PAN Apply Online: Your Step-by-Step Guide

Introduction : Applying for a Permanent Account Number (PAN) has never been easier, thanks to the convenience of online applications. Whether you are an Indian resident, a non-resident Indian (NRI), or a foreign national involved in financial activities in India, you can apply for a PAN card from the comfort of your home. This article will walk you through the process of applying for a PAN online, ensuring a smooth and hassle-free experience.

What is PAN?

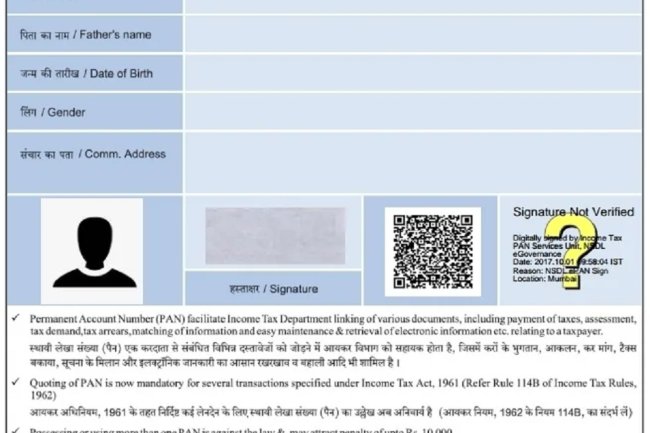

A Permanent Account Number (PAN) is a ten-digit alphanumeric identifier issued by the Income Tax Department of India. It is essential for various financial transactions, including filing income tax returns, opening bank accounts, purchasing property, and investing in mutual funds.

Who Needs a PAN?

-

Indian Residents: Anyone earning taxable income in India or engaging in significant financial transactions needs a PAN.

-

Non-Resident Indians (NRIs): NRIs with financial interests in India, such as property ownership, investments, or income, require a PAN.

-

Foreign Nationals: Foreign nationals involved in business or financial activities in India must also apply for a PAN.

Why Apply for PAN Online?

Applying for a PAN online offers several benefits:

- Convenience: You can apply from anywhere, at any time.

- Faster Processing: Online applications are processed more quickly than offline methods.

- Paperless: The process can be completed digitally, reducing paperwork and the need for physical document submissions.

- Trackable: You can easily track the status of your application online.

Steps to Apply for PAN Online

Follow these simple steps to apply for a PAN card online:

1. Choose the Right Portal

You can apply for a PAN card online through two authorized portals:

- NSDL (now Protean eGov Technologies): https://www.onlineservices.nsdl.com

- UTIITSL: https://www.pan.utiitsl.com

Both portals offer similar services, and you can choose either based on your preference.

2. Select the Appropriate Form

Depending on your category, choose the right form:

- Form 49A: For Indian citizens (including NRIs).

- Form 49AA: For foreign nationals.

3. Fill Out the Application Form

Provide accurate details such as your full name, date of birth, address, and contact information. Double-check all the information before submitting the form to avoid errors.

4. Upload Required Documents

You’ll need to upload scanned copies of your documents for identity proof, address proof, and date of birth proof. Acceptable documents include:

- Identity Proof: Aadhaar card, voter ID, passport, etc.

- Address Proof: Utility bills, bank statements, passport, etc.

- Date of Birth Proof: Birth certificate, matriculation certificate, passport, etc.

5. Pay the Application Fee

The application fee varies based on your communication address:

- Indian Address: ₹110 (including GST).

- Foreign Address: ₹1,020 (including GST).

Payment can be made via credit/debit card, net banking, or demand draft.

6. Aadhaar-Based e-KYC (Optional)

If you have an Aadhaar number linked with your mobile number, you can opt for Aadhaar-based e-KYC, which simplifies the process by automatically fetching your details.

7. Submit the Application

Once all details are entered and documents uploaded, submit the application. You will receive an acknowledgment number that you can use to track your application.

8. Receive Your PAN Card

- e-PAN: Within a few days of processing, you will receive an e-PAN in your registered email, which can be downloaded and used immediately.

- Physical PAN Card: The physical card will be mailed to your communication address within 15 days.

Tracking Your PAN Application

You can track the status of your PAN application using the acknowledgment number provided at the time of submission. Visit the NSDL or UTIITSL portal, enter your acknowledgment number, and view the current status.

Common Issues and How to Resolve Them

- Mismatch in Documents: Ensure that your name, date of birth, and other details match across all submitted documents to avoid rejections.

- Multiple PANs: If you have multiple PANs, surrender the additional one to avoid penalties.

- Incorrect Details: If you notice any errors in your PAN details, you can request corrections through the same online portals.

Conclusion

Applying for a PAN online is a simple and efficient process that saves time and effort. Whether you are an individual, an NRI, or a foreign national, obtaining a PAN is crucial for managing your financial affairs in India. Follow the steps outlined in this guide, and you’ll have your PAN card in no time.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?