How to Check Your PAN Card Number Online

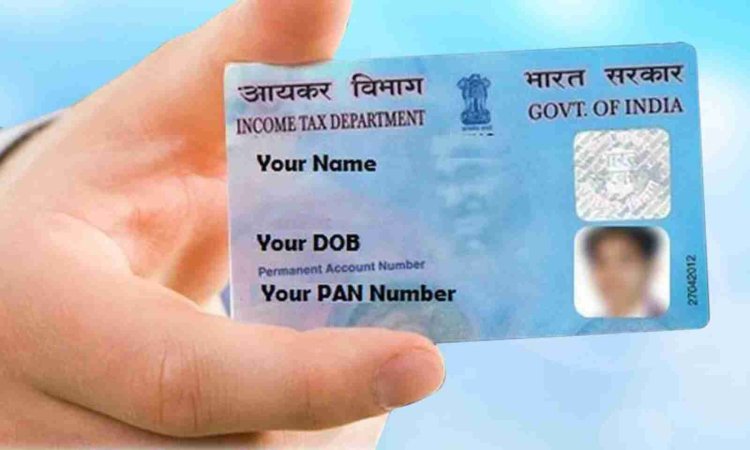

Introduction : The Permanent Account Number (PAN) is an essential identification tool for all tax-paying entities in India. Issued by the Income Tax Department, this 10-digit alphanumeric number is used for tax-related purposes and many financial transactions. If you’ve misplaced your PAN card or forgotten your PAN number, don’t worry—there are several ways to check your PAN card number online quickly and securely. In this article, we’ll explain the step-by-step methods to check your PAN card number using online government portals and other official resources.

How to Check Your PAN Card Number Online

-

Check PAN Number on the Income Tax e-Filing Portal

One of the most reliable ways to check your PAN card number is through the Income Tax Department’s e-filing portal. Here’s how you can do it:- Visit the official Income Tax e-Filing portal.

- Under the ‘Quick Links’ section, click on the “Know Your PAN” option.

- Enter your full name, date of birth, and the mobile number or email address registered with your PAN card.

- An OTP (One-Time Password) will be sent to your registered mobile number for verification.

- Once verified, your PAN card number will be displayed on the screen.

-

Check PAN Number Through Aadhaar-PAN Linking

If your PAN card is linked to your Aadhaar, you can use the Aadhaar-PAN linking portal to retrieve your PAN number. Here’s how:- Visit the Aadhaar-PAN linking page on the e-filing portal.

- Enter your Aadhaar number and other required details.

- If your PAN and Aadhaar are linked, you will be able to see your PAN card number.

-

Retrieve PAN Number via NSDL Portal

The National Securities Depository Limited (NSDL) provides another platform where you can check and retrieve your PAN card number online. Here’s the process:- Visit the official NSDL PAN portal.

- Navigate to the “Reprint PAN Card” option under the PAN services section.

- Enter your name, date of birth, and other required details.

- Your PAN card number will be retrieved and displayed during the process.

-

Using Your Income Tax Return (ITR) to Check PAN Number

If you have previously filed an Income Tax Return (ITR), your PAN card number will be present on the acknowledgment receipt of your ITR. You can access your filed ITR documents from the e-filing portal under the "My Account" section.

Why You Need Your PAN Number

Your PAN card number is vital for a range of activities such as:

- Filing Income Tax Returns (ITR)

- Opening bank and Demat accounts

- Applying for loans and credit cards

- Conducting large financial transactions (buying/selling property, investments)

- Buying or selling assets like shares and mutual funds

Losing track of your PAN number can hinder these processes, but with online services, you can easily retrieve or check your PAN card number without any hassle.

Conclusion

Checking your PAN card number online is simple, secure, and fast when using official government platforms like the Income Tax e-filing portal or NSDL. Always ensure that you only use authorized portals to safeguard your personal and financial information.

Once you retrieve your PAN card number, make sure to store it safely, either digitally or in a secure place, for future use.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?