A Complete Guide to PAN Details Checking – How to Verify and Retrieve Your PAN Information

Introduction : Your PAN (Permanent Account Number) is a vital identification number for all taxpayers and many financial transactions in India. It’s essential to ensure that your PAN details are correct and up-to-date. Whether you need to verify your PAN information for tax filing, financial transactions, or just for personal records, checking your PAN details is a straightforward process that can be done online. In this article, we’ll cover how to check your PAN details, retrieve lost information, and verify its accuracy.

Why is PAN Details Checking Important?

PAN is linked to various financial activities, including filing income tax returns, buying property, and large financial transactions. Checking and verifying your PAN details helps:

- Ensure accuracy in tax filings.

- Prevent identity theft or misuse.

- Avoid discrepancies during financial transactions.

- Retrieve lost or misplaced PAN information.

How to Check PAN Details Online

1. Use the Income Tax Department’s e-Filing Portal

The Income Tax Department’s e-Filing portal allows users to easily check their PAN card details online. Here’s how to do it:

- Visit the official e-Filing portal: https://www.incometax.gov.in/iec/foportal

- Navigate to the ‘Verify Your PAN Details’ section on the homepage.

- Click on the option to proceed.

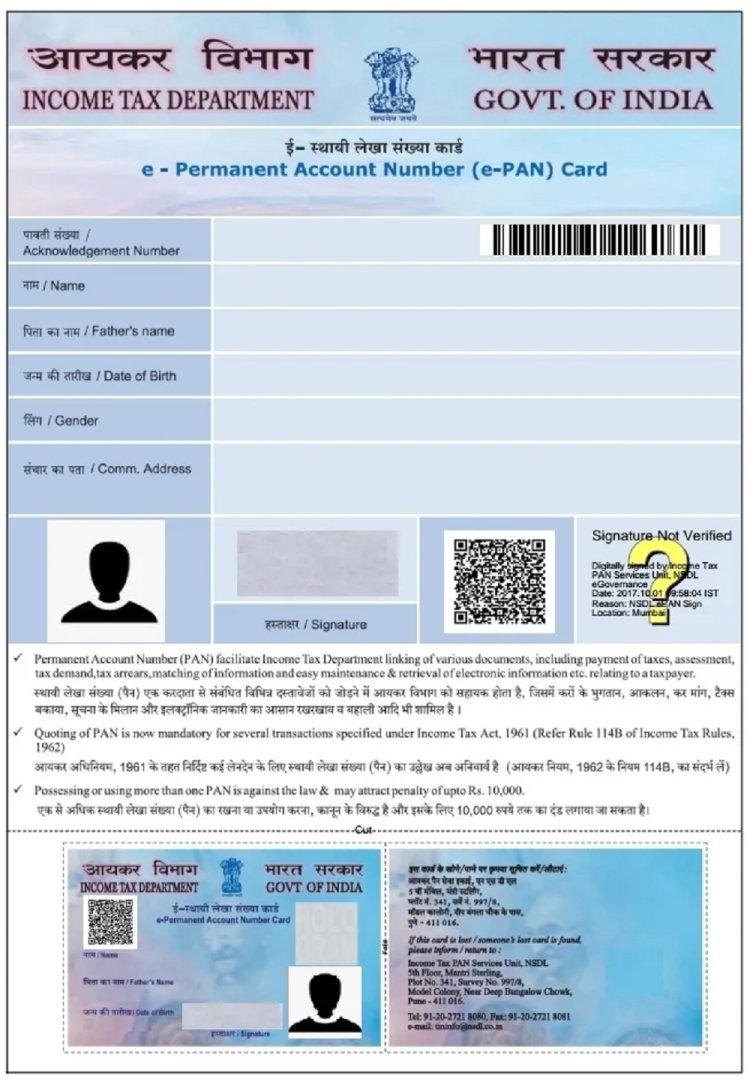

2. Enter Your PAN Card Information

Once you access the verification page, you will need to provide basic details, such as:

- PAN number

- Full name (as per the PAN card)

- Date of birth

- Captcha code for security verification

3. Submit and View Your PAN Details

After entering the required information, click on the ‘Submit’ button. The portal will then display your PAN details on the screen, including:

- Full name (as per the PAN records)

- PAN number

- Date of birth

- PAN status (whether it’s active or inactive)

You can confirm that the details are correct and note any discrepancies if they arise.

Alternative Ways to Check PAN Details

1. Contact NSDL or UTIITSL

You can also contact authorized agencies like NSDL or UTIITSL to verify your PAN details. Both of these platforms handle PAN-related queries, applications, and verifications. Simply visit their websites, and follow the steps to check PAN details.

2. Use Your Aadhaar

If your PAN is linked to your Aadhaar, you can verify your PAN information using your Aadhaar number on the Income Tax Department’s portal. This cross-verification ensures the details on both your Aadhaar and PAN match.

3. SMS-Based PAN Verification

The Income Tax Department also provides an SMS-based service for PAN verification. Send an SMS to 567678 with the format: ‘PAN<space>your PAN number’ to receive PAN verification details on your mobile.

What to Do if There Are Discrepancies in Your PAN Details?

If you notice any discrepancies in your PAN details (such as wrong name spelling, incorrect date of birth, or address mismatch), you can update your PAN card information. Here's how:

- Visit the NSDL or UTIITSL portal.

- Select the ‘PAN Correction’ option.

- Fill out the PAN correction form, upload relevant documents, and submit the application.

- You will receive an updated PAN card after successful verification.

How to Retrieve Lost or Forgotten PAN Details

If you’ve misplaced your PAN card or forgotten the number, you can retrieve it through the Income Tax Department’s e-Filing portal by providing your name and other personal information. Alternatively, you can contact NSDL or UTIITSL to recover your PAN number.

Why Keep PAN Details Up-to-Date?

Keeping your PAN details accurate and up-to-date is essential to avoid issues during tax filing, financial transactions, or government processes. Outdated PAN information can lead to delays or complications, so make it a priority to check your PAN details regularly.

Conclusion

Verifying and checking your PAN details online is a simple process that ensures your PAN information is accurate and current. Whether for tax filing, financial transactions, or identity verification, it’s important to keep your PAN card information updated and easily accessible. The Income Tax e-Filing portal, NSDL, and UTIITSL offer convenient services to check and update your PAN details efficiently.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?