Where to Find the PAN Number on a PAN Card

Introduction : A PAN card is a vital document issued by the Income Tax Department of India, serving as an identification tool for various financial and tax-related activities. Every PAN cardholder is assigned a unique Permanent Account Number (PAN), which is a 10-character alphanumeric code. This number is essential for tax filing, banking, and many other financial transactions. If you’ve recently obtained your PAN card and are unsure where the PAN number is located on it, this guide will help you identify it.

What is a PAN Number?

The PAN (Permanent Account Number) is a unique 10-digit alphanumeric code issued to individuals, businesses, and entities by the Income Tax Department of India. It is used to track financial transactions and ensure compliance with tax regulations.

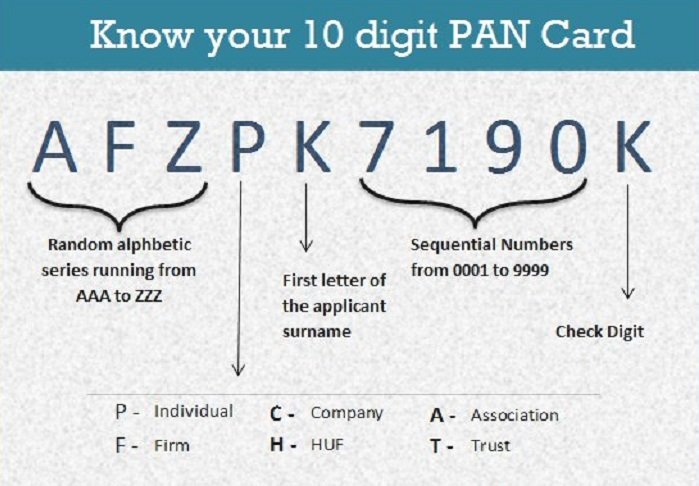

A PAN number follows a specific format:

- The first five characters are letters.

- The next four characters are numbers.

- The last character is a letter.

For example, a PAN number might look like ABCDE1234F.

Where is the PAN Number Located on a PAN Card?

The PAN card has a standard format, and the PAN number is prominently displayed on the card. Here’s how you can identify it:

1. Top Section of the PAN Card

The PAN number is located at the top center of the PAN card, just beneath the heading “Income Tax Department” and above your name. It is clearly visible and stands out on the card.

2. Details Provided on the PAN Card

Along with the PAN number, the following details are printed on the front side of the PAN card:

- Full Name: The cardholder’s full name as mentioned in the application form.

- Father’s Name: The father’s name is mandatory and appears right below the cardholder’s name.

- Date of Birth: The cardholder’s birthdate (or date of incorporation in the case of a company or business).

- Photograph and Signature: The cardholder’s photo and signature (or thumbprint for certain applicants) are displayed on the left side.

The PAN number is the most crucial element on the card, as it is required for various financial transactions.

Understanding the PAN Number Format

To better understand the PAN number, let’s break down its format:

- First Three Characters: These are random alphabets from A to Z.

- Fourth Character: This represents the type of PAN cardholder, such as:

- P for individual

- F for firm

- C for company

- A for association of persons (AOP)

- T for trust

- Fifth Character: This corresponds to the first letter of the PAN holder's surname or entity name.

- Next Four Characters: These are randomly assigned numeric digits.

- Last Character: A letter, randomly assigned as part of the alphanumeric structure.

For example, if the PAN number is ABCDX1234Z, the format will break down as follows:

- ABCDX: Random letters, with the fourth character indicating the holder type.

- 1234: Numeric digits.

- Z: A randomly generated letter.

Why is Your PAN Number Important?

The PAN number is required for several purposes, including:

- Filing Income Tax Returns: A PAN is mandatory to file returns and track taxable income.

- Opening a Bank Account: Banks require a PAN card to open new accounts, especially savings accounts.

- Large Financial Transactions: Any transactions exceeding a certain limit, such as property purchases, investments, or cash deposits, require a PAN.

- Receiving Tax Refunds: Tax refunds can only be processed if the PAN is linked to your bank account.

What to Do if You Can’t Find Your PAN Number?

If you’ve misplaced your PAN card or are unable to find the PAN number, you can easily retrieve it online:

- Visit the Income Tax e-Filing Portal: Use the “Know Your PAN” service by entering your personal details (name, date of birth, and mobile number).

- NSDL or UTIITSL Websites: You can also retrieve your PAN number through the official NSDL or UTIITSL portals.

- Linking with Aadhaar: If your PAN is linked with your Aadhaar card, you can retrieve the PAN using your Aadhaar number on the Income Tax portal.

Conclusion

The PAN number is a crucial part of your PAN card and is displayed prominently on the top section, beneath the "Income Tax Department" heading and above your name. Whether you need it for tax filing, financial transactions, or identification purposes, it’s essential to keep your PAN number handy and secure. If you lose your card or forget your PAN number, official government websites make it easy to retrieve it online.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?