PAN Card Cancel Process: A Step-by-Step Guide

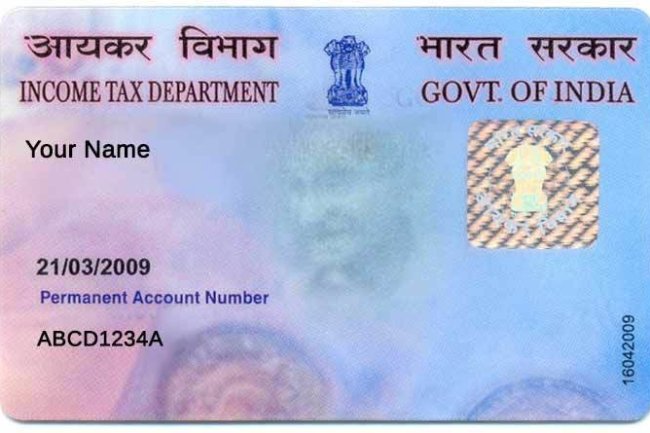

Introduction: A Permanent Account Number (PAN) is an essential document for individuals and entities engaging in financial transactions and tax-related activities in India. However, there are instances where you may need to cancel a PAN card, such as having duplicate PAN cards, incorrect information on the card, or closing a business entity. This article will guide you through the process of canceling a PAN card, providing clear steps and important considerations.

Reasons to Cancel a PAN Card

There are several situations where canceling a PAN card becomes necessary:

- Duplicate PAN Cards: Possessing more than one PAN card is illegal and can lead to penalties. If you have multiple PAN cards, it is essential to cancel the duplicates.

- Incorrect Information: If the PAN card contains incorrect details that cannot be corrected, you may need to cancel it.

- Business Closure: When a business or non-individual entity closes, the PAN card associated with it must be canceled.

- Death of the PAN Holder: The legal heirs or representatives may need to cancel the PAN card of a deceased individual.

Documents Required for PAN Card Cancellation

Before initiating the cancellation process, ensure you have the following documents ready:

- Original PAN Card: The PAN card that needs to be canceled.

- Proof of Identity: A valid ID proof such as an Aadhaar card, passport, or voter ID.

- Proof of Address: Documents like an Aadhaar card, utility bills, or bank statements.

- Reason for Cancellation: A letter or statement explaining the reason for canceling the PAN card.

- Death Certificate: In the case of a deceased individual, a copy of the death certificate is required.

How to Cancel a PAN Card: Online Method

Canceling a PAN card online is a convenient and straightforward process. Here’s how to do it:

Step 1: Visit the NSDL or UTIITSL Website

You can initiate the cancellation process through either the NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology and Services Limited) portal.

- For NSDL: Visit the NSDL e-Governance Official Website.

- For UTIITSL: Visit the UTIITSL PAN Services Website.

Step 2: Select the PAN Correction/Change Request Option

- Navigate to the section for PAN correction or change requests.

- Select Form 49A (for individuals) or Form 49AA (for non-individual entities).

Step 3: Fill in the Necessary Details

- Provide your details, including the PAN number that you want to cancel.

- Clearly state the reason for canceling the PAN card in the appropriate section of the form.

Step 4: Upload Supporting Documents

- Upload scanned copies of the required documents, such as the PAN card you wish to cancel, proof of identity, proof of address, and any other relevant documents.

Step 5: Submit the Form and Pay the Processing Fee

- After filling out the form and uploading the documents, submit the application.

- Pay the applicable processing fee using available payment options like credit/debit cards, net banking, or UPI.

Step 6: Receive the Acknowledgment Receipt

- Once submitted, you will receive an acknowledgment receipt containing a 15-digit acknowledgment number. This number can be used to track the status of your PAN cancellation request.

How to Cancel a PAN Card: Offline Method

If you prefer to cancel your PAN card offline, follow these steps:

Step 1: Obtain the PAN Correction/Change Request Form

- Download the PAN correction form (Form 49A or Form 49AA) from the NSDL or UTIITSL website, or obtain it from a nearby PAN service center.

Step 2: Fill Out the Form

- Enter all the necessary details, including the PAN number to be canceled.

- Provide the reason for the cancellation in the appropriate section.

Step 3: Attach the Required Documents

- Attach copies of the necessary documents, including the PAN card you wish to cancel, proof of identity, proof of address, and any additional documents.

Step 4: Submit the Form to a PAN Service Center

- Submit the completed form and documents to the nearest PAN service center or the respective NSDL/UTIITSL office.

Step 5: Collect the Acknowledgment Slip

- After submitting the form, you will receive an acknowledgment slip, which you should keep for tracking the status of your PAN cancellation.

Key Points to Remember

- Avoid Penalties: It is illegal to possess more than one PAN card. Make sure to cancel any duplicate PANs promptly to avoid penalties.

- Keep Acknowledgment Records: Always keep a copy of the acknowledgment receipt or slip for future reference.

- Consult a Professional: If you are unsure about the cancellation process or your specific situation, it may be beneficial to consult a tax professional or financial advisor.

Conclusion

The PAN card cancellation process is essential for individuals and entities that need to rectify issues such as duplicate PANs, incorrect details, or the closure of a business. By following the step-by-step guide provided in this article, you can ensure a smooth and hassle-free PAN card cancellation process. Whether you choose to complete the process online or offline, accuracy and attention to detail are key to successfully canceling a PAN card.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?