PAN Card Check by PAN Number

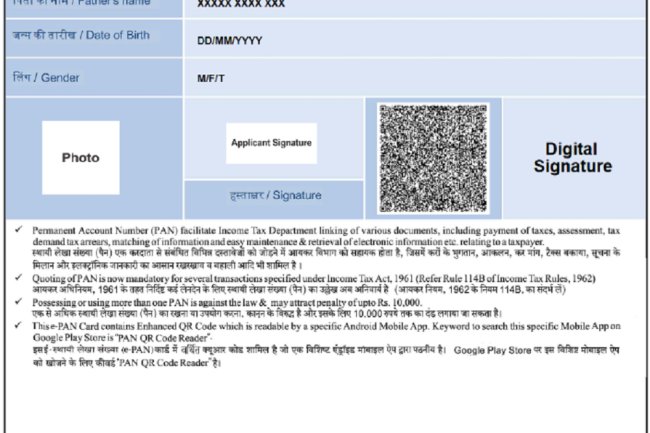

Introduction : The Permanent Account Number (PAN) is a unique 10-character alphanumeric identifier issued by the Income Tax Department of India. It is essential for various financial transactions, tax filing, and identity verification. If you need to check your PAN card details, you can do so easily using your PAN number. Here's a step-by-step guide on how to check your PAN card details online.

Why Check PAN Card Details?

- Verify PAN Card Information: Ensure that all details on your PAN card are correct, including your name, date of birth, and address.

- Confirm PAN Status: Check the status of your PAN card application or updates if you've applied for any changes.

- Prevent Fraud: Regularly checking your PAN card details can help prevent misuse or fraud.

Step-by-Step Guide to Checking PAN Card Details by PAN Number

1. Visit the Income Tax Department’s e-Filing Portal

Go to the official e-Filing website of the Income Tax Department: https://www.incometax.gov.in.

2. Navigate to the 'Verify Your PAN Details' Section

Once on the homepage, scroll down to find the 'Quick Links' section. Click on the 'Verify Your PAN Details' link.

3. Enter Your PAN Number

You will be prompted to enter your PAN number in the designated field. Make sure to input the number correctly.

4. Provide Additional Information

For verification, you may need to provide your full name, date of birth, and registered mobile number or email ID.

5. Submit the Details

After entering all the required information, click on the 'Submit' button. The system will process your request and display your PAN card details.

6. Review the PAN Card Information

Your PAN card details, including your PAN number, name, jurisdiction, and other relevant information, will be displayed on the screen. Ensure all details are accurate.

Other Methods to Check PAN Card Details

-

Via SMS: You can also check your PAN card details by sending an SMS to 567678 or 56161. Type "PAN" followed by your PAN number (e.g., PAN ABCDE1234F) and send it to the designated number.

-

Through the NSDL or UTIITSL Portals: You can also visit the NSDL or UTIITSL websites to check your PAN card details. These portals offer services related to PAN card issuance and updates.

Conclusion

Checking your PAN card details online using your PAN number is a quick and convenient process. Whether you need to verify your details, confirm the status of your application, or simply ensure that your PAN information is up-to-date, the e-Filing portal provides an easy solution. Regularly checking your PAN details can help you avoid any discrepancies and ensure that your financial transactions are smooth and secure.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?