How to Get a PAN Card Online in India – A Complete Guide

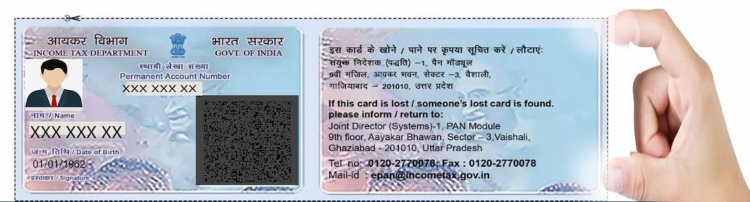

Introduction : The Permanent Account Number (PAN) is an essential identification code issued by the Income Tax Department of India. It is required for various financial transactions, tax filings, and to establish your identity for both personal and business purposes. If you don't have a PAN card yet, you can apply for it conveniently online. In this article, we'll walk you through the process of applying for a PAN card online step-by-step.

Why You Need a PAN Card

Before diving into the process, it’s important to know why a PAN card is crucial:

- Tax Filing: You need a PAN card to file income tax returns.

- Financial Transactions: PAN is required for transactions like opening a bank account, buying or selling property, or investing in mutual funds.

- Identity Proof: PAN also serves as a proof of identity for various applications and forms.

How to Apply for a PAN Card Online

You can apply for a PAN card online via the NSDL or UTIITSL websites. Both platforms offer similar services and are authorized by the Income Tax Department of India. Here’s how to do it:

Step 1: Visit the Official Website

Go to either of the following official websites:

- NSDL: https://www.onlineservices.nsdl.com

- UTIITSL: https://www.pan.utiitsl.com

Step 2: Choose the PAN Application Form

- Select Form 49A for Indian citizens.

- For foreign citizens, select Form 49AA.

Step 3: Fill in the PAN Application Form

Provide the required details such as:

- Full Name

- Date of Birth

- Address

- Contact details

- Aadhaar card number (if applicable)

Ensure that all the information is accurate to avoid delays in processing.

Step 4: Submit Documents

You will need to upload scanned copies of the following documents:

- Proof of Identity (Aadhaar card, Voter ID, Passport, etc.)

- Proof of Address (Utility bill, Aadhaar card, etc.)

- Proof of Date of Birth (Birth certificate, Matriculation certificate, etc.)

- Passport-size photograph

The documents should be legible, and the image size must meet the specified format on the portal.

Step 5: Payment of Application Fee

The fee for PAN card application is:

- ₹107 for an Indian address.

- ₹1,017 for a foreign address.

You can pay the application fee through Net Banking, Credit/Debit Card, or Demand Draft.

Step 6: Aadhaar Authentication (Optional)

If you have linked your Aadhaar card to your application, you can opt for e-KYC (electronic Know Your Customer) authentication to avoid sending physical documents. The system will authenticate your Aadhaar details automatically.

Step 7: Submit the Form

After completing the form and making the payment, submit the form. You will receive an acknowledgment number that can be used to track the status of your application.

Step 8: Send Physical Documents (If Required)

If you haven’t opted for Aadhaar-based e-KYC, you will need to send a physical copy of the acknowledgment form, along with your supporting documents, to the designated NSDL/UTIITSL office.

How to Track PAN Card Application Status

Once the application is submitted, you can track the status of your PAN card using the acknowledgment number:

- Visit the NSDL/UTIITSL website.

- Go to the PAN application status section.

- Enter your acknowledgment number.

- The current status of your PAN card will be displayed.

How Long Does It Take to Receive Your PAN Card?

After submitting the form and completing the verification process, it usually takes around 15 to 20 days for your PAN card to be dispatched to your address. If you opted for an e-PAN, you may receive it faster via email.

Frequently Asked Questions (FAQs)

Q1: Can I apply for a PAN card without Aadhaar? Yes, you can apply for a PAN card without Aadhaar. However, it will require physical document submission.

Q2: Can I make corrections in my PAN card online? Yes, corrections or changes in PAN card details can also be made online through the NSDL or UTIITSL portal.

Q3: What if I lose my PAN card? In case of loss or damage to your PAN card, you can apply for a reprint online via the same platforms.

Conclusion

Applying for a PAN card online is a quick, simple, and hassle-free process. By following the steps outlined above, you can easily get your PAN card without the need to visit any office in person. Make sure to provide accurate details and valid documents to avoid delays in processing.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?