How to Know Your PAN Details by PAN Number: A Step-by-Step Guide

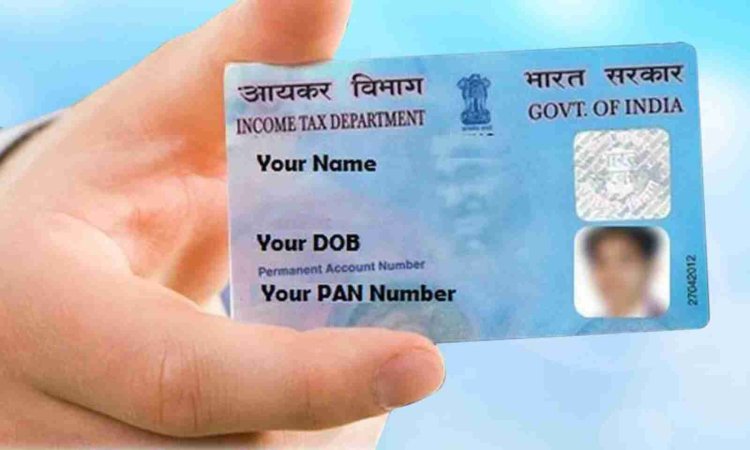

Introduction : The Permanent Account Number (PAN) is a unique identification number issued by the Income Tax Department of India. It's a crucial document for all financial transactions, tax filings, and identity verification. If you have your PAN number but need to verify your PAN details, such as your full name, date of birth, or address linked to your PAN, this guide will help you do so quickly and easily.

Why You Might Need to Check Your PAN Details

There are several reasons you might need to verify the details associated with your PAN number:

- Filing Income Tax Returns: Ensuring your PAN details are accurate before filing your returns can prevent any discrepancies or issues.

- Updating Information: If you’ve changed your address, name, or other personal details, it’s important to check that your PAN reflects these changes.

- Financial Transactions: Banks and financial institutions may require verification of your PAN details for opening accounts or processing loans.

- PAN Card Loss: If you’ve lost your PAN card, knowing the exact details linked to your PAN number can help in reissuing the card.

Step-by-Step Guide to Know Your PAN Details by PAN Number

1. Visit the Income Tax e-Filing Website

The first step is to visit the official Income Tax Department’s e-Filing website. This portal offers various services related to PAN and tax filing.

- Website: Income Tax e-Filing Portal

2. Log in to Your Account

To access your PAN details, you’ll need to log in to the e-Filing portal. If you already have an account, enter your User ID (usually your PAN number), password, and captcha code. If you don’t have an account, you’ll need to register.

- Steps to Register:

- Click on "Register Yourself" on the homepage.

- Select your user type (usually "Individual").

- Enter your PAN number, name, date of birth, and other required details.

- Complete the registration process by setting up your password.

3. Access the "Profile Settings" Section

Once logged in, navigate to the "Profile Settings" section. This area allows you to view and update various personal details linked to your PAN.

4. View Your PAN Details

In the "Profile Settings" section, you’ll find an option labeled "PAN Details." Clicking on this will display your registered details, including:

- Full Name

- Date of Birth

- PAN Number

- Address

- Father’s Name

Ensure that all the information is correct and up-to-date. If you notice any discrepancies, you may need to update your details.

5. Update Incorrect Information (If Needed)

If any of your PAN details are incorrect or outdated, you can update them by applying for a correction. This can be done online through the same portal. You’ll need to submit supporting documents that verify the correct information, such as your Aadhaar card, passport, or utility bill.

Alternative Method: Using the NSDL or UTIITSL Portals

In addition to the Income Tax e-Filing website, you can also check your PAN details through the NSDL or UTIITSL portals, which are authorized PAN service providers.

- NSDL PAN Portal: NSDL PAN Services

- UTIITSL PAN Portal: UTIITSL PAN Services

On these portals, you can use the "Know Your PAN" feature to retrieve your PAN details by entering your PAN number and verifying your identity with an OTP sent to your registered mobile number or email.

Important Tips

- Keep your PAN secure: Your PAN is a sensitive document. Avoid sharing it unnecessarily and ensure that your details are accurate to prevent misuse.

- Regularly check your details: Periodically verify your PAN details, especially before filing tax returns or making significant financial transactions.

- Link with Aadhaar: Ensure that your PAN is linked with your Aadhaar card, as this is now mandatory for various financial and tax-related processes.

Conclusion

Knowing your PAN details by simply using your PAN number is a quick and essential process, especially in today’s financial environment. Whether you’re filing taxes, applying for loans, or verifying your identity, ensuring that your PAN details are accurate is crucial. By following the steps outlined in this guide, you can easily access and verify your PAN details online, ensuring that your financial dealings remain smooth and secure.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?