How to Apply for a PAN Card Online in India: A Step-by-Step Guide

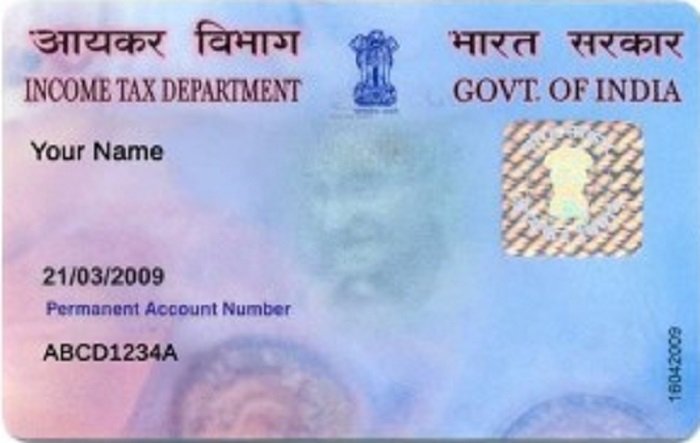

Introduction : A Permanent Account Number (PAN) is a 10-digit alphanumeric identifier issued by the Income Tax Department of India. It is mandatory for taxpayers and is used for various financial transactions such as filing income tax returns, opening a bank account, and applying for loans. Applying for a PAN card online is a simple and hassle-free process. In this article, we will guide you through the step-by-step procedure to apply for a PAN card online in India.

Why Do You Need a PAN Card?

A PAN card is essential for:

- Filing income tax returns.

- Opening a bank account.

- Buying or selling property.

- Applying for credit cards or loans.

- Making high-value transactions, such as investments or large purchases.

- Preventing tax evasion by tracking financial transactions.

Whether you’re an individual, company, or foreign national, you can apply for a PAN card easily online.

Steps to Apply for a PAN Card Online in India

You can apply for a PAN card through the official websites of either NSDL e-Gov or UTIITSL. Here’s how to do it:

Step 1: Choose the Official Portal

Visit either the NSDL e-Gov website or the UTIITSL website.

Step 2: Select the Type of Application

Choose the appropriate option based on whether you are applying for a new PAN card or making changes to your existing PAN. Select Form 49A if you are an Indian citizen, or Form 49AA for foreign citizens.

Step 3: Fill Out the Application Form

Enter your personal details, such as:

- Full name

- Date of birth

- Gender

- Address

- Aadhaar number (if available)

Ensure that all information matches the details on your identity proof.

Step 4: Upload Required Documents

You will need to upload scanned copies of the following documents:

- Proof of Identity (POI): Aadhaar card, passport, driving license, voter ID.

- Proof of Address (POA): Aadhaar card, utility bill, passport, bank statement.

- Proof of Date of Birth (DOB): Birth certificate, Aadhaar, passport, or school leaving certificate.

Step 5: Pay the Application Fee

You can pay the PAN card application fee online using debit/credit cards, net banking, or UPI. The fees are as follows:

- ₹110 for a PAN card dispatched within India.

- ₹1,011 for a PAN card dispatched outside India.

Step 6: Submit the Application

Once all the details are filled out and documents uploaded, review the form for accuracy. Submit the application. You will receive an acknowledgment receipt with a 15-digit number. Keep this number safe, as it will help you track your application status.

Step 7: Receive Your PAN Card

After submission, your application will be processed, and you will receive your PAN card by post within 15-20 working days. You can also download an e-PAN from the respective portal.

How to Track Your PAN Card Application Status

You can easily track the status of your PAN application online using your acknowledgment number:

- Go to the NSDL or UTIITSL portal.

- Enter your acknowledgment number and submit.

- Your application status will be displayed on the screen.

Conclusion

Applying for a PAN card online is quick and convenient. With just a few steps, you can complete the process and receive your PAN card in a matter of weeks. Whether you’re filing taxes, opening a bank account, or making large financial transactions, having a PAN card is essential. Make sure to apply for one if you haven’t already.

For a seamless and easy application process, visit Apply for PAN Card Online.

What's Your Reaction?