How to Find Your PAN Number: A Comprehensive Guide

Introduction : If you're in India, you're probably familiar with the importance of the Permanent Account Number (PAN). This ten-character alphanumeric identifier, issued by the Income Tax Department, is essential for a variety of financial transactions, including filing tax returns, opening a bank account, buying or selling property, and more. But what if you misplace your PAN card or forget your PAN number? Don't worry! In this article, we'll walk you through several methods to find your PAN number quickly and easily.

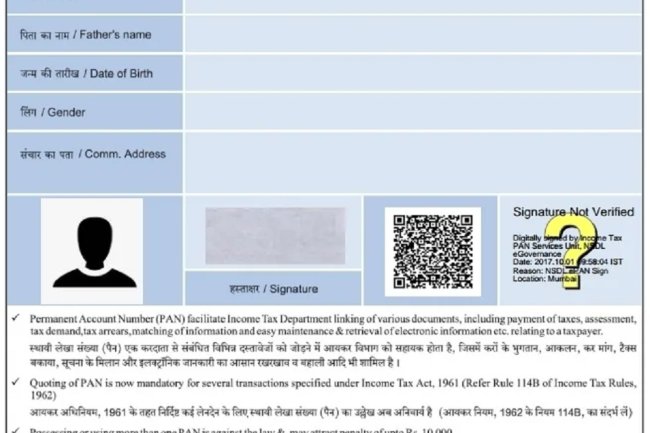

1. Check Your PAN Card

The most straightforward way to find your PAN number is by looking at your PAN card. The PAN number is prominently displayed on the front of the card. If you have your card, you can easily note down your number and keep it safe for future reference.

2. Look at Your Income Tax Return (ITR) Acknowledgement

If you've filed income tax returns in the past, your PAN number will be mentioned on your ITR acknowledgement. You can access your ITR documents either in physical form (if you’ve kept hard copies) or digitally, through the email associated with your tax filings.

3. Check Your Bank or Financial Institution Documents

Many banks and financial institutions require a PAN number to open an account or for KYC (Know Your Customer) purposes. If you have any documents or statements from your bank or other financial institutions, your PAN number may be listed there.

4. Find Your PAN Number Online via the Income Tax Department's Portal

If you can't find your PAN number using the above methods, you can easily retrieve it online using the Income Tax Department’s e-filing portal. Here's how:

Steps to Find Your PAN Number Online:

-

Visit the Income Tax Department's e-Filing Website: Go to https://www.incometaxindiaefiling.gov.in.

-

Navigate to the 'Know Your PAN' Section: On the homepage, look for the 'Know Your PAN' option under the 'Quick Links' section.

-

Fill in Your Details: You'll need to provide your full name, date of birth, and your registered mobile number.

-

Receive an OTP: Once you've entered your details, you will receive a One-Time Password (OTP) on your registered mobile number.

-

Verify OTP: Enter the OTP on the website to verify your identity.

-

Retrieve Your PAN: After verification, your PAN details will be displayed on the screen.

5. Use the NSDL or UTIITSL Portal

The National Securities Depository Limited (NSDL) and UTI Infrastructure Technology and Services Limited (UTIITSL) also offer services to help you find your PAN number. You can visit their respective websites and follow a similar process as the one mentioned above for the Income Tax Department’s portal.

6. Contact Your Income Tax Officer

If you're still unable to find your PAN number, consider contacting your local Income Tax Officer. You can provide them with your Aadhaar number, name, and date of birth to help them retrieve your PAN number from their records.

7. Using the Aadhaar-PAN Link

If you have linked your PAN to your Aadhaar number, you can also find your PAN details through the Aadhaar portal. Simply log in to the UIDAI website with your Aadhaar number and look for the PAN details section.

8. Visit Your Nearest PAN Service Center

Finally, if all else fails, visit a PAN service center. You can find these centers in most major cities and towns. Take your Aadhaar card and any other identification documents, and the service center staff can help you locate your PAN number.

Tips for Safeguarding Your PAN Number

Once you've found your PAN number, it's crucial to keep it safe. Here are a few tips:

- Keep a Digital Copy: Store a digital copy of your PAN card on a secure device or cloud storage.

- Memorize It: Try to memorize your PAN number to avoid future hassles.

- Avoid Sharing: Only share your PAN number with trusted entities to avoid identity theft or financial fraud.

Conclusion

Losing track of your PAN number can be stressful, but as you can see, there are several ways to recover it. Whether through online portals, banking documents, or local service centers, you can quickly find your PAN number and resume your financial activities without any hiccups. Always remember to keep your PAN number safe and secure to avoid future inconvenience.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?