How to Track Your PAN Number by Name: A Step-by-Step Guide

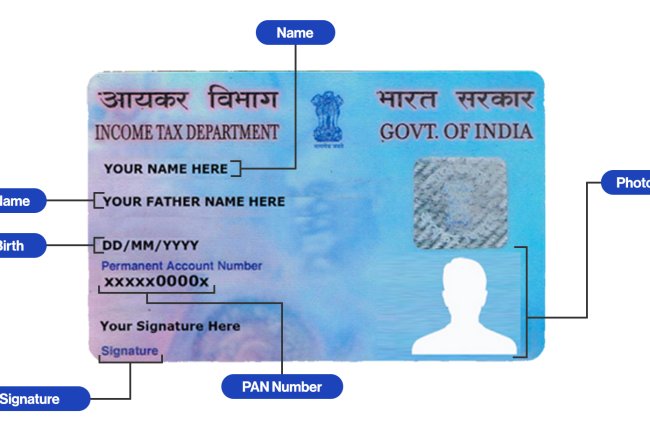

Introduction : If you've misplaced your Permanent Account Number (PAN) card or forgotten your PAN number, you can easily retrieve it using your name and other personal details. The PAN is a 10-digit alphanumeric identifier issued by the Income Tax Department of India, and it is essential for filing taxes, making financial transactions, and serving as proof of identity. In this article, we’ll explain how you can track or find your PAN number by using your name and date of birth.

Why You Might Need to Track Your PAN Number

There are several reasons why you may need to retrieve your PAN number:

- You’ve misplaced your PAN card and need to recover the number for a financial transaction.

- You want to verify your PAN number for tax purposes.

- You need to link your PAN with Aadhaar but can’t remember the PAN number.

Fortunately, the Income Tax Department of India offers ways to retrieve your PAN using just your name and date of birth.

Steps to Track PAN Number by Name

You can track your PAN number online by using the e-Filing portal of the Income Tax Department or by visiting the official NSDL or UTIITSL websites. Here’s a step-by-step guide:

Method 1: Using the Income Tax Department e-Filing Portal

-

Visit the Income Tax e-Filing Portal: Go to the official website: https://www.incometaxindiaefiling.gov.in.

-

Navigate to 'Know Your PAN': Under the "Quick Links" section, click on the "Know Your PAN" option.

-

Enter Your Details:

- Enter your name (as per your PAN records).

- Enter your date of birth or date of incorporation (in case of companies).

- Provide your registered mobile number.

- Enter the captcha code for verification.

-

Receive OTP and Verify: You will receive a One-Time Password (OTP) on your registered mobile number. Enter the OTP to proceed.

-

View Your PAN Number: Once verified, your PAN number will be displayed on the screen.

Method 2: Via Customer Care

If you are unable to retrieve your PAN number online, you can call the PAN card helpline offered by NSDL or UTIITSL. Provide your full name, date of birth, and other personal details to retrieve your PAN number.

Method 3: Check Your PAN Card Acknowledgment

If you recently applied for a new PAN card, you can check your PAN acknowledgment number (usually a 15-digit number) to track the status of your PAN card. This number is generated after you submit your PAN application.

Documents Needed for PAN Retrieval

To ensure a smooth process when retrieving your PAN number, keep the following details handy:

- Full name (as per your PAN card).

- Date of birth or date of incorporation (for businesses).

- Registered mobile number.

Why Knowing Your PAN Number Is Important

Your PAN number is essential for various reasons:

- Filing Income Tax Returns (ITR): You must provide your PAN number while filing taxes.

- Opening a Bank Account or Financial Transactions: Many financial institutions require PAN numbers for account opening or for transactions over a certain limit.

- Government Schemes and Benefits: Several schemes and services require PAN and Aadhaar linkage.

Conclusion

Tracking your PAN number by name is easy and convenient with the Income Tax Department’s online services. Whether you’ve lost your PAN card or simply can’t remember the number, using your name and date of birth allows you to recover it within minutes. Make sure to store your PAN number in a safe place to avoid future hassles.

For more information or to apply for a new PAN card, visit the official PAN Card Application Portal.

What's Your Reaction?