How to Perform a PAN Search by PAN Number: A Step-by-Step Guide

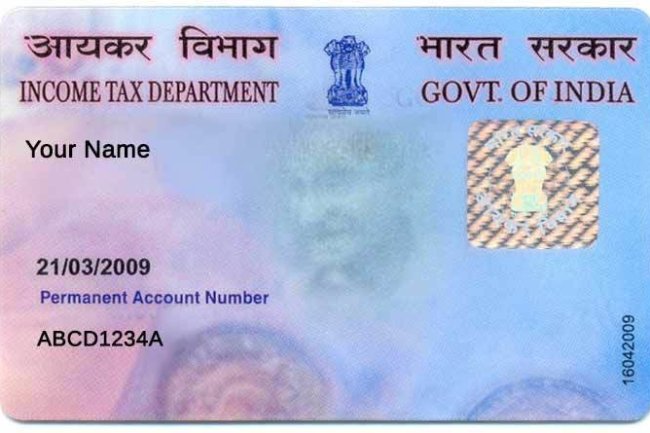

Introduction : A PAN (Permanent Account Number) is a unique identification code issued by the Income Tax Department of India. It is mandatory for individuals and businesses to have a PAN for filing taxes and conducting various financial transactions. Whether you need to verify your PAN details, check the status of your PAN card, or confirm its validity, performing a PAN search by PAN number is a simple and effective way to retrieve this information. In this article, we will guide you through the process of performing a PAN search using your PAN number, why it is necessary, and the official platforms available to help you.

Why Perform a PAN Search by PAN Number?

There are various reasons why you may need to perform a PAN search using your PAN number:

- Verification Purposes: To ensure that your PAN details are accurate and up-to-date, especially before filing income tax returns.

- Tracking Application Status: If you have applied for a PAN card and want to track its status.

- Compliance Checks: For KYC (Know Your Customer) procedures in banks and financial institutions.

- Lost PAN Card: If you’ve misplaced your PAN card but remember the number and need to verify the details.

Keeping your PAN details accurate ensures smooth processing of financial transactions and tax filings.

Steps to Perform PAN Search by PAN Number

Here’s how you can easily perform a PAN search by PAN number on different official platforms:

1. Income Tax e-Filing Portal:

- Visit the Income Tax e-Filing website.

- Go to the "Verify Your PAN" section.

- Enter your PAN number, full name, and date of birth.

- Submit the information to retrieve your PAN details.

2. NSDL (Now Protean eGov Technologies Limited):

- Head to the NSDL PAN Services.

- Navigate to the PAN Verification section.

- Enter your PAN number and other required details.

- Click on submit to view your PAN information.

3. UTIITSL (UTI Infrastructure Technology And Services Limited):

- Visit the UTIITSL PAN Services.

- Select the "Verify PAN" option.

- Provide your PAN number and other relevant details.

- Submit the form to access your PAN details.

What Information Can You Retrieve?

By performing a PAN search with your PAN number, you can access the following details:

- PAN cardholder’s full name

- PAN number

- Date of Birth

- PAN card status (whether it is active or inactive)

In some cases, further details like application status can also be accessed through this process.

Common Scenarios for PAN Search by PAN Number

- Income Tax Filing: Verify your PAN details to ensure they match with the Income Tax Department records.

- KYC (Know Your Customer) Verification: Banks, investment firms, and other financial institutions often require a PAN verification as part of their compliance checks.

- Tracking PAN Card Application Status: If you are waiting for your PAN card, you can track its status using your PAN number or the acknowledgment number provided during the application process.

- Loan or Credit Card Application: When applying for financial services, verifying your PAN details is essential to ensure that your application is processed without delay.

Benefits of PAN Search by PAN Number

- Easy and Convenient: Searching your PAN details online using just your PAN number saves time and effort.

- Instant Results: You get immediate access to key information like your PAN status and verification.

- Official Verification: Performing a PAN search via trusted platforms like NSDL, UTIITSL, or the Income Tax e-filing portal ensures the authenticity of the data.

Conclusion

Performing a PAN search by PAN number is an essential step to verify your PAN details, check its status, and ensure compliance with tax and financial regulations. The process is straightforward and can be done online through official government portals like the Income Tax Department, NSDL, or UTIITSL. Whether for tax filing, KYC verification, or tracking your PAN card, having access to your PAN details quickly and efficiently is crucial.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?