How to Check PAN Card Details Using Your PAN Number: A Step-by-Step Guide

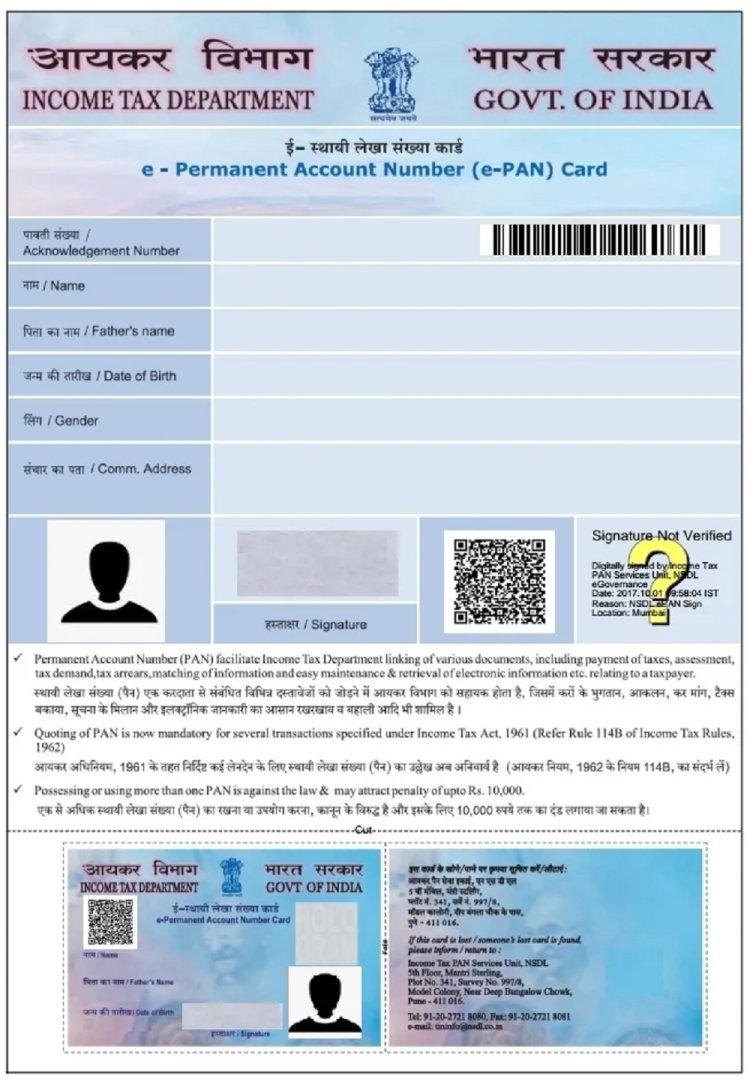

Introduction : The Permanent Account Number (PAN) is a unique alphanumeric code issued by the Income Tax Department of India. It's essential for various financial and tax-related activities. If you already have your PAN number but need to verify or check the associated details, you can easily do so online. In this article, we'll guide you through the process of checking your PAN card details using your PAN number.

Why You Might Need to Check PAN Card Details

There are several reasons why you may need to verify your PAN card details:

- Tax Filing: Ensure your PAN details are accurate before filing your income tax returns.

- Financial Transactions: Banks and financial institutions may require PAN verification for significant transactions.

- Verification: If you’ve applied for loans, credit cards, or government schemes, you may need to verify your PAN information.

- Correction: Checking the current details on your PAN card before requesting corrections.

Methods to Check PAN Card Details Using Your PAN Number

Here are the steps to check your PAN card details using your PAN number:

1. Using the Income Tax E-filing Portal

The Income Tax e-filing portal allows you to verify your PAN details easily.

- Step 1: Visit the official Income Tax e-filing website: www.incometaxindiaefiling.gov.in.

- Step 2: Under the ‘Quick Links’ section, click on ‘Verify Your PAN Details’.

- Step 3: You will be prompted to enter your PAN number, full name, and date of birth.

- Step 4: Complete the captcha verification and click on the ‘Submit’ button.

- Step 5: Once verified, the portal will display your PAN details, including your name, jurisdiction, and PAN status.

2. Using the NSDL Website

The National Securities Depository Limited (NSDL) website also offers PAN verification services.

- Step 1: Visit the NSDL PAN verification page: www.tin-nsdl.com.

- Step 2: Select the appropriate option for PAN verification and enter your PAN number.

- Step 3: Complete the captcha verification and submit the form.

- Step 4: Your PAN card details, including name, date of birth, and PAN status, will be displayed.

3. Through the UTIITSL Portal

The UTI Infrastructure Technology and Services Limited (UTIITSL) portal also allows you to check PAN card details.

- Step 1: Visit the UTIITSL PAN card services page: www.pan.utiitsl.com.

- Step 2: Under the PAN Card section, find the option for PAN card details verification.

- Step 3: Enter your PAN number, complete the captcha, and submit.

- Step 4: Your PAN details will be displayed, including the current status of your PAN card.

What Information Can You Check?

When you check your PAN card details using your PAN number, you can access the following information:

- Full Name: The name registered with your PAN.

- Date of Birth: The date of birth as recorded with the Income Tax Department.

- PAN Jurisdiction: The jurisdiction under which your PAN falls, which is linked to your Income Tax Office.

- PAN Status: Whether your PAN is active or inactive, and if there are any issues with it.

- Other Details: Depending on the portal, you might also see details like your address, father’s name, and more.

Important Points to Remember

- Accurate Information: Ensure that you enter your PAN number and other details correctly to avoid errors during verification.

- Secure Access: Always use official websites like the Income Tax e-filing portal, NSDL, or UTIITSL for PAN verification to ensure your data's security.

- Registered Mobile Number: Some portals might require OTP verification, so ensure your mobile number is registered with your PAN.

Conclusion

Checking your PAN card details using your PAN number is a quick and easy process that can be done online. Whether you need to verify your details for tax purposes, financial transactions, or just to ensure everything is correct, the methods outlined in this guide will help you access your PAN information securely. Make sure to keep your PAN number handy and use the official portals to check your details.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?