How to Find PAN Number Details by Name – A Complete Guide

Introduction : Your PAN (Permanent Account Number) is an essential identification tool for tax and financial transactions in India. But what if you need to retrieve your PAN number details and only have your name available? Whether you've misplaced your PAN card or simply forgotten the number, it’s possible to access your PAN details using just your name through online portals. In this article, we’ll explain how to find PAN number details by name using various methods.

What is a PAN Number?

A PAN number is a unique 10-character alphanumeric identifier issued by the Income Tax Department of India to track financial activities and tax filings. It’s required for transactions above a certain limit, filing income tax returns, and accessing various financial services.

Can You Find PAN Number Details by Name?

Yes, it is possible to retrieve PAN number details using your name, especially if your PAN is linked to your Aadhaar card or mobile number. Here’s a step-by-step guide to finding PAN number details by name online.

How to Find PAN Number Details by Name Online

1. Use the e-Filing Portal of the Income Tax Department

The official e-Filing portal of the Income Tax Department allows you to search for your PAN number by entering key details, including your name. Here’s how to do it:

- Visit the Income Tax e-Filing portal: https://www.incometax.gov.in/iec/foportal

- Navigate to the ‘Know Your PAN’ section under the PAN services.

2. Provide Personal Details

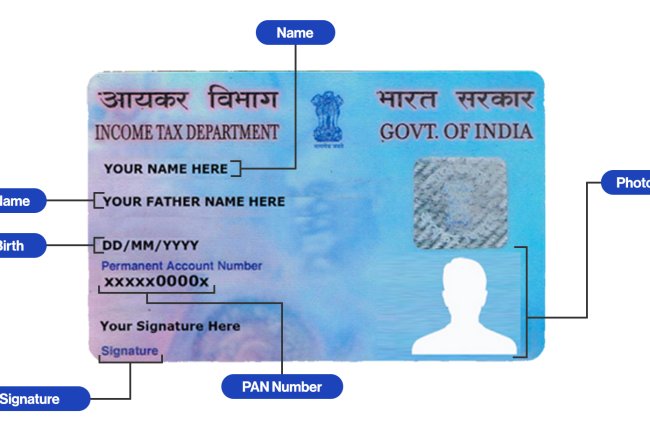

To find your PAN number, you will need to provide the following details:

- Full name (as per the PAN database)

- Date of birth (DD/MM/YYYY)

- Registered mobile number (for OTP verification)

- Captcha code to verify you’re not a robot

Make sure your name is entered exactly as it appears in official documents like your Aadhaar card to avoid errors.

3. Verify Using OTP

Once you’ve entered your details, the system will send an OTP (One-Time Password) to your registered mobile number. Enter the OTP to verify your identity.

4. Retrieve Your PAN Details

After successful OTP verification, your PAN number details will be displayed on the screen. You’ll be able to view the PAN number associated with your name, date of birth, and registered mobile number.

Alternative Methods to Find PAN Number by Name

1. Aadhaar-Linked PAN Retrieval

If your PAN is linked to your Aadhaar card, you can use your Aadhaar number to find PAN details through the e-Filing portal. Simply choose the Aadhaar PAN linking option and retrieve your PAN number by entering your name, Aadhaar number, and other personal information.

2. Contact NSDL or UTIITSL

You can also approach authorized agencies like NSDL or UTIITSL for PAN-related queries. Visit their websites and follow the steps for retrieving PAN details by name. Here’s how:

- Visit the NSDL PAN portal: https://www.onlineservices.nsdl.com/

- Choose the appropriate PAN services section and enter your name and other details to retrieve the PAN number.

3. SMS-Based PAN Retrieval

The Income Tax Department provides an SMS-based PAN retrieval service. To use this, send an SMS in the format ‘PAN<space>Your Name<space>Date of Birth>’ to 567678. You’ll receive a response with the PAN number associated with the name and date of birth.

4. Physical PAN Card Copy

If you have previously applied for a PAN card but misplaced it, you can check your personal records for any photocopy of the PAN card, which contains your number. Alternatively, you can reprint your PAN card from the NSDL or UTIITSL website if you know your name and other details.

Things to Keep in Mind

- Your name and date of birth must match the PAN records exactly. Even minor discrepancies can result in failure to retrieve your PAN details.

- Ensure that your mobile number is registered with the Income Tax Department for OTP-based verification.

- If your PAN is not linked to your Aadhaar or mobile number, it may be challenging to retrieve the details online, in which case you may need to visit an Aadhaar Enrollment Center or PAN service center.

Why is it Important to Keep Your PAN Number Safe?

Your PAN number is crucial for a variety of financial activities, including:

- Filing income tax returns

- Applying for loans or credit cards

- Conducting high-value transactions

- Purchasing or selling property

Since your PAN is tied to your financial records, it is important to keep it safe and accessible. If you lose your PAN card or number, promptly retrieve or reprint it to avoid any disruptions in financial activities.

Conclusion

Finding your PAN number details by name is a convenient process thanks to the online services provided by the Income Tax Department. With a few personal details, you can easily retrieve your PAN number online. This guide outlines the steps to ensure you can access your PAN details whenever you need them.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?