Understanding PAN Card Details by Number: Everything You Need to Know

Introduction : The Permanent Account Number (PAN) is an essential identification tool issued by the Income Tax Department of India. Whether you're filing taxes, making large financial transactions, or opening a bank account, your PAN card plays a critical role. Knowing your PAN card details by number can help you stay on top of your financial and tax obligations. In this article, we'll explain how to access and understand your PAN card details using your PAN number.

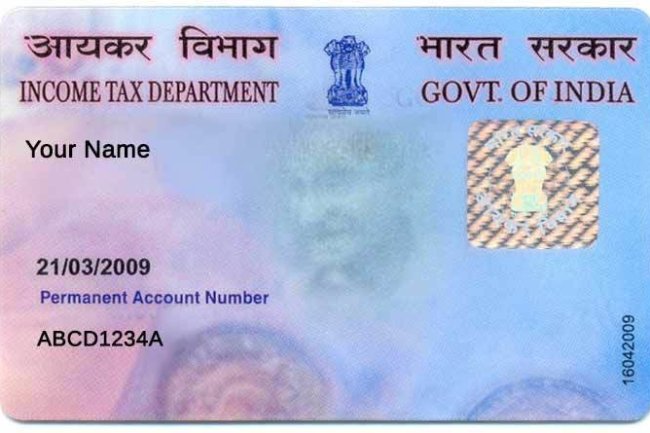

What Information Does Your PAN Card Contain?

Your PAN card includes several key details that are vital for identification and financial activities:

- PAN Number: A unique 10-digit alphanumeric code that serves as your identification for tax purposes.

- Full Name: The name of the PAN holder as registered with the Income Tax Department.

- Date of Birth/Date of Incorporation: This reflects the date of birth for individuals or the date of incorporation for companies.

- Father's Name: The father’s name is usually included for individuals.

- Signature: The cardholder's signature is also present for identity verification.

- Photograph: The cardholder’s photograph for identity verification.

Having access to these details through your PAN number is crucial for various financial and official processes.

Why You Might Need to Access PAN Card Details by Number

There are several reasons why you may need to check your PAN card details using your PAN number:

- Verification: Ensure that your PAN details are accurate and up-to-date.

- Prevent Fraud: Regularly checking your PAN details helps prevent unauthorized use of your PAN number.

- Retrieve Lost Information: If you've lost your PAN card, checking details by PAN number can help retrieve necessary information.

- Tax Filing: Correct PAN details are essential for accurate tax filings.

How to Check PAN Card Details by Number: Step-by-Step Guide

1. Visit the Income Tax e-Filing Portal:

- Go to the official Income Tax e-Filing website.

- Log in using your credentials or register if you're a new user.

2. Navigate to Profile Settings:

- Once logged in, select the ‘Profile Settings’ tab and choose ‘PAN Details’ from the dropdown menu.

3. Enter Your PAN Number:

- Input your PAN number in the provided field.

- The system will then display your PAN details, including your name, date of birth, and jurisdiction.

4. Verify the Details:

- Carefully review all the information displayed to ensure its accuracy.

- If you find any discrepancies, you can apply for corrections via the same portal.

5. Use Alternative Platforms:

- You can also use the NSDL or UTIITSL portals to check your PAN card details by number.

What to Do If You Find Discrepancies in Your PAN Card Details

If you find that your PAN card details are incorrect, follow these steps:

- Apply for Correction: Visit the NSDL or UTIITSL website to apply for corrections.

- Submit Required Documents: Provide the necessary documents to support your correction request.

- Track Your Application: You’ll receive an acknowledgment number that allows you to track the status of your application.

- Receive Updated PAN Card: Once the correction is processed, you’ll receive an updated PAN card with the corrected details.

Why It’s Important to Regularly Check Your PAN Card Details

- Accurate Tax Filing: Ensure your PAN details are correct to avoid issues during tax filing.

- Prevent Identity Theft: Regularly verifying your PAN details helps prevent misuse of your PAN number.

- Stay Compliant: Keeping your PAN details updated ensures compliance with financial regulations.

Conclusion

Knowing your PAN card details by number is essential for maintaining accurate financial records and staying compliant with tax laws. Whether you're verifying your PAN information, preventing fraud, or correcting errors, accessing your PAN details is a straightforward process that can save you time and hassle. Make sure to regularly check your PAN card details to ensure everything is in order.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?