What is a PAN Card Used For? A Comprehensive Guide

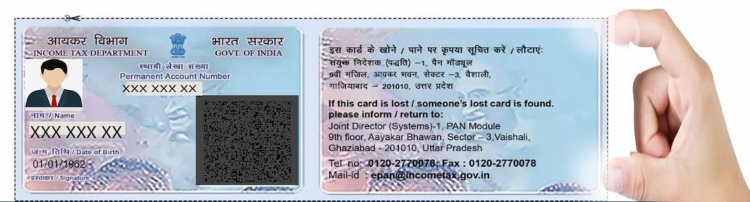

Introduction : A Permanent Account Number (PAN) Card is an essential document for Indian residents and non-residents conducting financial transactions in India. Issued by the Income Tax Department, a PAN is a unique 10-digit alphanumeric identifier that tracks and records financial activities to prevent tax evasion. Here’s a detailed look at the various uses of a PAN card:

1. Filing Income Tax Returns

One of the primary uses of a PAN card is to file income tax returns. Every individual or entity, including businesses that have taxable income in India, must have a PAN card to file their returns.

2. Opening a Bank Account

Whether it’s a savings account or a current account, PAN is required for opening any bank account in India. This helps banks monitor high-value transactions and report them to the Income Tax Department.

3. Making Large Financial Transactions

PAN is mandatory for financial transactions above a certain threshold, such as:

- Deposits exceeding ₹50,000 in a single day in banks.

- Purchase or sale of property valued over ₹10 lakhs.

- Buying or selling vehicles except for two-wheelers.

- Investments in mutual funds, stocks, or bonds above ₹50,000.

4. Applying for Loans and Credit Cards

Banks and financial institutions require a PAN card for granting loans, including home, car, and personal loans. It is also essential when applying for a credit card to assess the creditworthiness of the applicant.

5. Buying and Selling Real Estate

A PAN card is required for the purchase or sale of immovable property worth ₹10 lakhs or more. It ensures transparency in real estate transactions and helps in tracking the flow of black money.

6. Investing in Mutual Funds and Stock Market

To invest in mutual funds or stock markets in India, individuals must provide their PAN details. It ensures that the Income Tax Department tracks all high-value transactions and potential taxable income from investments.

7. Foreign Exchange Transactions

PAN is necessary for exchanging foreign currency of an amount equal to or greater than ₹50,000.

8. Obtaining a New Phone Connection

When applying for a postpaid mobile connection, telecom companies may require a PAN card for verification purposes, ensuring that only valid identities access mobile services.

9. Purchasing Jewelry

Purchases of jewelry exceeding ₹2 lakhs require a PAN card. This regulation aims to prevent the circulation of unaccounted wealth.

Importance of PAN Card

The PAN card plays a pivotal role in preventing tax evasion by ensuring that every significant transaction is recorded by the government. Without a PAN card, conducting major financial operations in India becomes virtually impossible, as it is the key document linking individuals and entities to their financial activities.

Conclusion

In summary, a PAN card is much more than a tax-related document. It is an indispensable tool for anyone participating in India's financial ecosystem.

From filing taxes to making investments and even purchasing property, a PAN card is essential for maintaining financial transparency and compliance with Indian tax laws.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?