Understanding the Minor PAN Card Age Limit in India

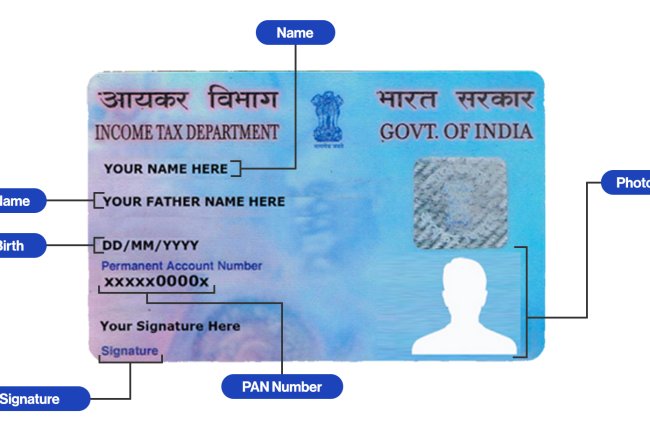

Introduction : A Permanent Account Number (PAN) is essential for various financial transactions in India, even for minors. The Indian government allows minors to apply for a PAN card, which is particularly useful for managing investments, filing taxes, and other financial activities. This article will explain the age limit for obtaining a minor PAN card, its significance, and how to apply for one.

What is a Minor PAN Card?

- A minor PAN card is issued to individuals under the age of 18.

- It serves the same purpose as a regular PAN card, allowing minors to be part of financial transactions, investments, and tax filings.

- Parents or guardians typically apply for the PAN card on behalf of the minor.

Age Limit for Minor PAN Card

- Eligibility: There is no minimum age requirement to apply for a minor PAN card. Even newborns can have a PAN card if required.

- Validity: The minor PAN card remains valid until the individual turns 18 years old.

- Conversion to Major PAN Card: Upon reaching 18, the cardholder must update their PAN details, including a recent photograph and signature, to convert it into a major PAN card.

Why a Minor Might Need a PAN Card

- Investments in Their Name: If parents or guardians wish to make financial investments, such as fixed deposits or mutual funds, in the minor’s name, a PAN card is necessary.

- Tax Implications: In cases where a minor earns income through various sources like inheritance, gifts, or investments, a PAN card is required for tax filings.

- Opening Bank Accounts: Some banks require minors to have a PAN card for opening accounts or for linking accounts to investment schemes.

How to Apply for a Minor PAN Card

-

Collect Required Documents:

- Proof of Identity: Birth certificate, Aadhaar card, or school ID of the minor.

- Proof of Address: Aadhaar card, passport, or other valid documents.

- Proof of Guardian: Aadhaar card, passport, or other ID proof of the parent/guardian.

-

Fill the PAN Application Form:

- Visit the official NSDL or UTIITSL portal.

- Choose Form 49A for a new PAN application.

- Provide the necessary details and upload the documents.

-

Submission and Payment:

- Review the information, make the payment, and submit the form.

- Print the acknowledgment slip and send it to the respective PAN processing center, if required.

-

Receive the PAN Card:

- Once processed, the PAN card will be mailed to the address provided in the application.

Frequently Asked Questions (FAQs)

-

Is there an age restriction for applying for a PAN card?

- Answer: No, there is no minimum age limit; even a newborn can apply for a PAN card.

-

Can a minor PAN card be used for all transactions?

- Answer: Yes, it can be used for all transactions, but certain legal capacities, like signing contracts, are limited until the minor turns 18.

-

How do I update the PAN card when my child turns 18?

- Answer: Apply for an update through the NSDL or UTIITSL website, providing the required documents, a recent photograph, and a signature.

Conclusion Obtaining a PAN card for a minor is a straightforward process and offers significant benefits for financial planning. Understan

ding the age limits and application procedure helps parents and guardians make informed decisions about their child's financial future.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?