How to Apply for a PAN Card Online in Andhra Pradesh (AP)

Introduction : A Permanent Account Number (PAN) is an essential document for financial and tax-related activities in India. Whether you’re an individual, a business, or an entity in Andhra Pradesh (AP), applying for a PAN card is a straightforward process that can be completed online. This guide will walk you through the steps to apply for a PAN card online in AP, highlighting the documents required and the online platforms where you can apply.

Why is a PAN Card Important?

A PAN card is a unique 10-digit alphanumeric code issued by the Income Tax Department of India. It is required for:

- Filing income tax returns.

- Opening bank accounts.

- Making financial transactions above a certain threshold.

- Purchasing real estate or vehicles.

- Applying for loans or credit cards.

Having a PAN card is essential for individuals and businesses alike to ensure tax compliance and smooth financial operations.

How to Apply for a PAN Card Online in Andhra Pradesh (AP)

Applying for a PAN card online is convenient and can be done from anywhere in Andhra Pradesh. Follow the steps below to apply for a PAN card:

Step 1: Visit the Official PAN Card Application Website

To apply for a PAN card online, you can visit either the NSDL or the UTIITSL portal. Both platforms are authorized by the government to process PAN card applications.

Step 2: Select the Appropriate Application Form

On the NSDL or UTIITSL portal, select the appropriate application form based on your situation:

- Form 49A for Indian citizens.

- Form 49AA for foreign citizens (if applicable).

If you're applying for a new PAN card, choose the "New PAN" option. For corrections or updates to an existing PAN card, choose the "Changes or Correction in PAN" option.

Step 3: Fill Out the Online Application Form

After selecting the correct form, you will need to fill out the online application. Here’s what you’ll be required to provide:

- Full name (as per Aadhaar or official documents)

- Date of birth (DOB)

- Gender

- Contact details (address, phone number, email)

- Aadhaar number (if applicable)

- Other personal and financial details

Ensure all information is accurate and matches your official documents, as incorrect details could lead to delays or rejection of your application.

Step 4: Upload Required Documents

You will need to upload scanned copies of documents to verify your identity, address, and date of birth. The most commonly accepted documents are:

- Proof of Identity: Aadhaar card, voter ID, passport, driving license, etc.

- Proof of Address: Utility bill, Aadhaar card, passport, etc.

- Proof of Date of Birth: Birth certificate, Aadhaar card, passport, or matriculation certificate.

Make sure that the scanned documents are legible and meet the required size and format specified on the portal.

Step 5: Pay the Application Fee

After filling out the form and uploading documents, you will be directed to pay the application fee. The fee varies depending on the communication address (whether it is within India or outside India). Payment options typically include credit/debit cards, net banking, or demand drafts.

- For addresses within India, the fee is usually ₹110 (inclusive of GST).

- For addresses outside India, the fee is approximately ₹1,020.

Step 6: Submit the Application

Once the payment is processed, submit the application. You will receive an acknowledgment number which you can use to track the status of your PAN card application.

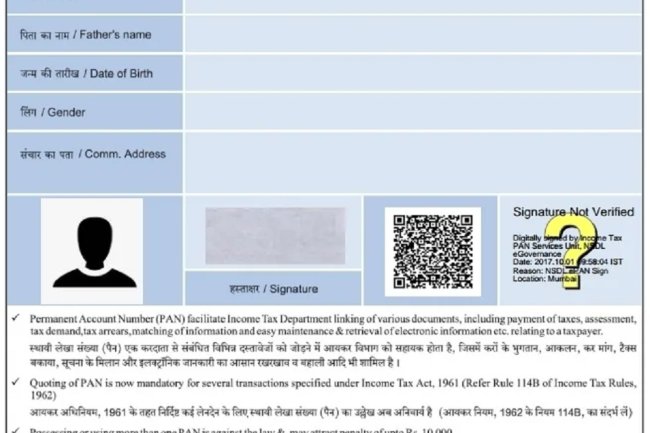

Step 7: Verification and Dispatch of PAN Card

After submitting the application, your details will be verified by the Income Tax Department. Once verified, your PAN card will be processed and dispatched to the address mentioned in your application. You will also receive an electronic PAN (e-PAN) via email, which is equally valid for use.

How Long Does it Take to Receive the PAN Card?

Typically, the PAN card is issued within 15 to 20 working days of submitting the application. The e-PAN is usually sent to your registered email ID within a few days of successful verification.

Benefits of Applying for PAN Card Online

- Convenience: You can apply from the comfort of your home.

- Time-Saving: No need to visit government offices in person.

- Tracking: You can track your application status online using the acknowledgment number.

- Faster Processing: The entire process, from application to receiving the PAN card, is faster when done online.

Documents Required for PAN Card Application in AP

- Proof of Identity (Aadhaar, Voter ID, Passport, Driving License)

- Proof of Address (Aadhaar, Utility Bill, Rent Agreement, Passport)

- Proof of Date of Birth (Birth Certificate, Aadhaar, Passport)

Conclusion

Applying for a PAN card online in Andhra Pradesh is a simple and efficient process. With government-authorized portals like NSDL and UTIITSL, you can easily complete the application, upload required documents, and receive your PAN card at your doorstep. Make sure to provide accurate information and valid documents to avoid any delays in processing. Once your PAN card is issued, you can use it for all your financial and tax-related activities, ensuring compliance with Indian tax laws.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?