Understanding the Details of a PAN Card Number - What You Need to Know

Introduction : A PAN (Permanent Account Number) is a ten-digit alphanumeric code issued by the Income Tax Department of India. This number serves as a unique identifier for taxpayers, making it essential for various financial transactions and tax-related activities. Understanding the details of your PAN card number can help you better manage your financial and legal obligations. In this guide, we'll break down the components of a PAN card number and explain its significance.

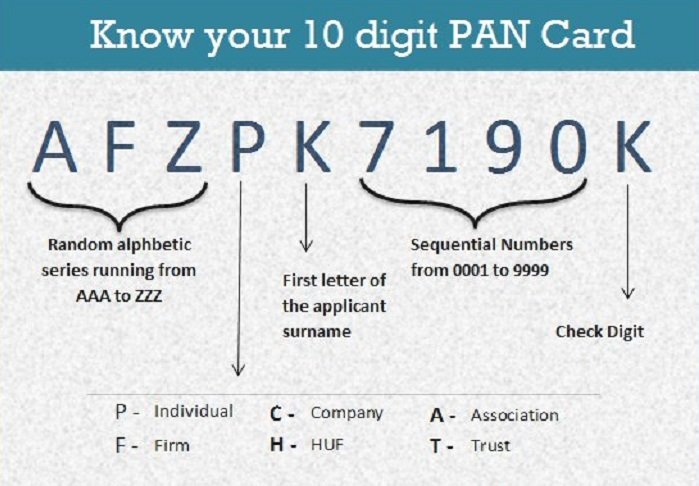

Structure of a PAN Card Number

A PAN card number is a combination of letters and numbers that follow a specific pattern:

-

First Three Characters (Alphabetic): The first three characters are letters, which are a sequence of alphabets from AAA to ZZZ. These characters have no specific meaning and are randomly assigned.

-

Fourth Character (Alphabetic): The fourth character represents the type of PAN holder, indicating the entity for which the PAN is issued. Here’s what it means:

- P: Individual

- C: Company

- H: Hindu Undivided Family (HUF)

- A: Association of Persons (AOP)

- B: Body of Individuals (BOI)

- G: Government Agency

- J: Artificial Juridical Person

- L: Local Authority

- F: Firm

- T: Trust

-

Fifth Character (Alphabetic): The fifth character is the first letter of the PAN holder's last name or surname for individuals. In the case of non-individual PAN holders, it represents the first letter of the entity’s name.

-

Next Four Characters (Numeric): These four characters are numeric, ranging from 0001 to 9999, and are unique to each PAN holder.

-

Last Character (Alphabetic): The last character is a check alphabet used for validation purposes.

Why Understanding Your PAN Card Number Matters

Knowing the structure of your PAN card number is important for several reasons:

- Identity Verification: Your PAN card number is used by various institutions, including banks, employers, and government agencies, to verify your identity.

- Tax Filing: Your PAN card number is essential when filing income tax returns, ensuring that your taxes are linked to the correct identity.

- Financial Transactions: PAN is mandatory for high-value transactions, such as buying property, investing in the stock market, and opening a bank account.

- Avoiding Penalties: Misuse or incorrect entry of your PAN number in financial transactions can lead to penalties or issues with tax authorities.

How to Verify PAN Card Details

If you want to verify your PAN card details to ensure accuracy, you can do so through various online platforms:

-

Income Tax e-Filing Portal:

- Visit the Income Tax e-Filing portal.

- Click on 'Verify Your PAN'.

- Enter your PAN card number, full name, and date of birth.

- Submit the information, and the portal will confirm whether the PAN details are correct.

-

NSDL Portal:

- Go to the NSDL PAN portal.

- Select the option to verify your PAN card details.

- Enter the required information and confirm your PAN card details.

-

Third-Party Services:

- Some third-party platforms allow you to verify PAN card details online, especially if you need to confirm the PAN of a company or organization. Always use reputable services to ensure data privacy.

Important Tips for Managing Your PAN Card Number

- Keep Your PAN Secure: As your PAN card number is linked to your financial identity, it is crucial to keep it secure and not share it unnecessarily.

- Update Details Promptly: If there are any changes in your personal details, such as your name or address, update your PAN card promptly to avoid discrepancies.

- Link PAN with Aadhaar: It is mandatory to link your PAN card with Aadhaar for continued validity. Ensure that this process is completed to avoid deactivation.

Conclusion

Your PAN card number is more than just a code; it is a critical element of your financial identity in India. By understanding the structure of your PAN card number and knowing how to verify its details, you can ensure smooth financial transactions and compliance with tax regulations. Always keep your PAN card information secure and up-to-date to avoid any legal or financial complications.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?