How to See Your PAN Card Details Online

Introduction: Your PAN (Permanent Account Number) is a vital document for financial transactions, tax filings, and identity verification in India. Whether you're filing taxes, opening a bank account, or applying for loans, your PAN card details play an essential role. However, many people may forget or misplace their PAN card details over time. Fortunately, there are several ways to check your PAN card details online without the need for physical documents. This article will guide you through various methods for checking your PAN card details online, making it easy to retrieve important information anytime you need it.

Why Do You Need to Check PAN Card Details?

-

Tax Filing: PAN is mandatory for filing income tax returns and is a critical identifier for the Income Tax Department.

-

Banking and Investments: Your PAN is required for opening bank accounts, investing in mutual funds, stock markets, or fixed deposits.

-

Loan Applications: When applying for home loans, car loans, or personal loans, you’ll need your PAN card details.

-

KYC Verification: PAN is often required for KYC (Know Your Customer) processes, especially for financial institutions.

-

Correction or Update: Knowing your PAN details is essential for making any updates or corrections to the information on your card.

How to See Your PAN Card Details Online

There are several ways to access your PAN card details online through government portals and apps. Below are the most commonly used methods:

1. Using the Income Tax e-Filing Portal:

The official Income Tax Department’s e-filing website allows users to view PAN card details easily.

Steps:

- Step 1: Visit the official e-filing website: https://www.incometax.gov.in

- Step 2: Log in using your PAN number as the user ID and enter your password.

- Step 3: After logging in, go to the “Profile Settings” section.

- Step 4: Under “Profile,” you will be able to see your PAN card details such as your name, date of birth, and PAN number.

This method also provides you with the option to update your PAN details if needed.

2. Know Your PAN (KYP) Facility:

You can check your PAN details through the "Know Your PAN" service offered on the Income Tax Department’s e-filing portal.

Steps:

- Step 1: Go to the "Know Your PAN" section on the Income Tax e-filing portal.

- Step 2: Enter your full name, date of birth, and registered mobile number.

- Step 3: An OTP (One-Time Password) will be sent to your registered mobile number for verification.

- Step 4: After verification, your PAN details, including the PAN number, will be displayed on the screen.

3. Using the NSDL or UTIITSL Portal:

The NSDL (Protean eGov Technologies) or UTIITSL websites also allow you to view your PAN card details.

Steps:

- Step 1: Visit the NSDL PAN portal https://www.tin-nsdl.com or UTIITSL portal https://www.utiitsl.com.

- Step 2: Navigate to the PAN section and choose the “PAN Card Status” or “Know Your PAN” option.

- Step 3: Enter your personal details like name, date of birth, and mobile number.

- Step 4: Once verified, your PAN details will appear on the screen.

4. Via Mobile Apps:

You can use apps like the Aaykar Setu or the Income Tax Department App to check your PAN card details.

Steps:

- Step 1: Download the official app from the Google Play Store or Apple App Store.

- Step 2: Open the app and select the "Know Your PAN" or "View PAN Details" option.

- Step 3: Enter your Aadhaar or PAN number, along with your mobile number, for OTP verification.

- Step 4: Once the OTP is verified, the app will display your PAN details.

5. Through Aadhaar Linking:

If your PAN card is linked to your Aadhaar, you can view your PAN details through the Aadhaar service.

Steps:

- Step 1: Go to the Income Tax e-filing portal or NSDL website.

- Step 2: Use the option to check PAN using your Aadhaar number.

- Step 3: Enter your Aadhaar number and the OTP sent to your registered mobile number.

- Step 4: Once verified, your PAN details will be displayed on the screen.

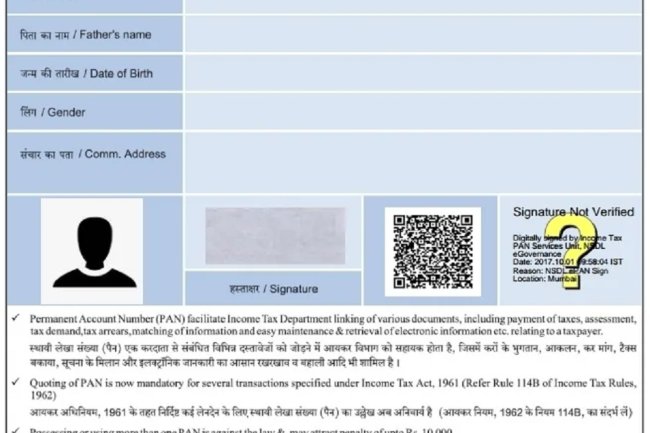

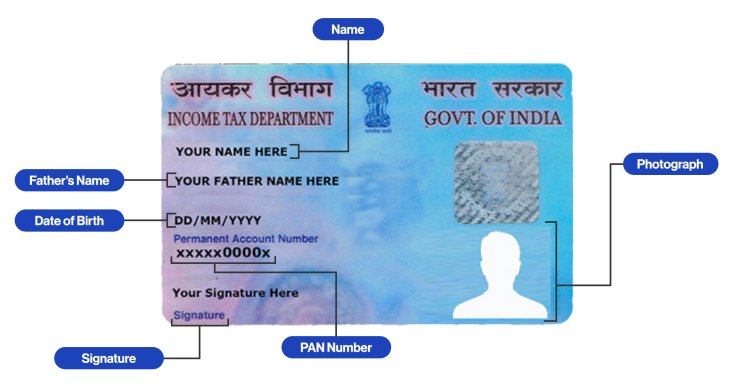

What PAN Card Details Can You View?

When you check your PAN card details online, the information typically includes:

- Full Name: The name as it appears on your PAN card.

- PAN Number: The 10-digit alphanumeric PAN.

- Date of Birth: The date of birth recorded in the PAN database.

- Father’s Name: The father’s name listed on your PAN card.

- Status of PAN: Whether it is active or inactive.

- Other Personal Information: Linked mobile number and email address (optional).

Benefits of Checking PAN Card Details Online:

- Immediate Access: No need to rely on physical documents; all your PAN details can be checked online.

- Verification for Updates: Easily verify your PAN card details if you're applying for a change or correction.

- Compliance: Ensure your PAN is correctly linked with bank accounts, Aadhaar, and other financial entities to avoid complications in financial transactions.

- Time-Saving: Save time by viewing your details online rather than visiting a service center.

Conclusion:

Checking your PAN card details online is quick and convenient, thanks to various government platforms like the Income Tax e-filing portal and NSDL. Whether you need your PAN number for tax filing, financial transactions, or simply to update your records, the online method allows you to access your details in minutes. By following the steps outlined above, you can view your PAN card details hassle-free.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?