How to Check Your PAN Card Number: A Step-by-Step Guide

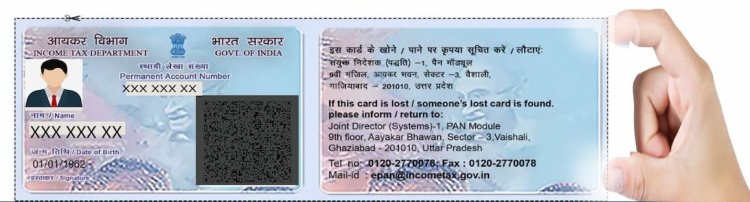

Introduction : The Permanent Account Number (PAN) is a vital identifier for taxpayers in India. Issued by the Income Tax Department, this unique 10-digit alphanumeric number is essential for a variety of financial transactions, such as filing income tax returns, opening a bank account, applying for loans, and purchasing property. Knowing your PAN card number is crucial for ensuring smooth financial and legal transactions. If you've misplaced your PAN card or forgotten the number, don't worry! This article provides a detailed guide on how to check your PAN card number quickly and easily.

Why You Might Need to Check Your PAN Card Number

There are several scenarios where you might need to check your PAN card number:

- Lost or Misplaced PAN Card: If you've lost or misplaced your PAN card, you'll need the PAN number to carry out various financial transactions.

- Forgotten PAN Number: If you have forgotten your PAN number and need it for filing taxes, making investments, or any other financial activity.

- PAN Verification: To verify your PAN details for compliance or verification purposes, such as during employment onboarding or loan applications.

Prerequisites for Checking Your PAN Card Number

Before you begin the process of checking your PAN card number, ensure you have the following information readily available:

- Full Name: Your full name as registered in the PAN database. Make sure to use the exact name, including any middle names or initials.

- Date of Birth: Your date of birth or date of incorporation (for businesses) as recorded in the PAN database.

- Father’s Name: Your father's full name as mentioned in the PAN records.

- Registered Mobile Number: The mobile number linked with your PAN for OTP (One-Time Password) verification.

Step-by-Step Guide to Check Your PAN Card Number Online

The Income Tax Department of India provides a convenient online method to check your PAN card number. Here’s a step-by-step guide on how to do it:

-

Visit the Official Income Tax e-Filing Website:

- Open your web browser and navigate to the Income Tax e-Filing website.

-

Access the 'Know Your PAN' Service:

- On the homepage, locate the option labeled "Know Your PAN" under the Quick Links or Services section. This service allows users to retrieve their PAN number using personal details.

-

Fill in the Required Personal Details:

- Enter your full name, date of birth, and the registered mobile number. Ensure that the details you provide match the information in the PAN database.

-

Enter the CAPTCHA Code:

- Complete the CAPTCHA verification to confirm that you are a human and not an automated bot. This step is essential for security reasons.

-

Submit the Form:

- Click on the “Submit” button after filling in all the required details and completing the CAPTCHA.

-

Verify OTP Sent to Your Mobile:

- An OTP will be sent to your registered mobile number. Enter this OTP in the designated field to verify your identity.

-

Retrieve Your PAN Number:

- After successful verification, your PAN number will be displayed on the screen. You can make a note of it or take a screenshot for future reference.

Alternative Methods to Check Your PAN Card Number

If you are unable to access the Income Tax e-Filing website or prefer a different method, here are some alternative ways to check your PAN card number:

-

Contact the Income Tax Department:

- You can call the Income Tax Department’s helpline and provide them with your personal details. A representative will assist you in retrieving your PAN number.

-

Visit a PAN Service Center:

- If you prefer in-person assistance, visit a nearby PAN service center or NSDL/UTIITSL office. The staff at these centers can help you find your PAN number after verifying your identity.

-

Using Aadhaar Number:

- If your PAN is linked to your Aadhaar number, you can use your Aadhaar details to check your PAN number on the Income Tax e-Filing website.

Important Considerations

When checking your PAN card number, keep the following considerations in mind:

- Ensure Accurate Information: Make sure the information you provide matches exactly with what is recorded in the PAN database to avoid errors.

- Data Privacy and Security: Always use official or trusted websites to protect your personal information from unauthorized access.

- Legal Compliance: Use the PAN retrieval service responsibly and in compliance with legal requirements. Unauthorized use of someone else’s PAN details can lead to legal consequences.

Conclusion

Checking your PAN card number is a simple and straightforward process, thanks to the online services provided by the Income Tax Department. Whether you have misplaced your PAN card, forgotten your PAN number, or need to verify your PAN details, the steps outlined in this guide will help you retrieve your PAN number quickly and securely. Always use official channels and keep your personal information safe to prevent misuse.

Call customer care regarding your PAN card (Customer Care Number :18001801961, 1800 1034455). By giving your name, father's name, your Aadhaar card number details, the PAN card number on your name will be given. After taking the PAN number, apply in Pan CSF.

If you want to apply PAN card, apply through this link https://pancardonlineindia.com/

What's Your Reaction?