How to Access PAN Card Information Online

Introduction : The Permanent Account Number (PAN) is a crucial document for individuals and businesses in India, issued by the Income Tax Department. It is used for filing taxes, financial transactions, and as proof of identity. Whether you need to check your PAN card details or update your information, accessing PAN card info online is now easier than ever. In this article, we will explain how you can access and manage your PAN card information online using government portals and other authorized services.

What is PAN Card Information?

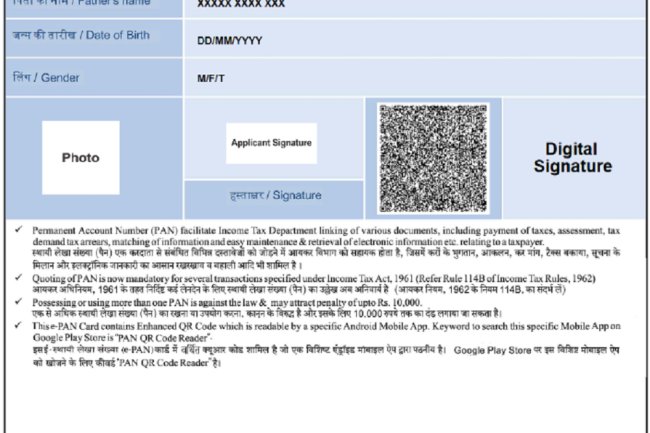

Your PAN card contains essential details such as:

- PAN Number (Unique 10-digit alphanumeric code)

- Name of the PAN holder

- Date of birth or date of incorporation (for businesses)

- Father’s name (for individuals)

- Photograph (for individuals)

This information is linked to your tax records and financial history, making it critical to ensure its accuracy. If you need to view, verify, or update this information, you can do so online through various official channels.

How to Access PAN Card Information Online

Here are some simple ways to check your PAN card info online:

-

Using the Income Tax e-Filing Portal

The official Income Tax e-filing portal allows you to access and manage your PAN card details online. Here’s how:- Visit the Income Tax e-Filing portal.

- Log in using your PAN number and password (or register if you haven’t done so before).

- Navigate to the "Profile Settings" section.

- Select “PAN Details” to view your PAN card information, including name, PAN number, and linked Aadhaar number.

- You can also update your address or contact details through this portal.

-

Check PAN Card Information via NSDL Portal

The National Securities Depository Limited (NSDL) provides an online service for PAN-related queries:- Go to the NSDL PAN portal.

- Under the “PAN Card Services” section, select “Know Your PAN.”

- Enter your full name, date of birth, and registered mobile number.

- Verify using OTP sent to your mobile, and your PAN card information will be displayed.

-

Through UTIITSL Portal

UTI Infrastructure Technology and Services Limited (UTIITSL) also offers an online platform for PAN services:- Visit the UTIITSL PAN services.

- Click on “PAN Card Details” and fill in your name, date of birth, and other personal details.

- Your PAN information will be displayed after verification.

-

Link Aadhaar with PAN

You can check and update your PAN card info if it's linked with Aadhaar:- Visit the Aadhaar-PAN linking page.

- Enter your Aadhaar number and PAN to see if they are linked.

- This also helps retrieve PAN information in case of a forgotten PAN number.

What Can You Do with Online PAN Card Info?

- Verify PAN Details: Ensure the correctness of your PAN information, including name, address, and date of birth.

- Update PAN Card Info: You can update your PAN card details, such as name changes, address updates, and corrections in case of discrepancies.

- Check PAN-Aadhaar Linking Status: Ensure that your PAN card is linked with Aadhaar to avoid complications while filing income tax returns.

- File Income Tax Returns (ITR): Access your PAN details to file accurate tax returns via the e-filing portal.

- Reprint PAN Card: If your PAN card is lost or damaged, you can apply for a reprint through the NSDL or UTIITSL portals.

Why Accessing PAN Information Online is Important

Your PAN card information is tied to your financial and tax-related activities. Any errors or outdated information can lead to problems with tax filing, loans, and financial transactions. Accessing and updating your PAN information online ensures that you are compliant with the tax authorities and prevents legal complications.

Conclusion

Accessing your PAN card information online is a quick and secure way to manage your tax and financial identity. Whether you need to check, update, or link your PAN with Aadhaar, the e-filing and NSDL portals provide easy-to-use solutions. Always use official government websites to avoid unauthorized access to your sensitive data.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?