details:

- Step 1: Go to the NSDL PAN portal: https://www.tin-nsdl.com/

- Step 2: Select the ‘PAN Verification’ option.

- Step 3: Enter your PAN number, name, date of birth, and captcha.

- Step 4: After submission, you’ll be able to see your PAN details.

4. Using UTIITSL Portal

The UTI Infrastructure Technology And Services Limited (UTIITSL) also offers a platform for checking PAN details:

- Step 1: Visit the UTIITSL website: https://www.pan.utiitsl.com/

- Step 2: Navigate to the ‘Verify PAN’ section.

- Step 3: Enter your PAN number and captcha code to view your PAN details.

5. Through SMS

You can check your PAN details via SMS as well. Here’s how:

- Step 1: Send an SMS in the following format:

PAN<space>YOUR_PAN_NUMBERto 567678. - Step 2: You will receive an SMS with your PAN card details.

Important Things to Keep in Mind

- Correct Information: Ensure that the name, date of birth, and PAN number you enter match exactly with what’s in the official PAN records.

- Registered Mobile Number: Keep your mobile number updated with the Income Tax Department to receive OTPs for verification.

- e-Filing Registration: Registering on the e-Filing portal makes it easier to access and manage your PAN and income tax information.

What to Do If Your PAN Details Are Incorrect?

If you notice any discrepancies or incorrect information in your PAN card details, you can apply for corrections through the NSDL or UTIITSL portals. The process involves filling out the PAN card correction form, uploading supporting documents, and paying a nominal fee.

Here’s how you can do it:

- Visit the NSDL or UTIITSL portal.

- Select the option for PAN correction.

- Enter the correct details and upload the necessary documents.

- Submit the application and pay the fee.

- After successful verification, you will receive an updated PAN card with the correct details.

Why You Should Keep Your PAN Card Details Updated

It’s important to ensure that your PAN details are accurate and updated because:

- PAN is linked to your financial records, including your bank accounts, investments, and tax filings.

- Accurate PAN details help avoid delays or issues when conducting high-value transactions.

- Incorrect PAN details could result in complications during tax filing or refunds.

Conclusion

Checking your PAN card details online is a simple and efficient process, thanks to the Income Tax Department’s online portals like the e-Filing portal, NSDL, and UTIITSL. Whether you need to verify your PAN number, name, or other important details, this guide provides easy steps to help you access your PAN information. Regularly verifying and updating your PAN details ensures smooth financial transactions and compliance with tax regulations.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?