What to Do If You've Lost Your PAN Card and Number: A Complete Guide

Introduction : Losing your Permanent Account Number (PAN) card and not remembering your PAN number can be frustrating, especially given its importance for financial transactions, tax filing, and identity verification. However, the good news is that recovering your PAN card and number is a straightforward process, thanks to the online services provided by the Income Tax Department, NSDL, and UTIITSL. In this article, we’ll guide you through the steps to recover your PAN number and apply for a duplicate PAN card.

Why You Need Your PAN Card

Your PAN card serves several essential purposes, including:

- Tax Filing: It is mandatory for filing income tax returns.

- Financial Transactions: PAN is required for transactions above ₹50,000.

- Identity Verification: PAN is used as proof of identity for opening bank accounts, applying for loans, and other financial activities.

- KYC Compliance: Banks, insurance companies, and mutual funds require PAN for Know Your Customer (KYC) processes.

- Property and Investment Transactions: PAN is necessary for property purchases, share trading, and mutual fund investments.

What to Do If You've Lost Your PAN Card and Number

If you've lost your PAN card and don’t remember your PAN number, follow these steps to recover it and apply for a duplicate.

1. Find Your PAN Number Online

You can recover your PAN number using the Income Tax Department’s e-Filing portal. The platform allows users to retrieve their PAN number by providing basic personal information.

Steps:

- Visit the Income Tax e-Filing Portal.

- Click on the “Know Your PAN” option under "Quick Links."

- Enter your name, date of birth, father’s name, and registered mobile number.

- Complete the captcha code and click Submit.

- You will receive an OTP on your registered mobile number for verification.

- After OTP verification, your PAN number will be displayed on the screen.

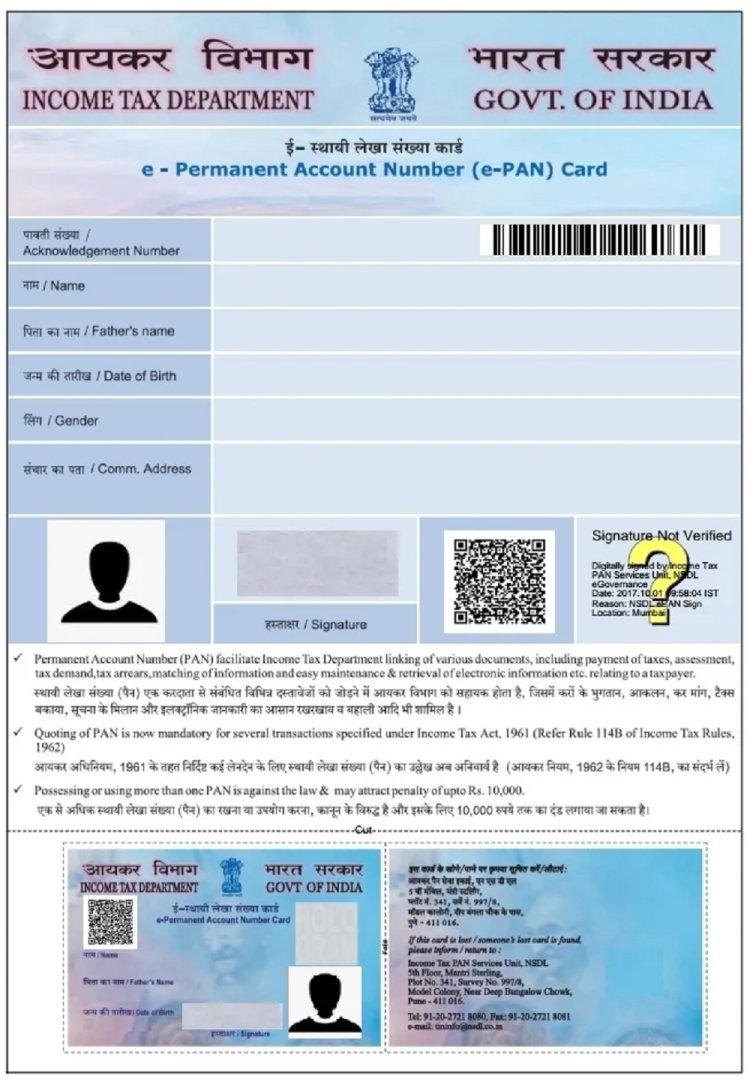

2. Apply for a Duplicate PAN Card (e-PAN or Physical Card)

Once you’ve recovered your PAN number, you can apply for a duplicate PAN card. You have the option to get a digital e-PAN or request a physical PAN card.

Using NSDL (National Securities Depository Limited)

Steps:

- Visit the NSDL PAN Portal.

- Click on “Reprint of PAN Card”.

- Enter your PAN number, date of birth, and name.

- Complete the verification process by providing the OTP sent to your registered mobile number.

- Choose whether you want to receive an e-PAN or a physical PAN card.

- Pay the required fee and submit your application.

- You’ll receive your PAN card in a few days, or you can download the e-PAN instantly.

Using UTIITSL (UTI Infrastructure Technology and Services Limited)

Steps:

- Visit the UTIITSL PAN Portal.

- Select the “Apply for Duplicate PAN Card” option.

- Enter your personal details, including the PAN number, name, and date of birth.

- Verify your identity through an OTP sent to your mobile number.

- Choose between receiving an e-PAN or a physical PAN card.

- Pay the required fees and complete the submission process.

- Your e-PAN will be available for download immediately, or the physical card will be dispatched.

Other Methods to Recover Your PAN Number

If you are unable to retrieve your PAN number online, there are other ways to find your PAN:

- Check Previous Financial Documents: Your PAN number may be listed on previous tax returns, bank statements, Form 26AS, or investment documents.

- Contact Your Employer: If you’ve provided your PAN to your employer, they may have it on file in their payroll or HR records.

- Visit Your Nearest PAN Service Center: You can visit an authorized PAN service center and provide them with your details to retrieve your PAN number.

Important Information When Applying for a Duplicate PAN

- Ensure your mobile number is registered with your PAN card for OTP verification.

- Keep a digital copy of your Aadhaar card and passport-size photograph ready if required during the application process.

- The fee for a duplicate PAN card is usually nominal, and an e-PAN is often delivered instantly to your registered email.

Why It’s Important to Recover Your PAN

Recovering your PAN card and number is crucial for ensuring seamless financial and legal operations:

- Filing Tax Returns: Your PAN is mandatory for filing tax returns and tracking your tax payments.

- Financial Transactions: Large financial transactions, such as property sales and high-value deposits, require PAN.

- KYC Compliance: Opening a bank account, making investments, or purchasing insurance policies require KYC verification using PAN.

- Credit History and Loan Applications: Lenders use PAN to check your creditworthiness before approving loans or credit cards.

- Avoid Identity Fraud: Recovering your PAN ensures that no one else can misuse your lost PAN for illegal activities.

How to Prevent Losing Your PAN Again

To avoid losing your PAN card or number in the future, follow these tips:

- Store a Digital Copy: Save a digital copy of your PAN card on your phone or cloud storage for easy access.

- Link PAN with Aadhaar: Linking your PAN with Aadhaar allows easy retrieval of your PAN details if lost.

- Use e-PAN: The digital e-PAN can be downloaded instantly, eliminating the need for a physical card.

- Keep Financial Records: Make sure to record your PAN number in your tax returns and important financial documents.

Conclusion

Losing your PAN card and number can be stressful, but recovering them is straightforward thanks to online services provided by the Income Tax Department, NSDL, and UTIITSL. By following the steps outlined above, you can easily retrieve your PAN number and apply for a duplicate PAN card, ensuring that your financial and tax-related activities proceed without disruption. Always make sure to keep a digital copy of your PAN card for quick access in the future.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?