How to View Your PAN Card Details Using PAN Number

Introduction: The Permanent Account Number (PAN) is a crucial identification tool for financial transactions in India. While most people have their PAN card with them, sometimes you may need to view your PAN details online for verification, income tax filing, or other purposes. The good news is that you can easily view PAN card details using just your PAN number. This guide will show you how to do that quickly and safely.

How to View PAN Card Details Using PAN Number

1. Visit the Income Tax e-Filing Website

The Income Tax Department provides a secure platform for individuals to view their PAN card details. Here’s how you can access it:

- Go to the Income Tax e-Filing website.

- If you are a registered user, log in with your User ID (which is your PAN), password, and date of birth.

- If you’re not registered, click on "Register" and follow the steps to create an account.

2. View PAN Details through 'Profile Settings'

Once logged in, you can view your PAN card details by following these steps:

- Go to "My Profile" under the 'Profile Settings' section.

- Here, you will be able to view key PAN card details such as:

- PAN number

- Name on PAN card

- Date of Birth

- Status of the PAN (Active/Inactive)

3. Use Third-Party Websites to Verify PAN

There are also third-party websites, such as NSDL and UTIITSL, where you can verify PAN details using your PAN number. These are mainly used for PAN verification purposes:

Steps to verify PAN on NSDL:

- Visit the NSDL PAN Verification page.

- Select “Verify PAN” under PAN services.

- Enter your PAN number and other required details.

- The system will display basic PAN card information such as the name, PAN status, and whether it’s active or not.

4. Check Your PAN Card Details via UTIITSL

You can also verify your PAN details using UTI Infrastructure Technology and Services Limited (UTIITSL):

- Visit the UTIITSL PAN card verification page.

- Enter your PAN number and necessary details.

- The site will show a summary of your PAN details, such as your name and PAN status.

5. Verify PAN through the Income Tax Department SMS Service

The Income Tax Department offers an SMS service to verify PAN details:

- Send an SMS in the following format to 567678 or 56161:

NSDLPAN <space> Your PAN Number - You will receive a message with details of the PAN holder, including the PAN card’s status.

Frequently Asked Questions (FAQs)

1. Can I view my full PAN card online?

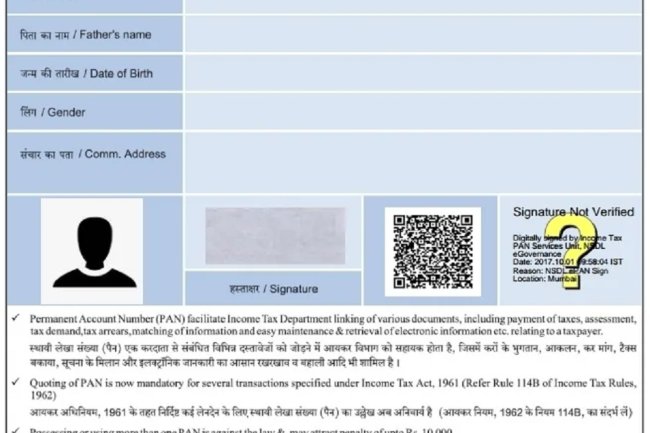

You can only view basic details like PAN number, name, and status online. To view or download a full copy of your PAN card, you need to reprint it or access it via the Income Tax e-Filing website.

2. Is it safe to check PAN details online?

Yes, it is safe if you use official government websites such as the Income Tax e-Filing portal, NSDL, or UTIITSL.

3. What if my PAN status shows as inactive?

If your PAN shows as inactive, you should contact the Income Tax Department immediately to rectify the issue. An inactive PAN can cause issues with financial transactions and tax filings.

4. Do I need to create an account to check my PAN details?

For full details, you will need to create an account on the Income Tax e-Filing website. However, for basic verification, third-party websites like NSDL or UTIITSL can provide some information without account creation.

Conclusion:

Viewing your PAN card details online using just your PAN number is a simple and secure process. Whether through the Income Tax e-Filing website, NSDL, UTIITSL, or even by SMS, these methods give you easy access to essential PAN information. Keep your PAN details secure, and ensure that your PAN card status is always active to avoid any complications.

What's Your Reaction?