Know About Your PAN: A Complete Guide to Understanding and Managing Your PAN Card

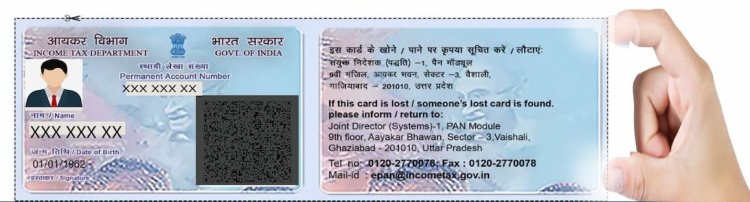

Introduction : A Permanent Account Number (PAN) is more than just a government-issued identification card; it is a vital document required for numerous financial and taxation purposes in India. Whether you're filing taxes, making large financial transactions, or investing in securities, your PAN card links all these activities to your unique number. In this article, we’ll help you understand everything you need to know about your PAN, its importance, and how to manage your PAN details effectively.

What is a PAN?

A PAN, or Permanent Account Number, is a 10-character alphanumeric identifier issued by the Income Tax Department of India. This number is unique to each individual, business, or entity and is used to track all financial transactions and taxes linked to that individual or entity. A PAN card is required for several purposes such as:

- Filing income tax returns

- Opening a bank account

- Purchasing or selling property

- Investing in shares, mutual funds, or other financial instruments

Importance of PAN in Financial and Tax Transactions

Having a PAN is essential for anyone involved in financial activities, both individuals and businesses. Here are some reasons why your PAN is important:

- Income Tax Filing: Your PAN is mandatory for filing income tax returns. It helps the Income Tax Department track your taxable income and ensure compliance.

- High-Value Transactions: If you’re making high-value transactions such as purchasing a car, buying or selling property, or investing in mutual funds, your PAN needs to be quoted to avoid tax evasion.

- Banking & Financial Services: Most banks and financial institutions require your PAN to open accounts, make deposits exceeding ₹50,000, or apply for loans.

- Identity Proof: PAN serves as a valid ID proof in various contexts, including government services and KYC procedures.

How to Know Your PAN Details: Step-by-Step Guide

Whether you need to verify your PAN number, retrieve lost details, or update your information, you can do it easily online. Here’s a simple guide on how to know about your PAN details:

Step 1: Visit the Official PAN Service Websites

Go to the official websites of either NSDL (National Securities Depository Limited), UTIITSL (UTI Infrastructure Technology and Services Limited), or the Income Tax e-filing portal.

Step 2: Choose the PAN Services Option

Look for the option that allows you to retrieve your PAN details. It might be under sections such as ‘Know Your PAN’, ‘Retrieve PAN Details’, or ‘Check PAN Status’.

Step 3: Enter Your Personal Information

To get your PAN details, you will need to provide your:

- Full name (as registered with PAN)

- Date of birth

- Registered mobile number

- Father’s name (in some cases)

Step 4: Verification via OTP

Once you’ve entered the necessary details, you will receive an OTP on your registered mobile number. Enter this OTP to proceed with the request.

Step 5: Access PAN Details

After the successful OTP verification, your PAN details, including your PAN number, will be displayed on the screen. You can also check whether your PAN is active or if any corrections need to be made.

How to Verify and Link Aadhaar with PAN

One crucial update in recent years is the requirement to link your PAN with Aadhaar. Failing to link these two documents could lead to the deactivation of your PAN. Here's how you can check if your Aadhaar is linked to your PAN and complete the process if it isn’t:

- Visit the Income Tax e-filing portal.

- Click on ‘Link Aadhaar’ or check the status by entering your PAN and Aadhaar details.

- Once verified, your PAN and Aadhaar will be linked, ensuring compliance with government regulations.

How to Correct PAN Details

If there are any discrepancies in your PAN details, such as a spelling mistake in your name or an incorrect date of birth, you can easily make corrections through the NSDL or UTIITSL portals. Here’s how:

- Visit the PAN Correction Form section on the website.

- Fill out the required fields, and provide the correct details.

- Submit the form online, and upload any necessary documents for verification.

- Pay the nominal correction fee, and you will receive the updated PAN card within a few weeks.

FAQs About PAN

Q1: Is it mandatory to have a PAN card?

A1: Yes, if you earn taxable income or are involved in significant financial transactions, it is mandatory to have a PAN.

Q2: Can I hold more than one PAN?

A2: No, holding more than one PAN is illegal and can result in a fine. Ensure you have only one active PAN.

Q3: What should I do if I lose my PAN card?

A3: You can apply for a reprint of your PAN card using the PAN number. Visit the NSDL or UTIITSL portal and request a duplicate card.

Q4: How can I check my PAN status?

A4: You can check the status of your PAN application or verify your PAN details by visiting the official PAN service websites and using the ‘PAN Status’ feature.

Conclusion

Your PAN is a critical tool for managing your finances and complying with tax regulations in India. Whether you’re filing taxes, making investments, or handling high-value transactions, your PAN serves as the key identifier in the system. Knowing how to manage your PAN details, correct discrepancies, and ensure your PAN is linked to your Aadhaar will help you avoid any issues with the Income Tax Department or financial institutions.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?